ST 149 of the Criminal Code of the Russian Federation.

Illegal obstruction of an assembly, meeting, demonstration, procession, picketing or participation in them, or coercion to participate in them, if these acts were committed by an official using his official position or with the use of violence or the threat of its use, is punishable by a fine of up to three hundred thousand rubles or in the amount of wages or other income of the convicted person for a period of up to two years, or forced labor for a term of up to three years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years or without it, or imprisonment for a term up to three years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years.

Article 149 of the Tax Code of the Russian Federation: which transactions are not subject to VAT?

Art. 149 of the Tax Code includes groups of transactions free from VAT:

- Registration of premises for rent to foreigners and their organizations (clause 1 of Article 149 of the Tax Code of the Russian Federation) accredited in the Russian Federation.

An indispensable condition for non-charge of VAT under clause 1 of Art. 149 of the Tax Code of the Russian Federation are mirror actions of the corresponding foreign state in relation to citizens and organizations of Russia, which is confirmed by the execution of an international treaty.

The list of such states is compiled by the Ministry of Foreign Affairs and the Ministry of Finance of the Russian Federation (order dated 05/08/2007 No. 6498/40n). The document confirming such exemption is a copy of the certificate of inclusion in the register of accredited branches and representative offices of foreign legal entities, the form of which was approved by Order of the Federal Tax Service of Russia dated December 26, 2014 No. ММВ-7-14/ [email protected] This certificate is issued by the Federal Tax Service.

- Sales of socially oriented goods, works or services (clause 2 of article 149 of the Tax Code of the Russian Federation).

All subparagraphs of clause 2 of Art. 149 of the Tax Code of the Russian Federation as amended in 2021 affect the social side of the work of economic entities. These, in particular, include medical, international and religious relations, which helps reduce the financial burden on such organizations. The main VAT benefits apply to the production of medicines, the provision of medical services and education.

- Exemption of a number of operations (clause 3 of Article 149 of the Tax Code of the Russian Federation), which we will discuss in more detail below.

When using the operations included in clause 3 of Art. 149 of the Tax Code of the Russian Federation, a company can declare a refusal (clause 5 of Article 149 of the Tax Code of the Russian Federation) from VAT exemption. Then she will be able to apply VAT deduction. To do this, an application is submitted to the Federal Tax Service indicating the specific transactions for which this is required. This restriction is valid for a specific counterparty for a year. In this case, the company must organize accounting separately for preferential and regular VAT (clause 4 of article 149 of the Tax Code of the Russian Federation).

For information on the deadline for submitting such an application, see the article “How to refuse VAT exemption?”

You will find a sample application in the article “Sample application for refusal of VAT exemption” .

The legislator is allowed to amend Art. 149 of the Tax Code of the Russian Federation. Then the base for calculating VAT is determined on the date of release of goods or completion of work and services (clause 8 of Article 149 of the Tax Code of the Russian Federation). The actual day they are paid does not matter.

Judicial practice under Article 149 of the Criminal Code of the Russian Federation

The appeal ruling of the Judicial Collegium for Criminal Cases of the Supreme Court of the Russian Federation dated October 10, 2017 N 35-APU17-12

denied compensation for moral damage in connection with his acquittal on charges of committing a crime under Art. and part 2 of Art. 149 of the Criminal Code of the RSFSR. After hearing the report of judge A.N. Klimov, the explanation of the convicted V.A. Vasiliev. in videoconference mode, who supported the arguments of his appeal, the opinion of prosecutor V.Yu. Gurova, who believed that the decision should be left unchanged, the Judicial Collegium

Resolution of the Presidium of the Supreme Court of the Russian Federation dated June 20, 2018 N 64P18

Chernenko Konstantin Gennadievich, ... convicted: February 20, 1996 under Art. , part 2 art. 144, part 2 art. 144, part 1 art. 149, art. , Criminal Code of the RSFSR to 3 years of suspended imprisonment with a probationary period of 2 years; March 12, 1999 under Part 2 of Art. 108 of the Criminal Code of the RSFSR to 8 years in prison, on the basis of Art. Criminal Code of the RSFSR to 9 years in prison, on July 1, 2005, released on parole for 4 months 16 days, -

Appeal ruling of the Judicial Collegium for Criminal Cases of the Supreme Court of the Russian Federation dated December 24, 2019 N 5-APU19-86

to the resolution of the Deputy Prosecutor General of the Russian Federation dated July 24, 2021, which satisfied the request of the General Prosecutor's Office of the Republic of Belarus to extradite I.V. Demyanchuk. to bring to criminal liability for committing crimes under Part 1 of Art. 149, part 4 art. 209 of the Criminal Code of the Republic of Belarus, was left without satisfaction.

