If a company or individual purchases goods or securities with the aim of selling them at a higher cost and making profit, then such acts can be classified as speculation.

Now the article of the Criminal Code of the Russian Federation qualifies as unlawful acts that relate to speculation actions aimed at manipulating the market situation or unauthorized use of insider data. Criminal liability is provided for such acts.

What is speculation

Actions of a speculative nature include the purchase of the following assets for the purpose of resale at an inflated price:

- stock;

- bonds;

- collectibles;

- real estate

- other material assets.

Speculation does not include purchases made for personal use or dividend income.

An example of such actions in the field of goods, for which an article for profiteering may be assigned, is a situation where a person trades at an inflated price in scarce essentials in a territory where active hostilities are ongoing, a man-made accident or a natural disaster has occurred.

Causes

If we look at the reasons for speculation, there may be many factors:

- A real opportunity to get rich quickly . This lottery attracts many people. For example, during war years people sell jewelry and art objects for next to nothing, but in another country these same goods will cost many times more.

- The effect of inflation, which actively raises the cost of most goods . Therefore, when purchasing many valuables, you can be sure that in a few years they will cost much more.

- Unprofitable and destroyed agriculture . Due to this, most enterprises operating in this industry cost pennies. But as soon as you raise them to a new level, the value of shares for this company will increase significantly.

- Political instability . Many citizens do not trust the authorities and the current economic situation, since the slightest conflicts at the global level create tangible instability of the Russian ruble.

Therefore, those people who have any free money prefer to store it in a more stable currency. And this creates a demand for speculators providing the necessary services.

You can find out more about this in the video presented.

Prosecution

The current Criminal Code provides for punishment for the following acts, which can be classified as speculative acts:

- Article No. 185, paragraph 3 regulates liability for manipulation of financial markets.

- Article No. 185, paragraph 6 establishes liability for the illegal use of insider information obtained.

Persons over 16 years of age may be held liable under this article for speculation.

Qualification of the crime

When the economy in the Russian Federation changed to a market type, this concept disappeared, and in the Criminal Code of the Russian Federation of 1996 it no longer existed. Today, this regulatory act contains 2 articles for committing fraud at the federal level or in the financial market, which subsequently lead to negative results for society as a whole and the financial situation in the state.

Therefore, this year the following articles of the Criminal Code of the Russian Federation are in force: Article 185.3 for manipulation and Article 185.6 for unauthorized use of insider data.

It is important that the above criminal acts must be committed exclusively with direct intent. And the key motive, as a rule, is self-interest and the desire to acquire financial gain.

For these crimes, liability under criminal law begins at the age of 16.

Sanctions for illegal actions in the financial market

Market manipulation involves various actions that are aimed at artificially reducing or increasing the main characteristics of the market:

- demand;

- offer;

- volume of sales.

As a result of such acts, significant material damage is caused to the state budget and citizens of the Russian Federation; attackers receive increased profits or minimize losses. Persons manipulating the market achieve their goal in various ways:

- presenting false information as truth;

- carry out purchase and sale of currency in large volumes;

- create or reduce market interest in a certain group of goods;

- carry out other similar actions.

If deliberate market manipulation is proven, the violator of the law may be given one of the following penalties under the article for speculation:

- imposition of penalties in the amount of up to 500,000 rubles;

- engagement in labor activities for a period of no more than 4 years;

- detention in correctional institutions for 4 years, as well as a fine of 50,000 rubles.

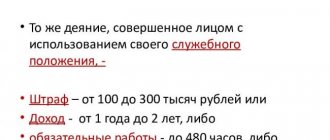

Under certain circumstances of the crime, the offender may be prohibited from engaging in certain activities as an additional punitive measure. If market manipulation was planned and carried out by a group of criminals, resulting in significant material damage, then the punishment is significantly increased:

Have a question for a lawyer? Ask now, call and get a free consultation from leading lawyers in your city. We will answer your questions quickly and try to help with your specific case.

Telephone in Moscow and the Moscow region: +7

Phone in St. Petersburg and Leningrad region: +7

Free hotline throughout Russia: 8 (800) 301-39-20

- the maximum amount of penalties is 1 million rubles;

- an attacker may be subject to forced labor for a period of no more than 5 years;

- The most severe punishment for such an act is imprisonment for a term of 7 years with the possibility of imposing fines of up to 1 million rubles.

Situation 2 (sad)

From a number of news reports, the author knows that in an emergency situation, some “economic entities” are selling essential goods at obviously inflated prices (fortunately, there are also those who are distributing such goods for free). Many people know that during a flood, the most scarce commodity is water. There have been reports in the media that in some cases in areas affected by floods, cases of sale of ordinary drinking water at many times higher prices have been recorded.

According to Article 11 of the Federal Constitutional Law of May 30, 2001 N 3-FKZ “On a State of Emergency,” the Decree of the President of the Russian Federation on the introduction of a state of emergency for the period of the state of emergency may provide for the introduction of the following measures and temporary restrictions:

d) establishing restrictions on the implementation of certain types of financial and economic activities, including the movement of goods, services and financial assets;

e) establishing a special procedure for the sale, acquisition and distribution of food and basic necessities;

In practice, such measures are not prescribed in the decrees of the President of the Russian Federation (I may be wrong). I believe that in the above example with drinking water, there are clearly enslaving transactions in the sense of Part 3 of Article 179 of the Civil Code of the Russian Federation. However, state, including judicial protection of the rights of citizens in such conditions is difficult (I think there is no need to explain why).

Applicable measures of liability for disclosure of insider information

Every commercial company has information that is not subject to public disclosure. It is of particular importance and, if not published in a timely manner, can have a significant impact on the financial stability of the enterprise. Such data is called insider information.

Attackers are trying in every way to recognize them and use them for their own selfish purposes to obtain material gain. Examples of such illegal acts could be:

- carrying out various operations with securities, goods, and other material assets;

- provoking other market participants to buy or sell financial instruments.

For carrying out such acts, attackers are held criminally liable under Article No. 185.6 for speculation and dissemination of insider information. The article comes into force only in the following cases:

- causing significant material damage to third parties or the state;

- As a result of the actions in question, the attacker received a large income or avoided significant losses.

Criminals who commit such acts will face one of the following punishments:

- penalties in the range of 300 - 500 thousand rubles;

- performing forced labor activities. The maximum term of such punishment is 4 years;

- detention in a colony or prison for no more than 4 years. At the discretion of the court, in addition to the main punishment, the offender may be given a fine of no more than 50,000 rubles.

If it has been established that insider information was transferred to a third party, resulting in significant material damage or the attacker receiving illegal profits, the following penalties may be imposed:

- withholding an amount of up to 1 million rubles in the form of a fine or funds received by the criminal for 4 years;

- imposing obligations to perform forced labor for 4 years;

- The period of detention in a correctional institution can be 6 years with an additional fine of 100,000 rubles.

conclusions

General conclusion

– in the modern period, purchasing a product at a lower price and its subsequent sale at a higher price is an absolutely normal, and moreover, economically feasible phenomenon.

Harm from speculation occurs when profits are made without clear economic justification. Thus, in a number of cases such activity can be considered as socially dangerous

, since it contradicts economic feasibility and at the same time violates a number of legislative norms. Let's look at examples.

Administrative responsibility

If insignificant material damage was caused during the disclosure of insider information, then administrative liability will be assigned for such an act. The sanctions imposed are regulated by the article speculation of the Code of Administrative Offenses in Article 15.21:

| Category of criminals | Punishment applied | Maximum amount |

| Private individuals | Fine | 5 000 |

| Officials | 50 000 | |

| Organizations | 700 000 |

General conclusion

Of course, as a general rule, resale of goods at a higher price in a capitalist system is quite justified. For example, retail companies ensure that goods are delivered to the end consumer.

However, in some cases, such activities involve the receipt of clearly unjustified income, and at the same time the interests of the individual, society and the state are violated. In all such cases, the requirements of the law are simultaneously violated (on the protection of consumer rights, on a state of emergency, on the protection of competition, etc.). However, judicial protection of citizens' rights seems clearly difficult.