Appeal ruling of the Appeal Board of the Supreme Court of the Russian Federation dated 07/07/2020 N APL20-159

From the case materials it appears that by the verdict of the Tomsk Regional Court of October 14, 1991 Sukhinin V.A. Convicted for a combination of crimes provided for in paragraphs “d”, “h” of Article 102, Part 1 of Article 144, Part 2 of Article 149 of the Criminal Code of the RSFSR, to an exceptional measure of punishment - the death penalty. By the ruling of the Judicial Collegium for Criminal Cases of the Supreme Court of the RSFSR dated February 28, 1992, this sentence was left unchanged. March 10, 1992 and August 20, 1992 Sukhinin V.A. filed written petitions for pardon. Having considered these petitions, the President of the Russian Federation, guided by the principle of humanity, issued a Decree on his pardon, which Sukhinin V.A. the death penalty was replaced by life imprisonment.

Appeal ruling of the Judicial Collegium for Criminal Cases of the Supreme Court of the Russian Federation dated April 18, 2017 N 32-APU17-7sp

Utkin A.P. ... previously tried on May 5, 1995 by the Judicial Collegium for Criminal Cases of the Saratov Regional Court (taking into account the changes made by the Determination of the Judicial Collegium for Criminal Cases of the Supreme Court of the Russian Federation on July 20, 1995) under Art. 102 paragraphs “a”, “e”, “n”, part 1 of Art. 149, paragraphs “a”, “c”, part 2 of Art. 146 of the Criminal Code of the RSFSR to 15 years in prison with confiscation of property, released on May 12, 2009 based on the decision of the Pugachevsky District Court of the Saratov Region dated April 29, 2009, on parole for 4 months 14 days,

Which transactions are free from VAT taxation in accordance with paragraph 2 of Art. 149 of the Tax Code of the Russian Federation?

In regulated clause 2 of Art. 149 of the Tax Code of the Russian Federation the list includes:

1. Sales operations:

- medical goods: prosthetics, orthopedic shoes, etc. (according to the list approved by Government Decree No. 1042 dated September 30, 2015);

- vehicles for disabled people;

- glasses, frames and lenses intended for vision correction;

- funeral supplies (the list is given in Government Decree No. 567 dated July 31, 2001);

- goods as part of gratuitous assistance;

- results of intellectual activity (computer programs, inventions, etc.);

- material assets issued from the state reserve (from 01/01/2018).

ATTENTION! From 01/01/2021, operations for the implementation of exclusive rights to computer programs and databases included in the unified register, and the rights to use these programs and databases, were exempt from VAT. The exemption does not apply to the transfer of rights if these rights consist of obtaining the ability to: distribute and receive advertising on the Internet; post offers on the Internet for the purchase and/or sale of goods (works, services); look for information about potential buyers and sellers.

2. Works and services:

- medical services (according to the list of compulsory medical insurance);

- provision of services to the elderly, disabled and sick - care for them is carried out when issuing conclusions from social protection authorities and health care organizations;

- services for medical diagnostics and treatment of the population (their list contains the Decree of the Government of the Russian Federation dated February 20, 2001 No. 132);

- ambulance services and other types of medical services (blood collection from donors, patient care);

- services for preschool education of children, including classes with them in clubs and sections;

- services for transporting passengers by various modes of transport;

IMPORTANT! Exemption from VAT does not apply to services for the transportation of passengers by suburban railway transport until 01/01/2030. For these services, a 0% rate is introduced (Law “On Amendments...” dated 04/06/2015 No. 83-FZ).

See also “Transportation of passengers under government contracts is not subject to VAT” .

- funeral services and work on the production of monuments;

- repair and maintenance services for household and medical goods during the warranty period;

- works related to objects of cultural heritage of the Russian Federation included in the State Register;

- housing construction work for military personnel;

- car technical inspection services;

- works on staging and filming films;

- educational services of non-profit organizations;

- maintenance work for sea and river vessels;

- other works and services.

Read more about all these operations in the article “Operations not subject to VAT: types and features” .

Taxpayers often have disputes with the Federal Tax Service related to the application of VAT benefits. You can find out how the latest judicial practice on this issue is shaping up from the analytical selection from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Is the sale of medical equipment exempt from VAT?

When selling medical equipment or accessories for it, including those imported into the Russian Federation, it is subject to VAT exemption if a registration certificate is issued for it based on the list approved by Decree of the Government of the Russian Federation dated September 30, 2015 No. 1042.

Please note that from July 1, 2017, the right to a benefit is confirmed by a registration certificate for a medical product issued in accordance with the law of the Eurasian Economic Union. In addition, until December 31, 2021, the benefit can be confirmed by presenting a registration certificate for a medical product (registration certificate for a medical product (medical equipment), issued in accordance with the legislation of the Russian Federation (clause 1 of article 1 of the law dated 03/07/2017 No. 25 -FZ). Such a certificate must be presented to the Federal Tax Service by the taxpayer selling this equipment. This also applies to accessories for this equipment. The registration certificate must indicate that it is issued for a set of specific equipment (for example, a dental chair with a set of tools for it) .