If I missed something, I invite you to discuss!

Categories of citizens held accountable

Almost any citizen or company can carry out speculative actions. Only persons from a certain area can obtain insider information. Among them:

- Company administration.

- Dedicated employees.

- Third parties performing special tasks (auditors, consultants, lawyers).

In addition to being held accountable under the article for speculation and dissemination of insider information, other troubles may await them:

- termination of all agreements and termination of cooperation;

- damaged reputation.

As a rule, in such cases, the employee is fired “under the article”, which means that he will not be able to get a good similar position in the future.

Situation 3 (Eurovision)

Holding individual events (a good example for Russia is the Eurovision 2009 music competition) involves selling related products to fans. From media reports, the author knows that, for example, a 0.5 liter bottle of ordinary water was sold at the Olimpiysky Sports Complex at a price 10 times higher than the retail price.

In the author’s opinion, there is also obvious speculation here, which is in no way substantiated by economic realities. This became possible due to the fact that “selected” suppliers were involved in the sale of related products during the competition. There is a violation of Article 6 of the Federal Law of July 26, 2006 N 135-FZ “On the Protection of Competition” on the monopoly high price of goods.

How is speculation different from investment?

An investor makes his money work for himself. It doesn’t matter to him how prices for the investment object change; he does not buy this object in order to resell it later. An investor needs constant income from his investments.

For example, if I bought an apartment for two million, and then sold it for two million and a hundred thousand, this is speculation. If I bought an apartment and rent it out to students for 20,000 a month, that’s an investment. It doesn’t matter to me how prices for apartments change in my area; I am not going to sell the purchased property to anyone. She is a constant source of income for me.

A speculator always sells what he buys. To make money on price differences. If the product is not sold, the speculator does not receive any profit from it and cannot even return the money invested, and suffers from this.

An investor may not sell what he bought for the rest of his life. However, he not only gets his money back, but also makes huge profits. Because the purchased “financial asset” constantly brings him income. Like cow's milk.

When the famous American investor Warren Buffett was asked how to invest correctly, he said: “Invest only in things that you will never sell in your life.” That is, we invested - and we get richer all our lives and receive income.

Speculation in the precious metals market

Today, such operations in the metals market have become unprecedentedly widespread. It is the activity of speculators represented by individual investors that determines the level of quotations of various metals.

Speculation in gold has been known for a long time. After all, it has long been the most reliable investment instrument. However, similar actions with platinum and palladium are quite surprising.

The rise in prices for precious metals is almost entirely caused by a large number of speculative investments in precious metals. Experts believe that the most important factor in the rise in gold prices is information, since it is this factor that mainly influences the behavior of participants in transactions.

Functions, tasks and goals of speculation

What functions have speculators taken on in the modern economic system? They simplify transactions on the free market, and serve there as compensation for transactions that for some reason did not take place.

It turns out that the speculator insures the transaction in a certain way, regulating the financial disputes that arise.

The more active a speculator is, the more transactions are made, the faster market relations develop, and the less likely there are sharp price increases.

In the markets, speculators are usually divided into “bears” and “bulls” .

- Bears sell assets in hopes of getting them back later when prices drop .

- Bulls to sell them for even more when prices start to rise.

Of course, the division is conditional, since one market participant can act both as a “bear” and as a “bull”. It depends on what economic benefit he sees for himself in a particular transaction.

Analysts are confident that this type of business will develop more widely and more intensively.

Why is there such a negative attitude towards speculators?

Really, why? Even the words themselves are somehow unpleasant: “speculator”, “outbid”. The answer is simple - these people are trying to make money without creating any new material values. Their goal is profit.

If everyone becomes speculators, the development of civilization will stop. The world will think only about money, about how to buy cheaper and sell more expensive.

Society respects those who create and create something new. New houses, new cars, new drugs. They respect those who are trying to make this world a better place, and not just make money and get rich.