Impact and cutting instruments (drills, burs, cutters) intended for dental treatment are subject to VAT exemption according to the list approved by Decree of the Government of the Russian Federation dated September 30, 2015 No. 1042.

Are medical examination services subject to taxation?

Medical examinations of workers are carried out before entering certain types of work and to prevent diseases. For example, in organizations operating transport, drivers must undergo a medical examination before and after the trip (Article 20 of the Law “On Road Traffic Safety” dated December 10, 1995 No. 196-FZ).

Medical examination services are exempt from VAT. However, a medical organization or private practitioner must have a license (Resolution of the Government of the Russian Federation of April 16, 2012 No. 291).

The enterprise can organize a medical office or health center, where medical staff from clinics or medical workers under contracts will work.

The contract for the provision of medical services must specify the actions of the person conducting the medical examination and the grounds for removing drivers from work. The medical examination data is recorded in a special journal. The waybill for a driver admitted to the flight is stamped: “Admitted.” This is proof for the traffic police that the medical examination was carried out.

Compliance with these requirements can be verified by Rostransnadzor or a labor inspectorate. Failure to comply will lead to fines for the manager and the company itself (Article 11.32, Article 12.31.1, Article 12.32 of the Administrative Code).

What conditions must be met for services under clause. 4 p. 2 tbsp. 149 of the Tax Code?

Preschool institutions are created for children with the purpose of:

- provision of preschool education;

- strengthening children's health;

- children's development.

Such organizations operate on the basis of a license, which they receive based on compliance with the requirements of Art. 91 of the Law “On Education...” dated December 29, 2012 No. 273-FZ, taking into account the type of educational services.

Commercial educational organizations have the right to use the VAT exemption, but only those who use a preschool education program (Resolution of the Arbitration Court of the West Siberian District dated September 15, 2014 No. A27-18046/2013). In addition, they need a license to conduct general educational activities (subclause 40, clause 1, article 12 of the law “On Licensing...” dated May 4, 2011 No. 99-FZ).

Thus, the taxpayer must have all the documents listed above in order to confirm to the tax authorities the right to use the VAT exemption.

Is it necessary to submit a VAT return when carrying out transactions listed in Art. 149 of the Tax Code of the Russian Federation, explained ConsultantPlus experts. Get free demo access to K+ and go to the Tax Guide to find out all the details of this procedure.

Second commentary to Art. 149 of the Criminal Code of the Russian Federation

1. The object of the crime is the constitutional right of citizens of the Russian Federation to hold meetings, rallies, demonstrations, processions and picketing (Article 31 of the Constitution of the Russian Federation). Criminal liability is established only for illegal obstruction of the mass events specified in the disposition of the commented article.

2. Rally - a meeting of citizens to publicly express their attitude towards the actions of individuals and organizations, events in socio-political life. Demonstration is a public expression of socio-political sentiments by a group of people using posters, banners and other visual aids during the procession. Street procession is an organized mass movement of people along a pedestrian or roadway in order to draw attention to any problems. Picketing is a clear demonstration by a group of citizens of their intentions and views without a procession or sound signals.

3. The objective side of the crime is formed by:

a) actions (inaction) expressed in illegally obstructing the holding of a meeting, rally, demonstration, procession, picketing or illegally preventing participation in them;

b) specific methods of obstruction - the use by an official of his official position or the use of violence or the threat of its use.

4. Violence as a method of obstruction or coercion is understood as causing intentional minor harm to health (Article 115 of the Criminal Code) and beatings (Article 116 of the Criminal Code). More dangerous methods of violence form an independent crime and must be qualified in conjunction with Art. 142 of the Criminal Code.

5. The threat of violence as a method of obstruction or coercion is the threat of inflicting any physical violence (up to the threat of murder).

6. The subject of a crime is both a private person who has reached 16 years of age and an official when the crime is committed by the latter using his official position.

7. The subjective side of the crime is characterized by direct intent.

Is VAT payable on the collection and sale of metal waste?

The sale of scrap and waste metals (ferrous and non-ferrous) from 01/01/2018 is no longer subject to VAT exemption (subclause 25, clause 2, article 149 of the Tax Code of the Russian Federation).

In their production activities, companies that accept scrap metal follow the provisions of the Law “On Waste...” dated June 24, 1998 No. 89-FZ and Government Decrees dated May 11, 2001 No. 369 and No. 370. Taking them into account, waste and scrap can only be accepted from their owners if documents are available. The owner, in the application for acceptance of scrap, indicates how he acquired the right to the scrap being handed over. Upon delivery of scrap, an acceptance certificate is drawn up. The company receiving the scrap must test it for radiation and explosion hazards.

Further sales of scrap ferrous and non-ferrous metals are subject to VAT, but the tax is paid not by the seller, but by the buyer, who in this case acts as a tax agent (letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3 / [email protected] ).

See here for details.

Which operations from clause 3 of Art. 149 of the Tax Code of the Russian Federation are exempt from VAT?

In accordance with paragraph 3 of Art. 149 of the Tax Code of the Russian Federation exempts from VAT taxation:

- sale by religious organizations of literature and items related to religion (the list is approved by the Government of the Russian Federation);

- sale of goods, services and work produced by organizations and societies of disabled people (the list is approved by the Government of the Russian Federation); at the same time, the number of disabled people in such societies should be at least 80%;

- bank operations:

- on attracting public deposits and cash services;

- maintaining bank accounts of organizations;

- buying and selling currencies and precious metals;

- servicing bank cards;

NOTE! As of June 1, 2018, banking transactions with precious stones are excluded from the list of transactions not subject to VAT.

See here for details.

- sale of entrance tickets (on strict reporting forms) to sporting events and provision of stadiums for rent;

- operations on loans of money and securities;

- carrying out R&D at the expense of the budget of the Russian Federation or support funds under the Law “On Science” dated August 23, 1996 No. 127-FZ to create new technologies and products - these include the development of new designs of machines and equipment, instruments, testing them and obtaining practical results from their use;

For more information about documents confirming VAT benefits for R&D, see the article “VAT exemption can be partially waived .

Commentary to Art. 149 Criminal Code

1. The concepts used in the article are disclosed in the Federal Law of June 19, 2004 N 54-FZ “On meetings, rallies, demonstrations, processions and pickets.”

2. The objective side is characterized by alternatively provided actions in relation to a legally held event: a) illegal obstruction in any form of holding a meeting, rally, demonstration, procession, picketing (for example, putting forward formally legal, but substantively unfounded demands on the organizers of a public event, unlawful suspension or termination of a public event); b) unlawful obstruction in any form of participation in them; c) illegal coercion in any form to participate in them.

3. The criminal nature of these actions is given either by a special subject committing them (an official using his official position) or by a special method of committing a crime (using violence or the threat of its use). Violence resulting in the infliction of grievous or moderate harm to health is additionally qualified under Art. 111 - 112 CC.

Under what conditions can a public organization of disabled people receive a VAT benefit?

In accordance with Art. 117 of the Civil Code of the Russian Federation, public organizations of disabled people are non-profit. In their activities, such organizations have the right to apply VAT benefits, provided that the income-generating activities are in addition to the statutory ones. Only in this case the income received can be exempt from VAT. Profit-making activities by an organization of disabled people must create a material base for the implementation of its statutory goals. If this does not happen, then the VAT benefit is not possible. This point of view was expressed by the Presidium of the Supreme Arbitration Court in its resolution dated September 14, 2010 No. 1812/10 in case No. A76-9347/2009-43-49.

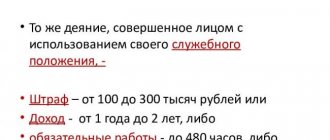

Responsibility

Entities violating the Law “On Rallies”, as well as Art. 31 of the Constitution, the following are punishable:

- Monetary recovery in the amount of up to 300 thousand rubles. or equal to salary/other income for 2 years.

- Forced labor for up to 3 years.

- Imprisonment for the same period.

In addition to the last two sanctions, the court may impose a ban on engaging in a specific activity or holding a specific position for 3 years.

How to calculate VAT when the bank receives an apartment to repay a loan?

When repaying a bank loan, the borrower paid with an apartment. This meets the requirements of Art. 409 Civil Code. The bank has the right to sell the residential premises to return the money on the issued loan. These actions are free from VAT (subclause 22, clause 3, article 149 of the Tax Code of the Russian Federation).

For operations provided for in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation (both for all and selectively), the taxpayer may refuse to apply the benefit. To do this, you only need to submit a corresponding application to the tax authorities before the start of the tax period, from which VAT will be charged on this transaction, and the benefit will not be applied.

Specifics of the crime

Unlawful obstruction of pickets, marches, meetings and other public events, as well as participation in them, can be manifested by action or inaction. For example, an official authorized to make decisions about their organization may pass an act that unlawfully prohibits citizens from exercising their constitutional right. Action can manifest itself in creating real barriers to people's paths. These can be both material objects and barriers from law enforcement officers. Inaction is manifested, for example, in the failure to provide meeting space.

Results

Art.

149 of the Tax Code of the Russian Federation regulates the list of transactions for which the taxpayer is exempt from VAT. Legislators quite often make changes to Art. 149 of the Tax Code of the Russian Federation and comment on certain nuances of the application of benefits. To avoid making mistakes when calculating tax, follow our “VAT Benefits” section. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.