Any citizen can file a complaint with the Federal Tax Service if he discovers that tax legislation has been violated, as well as in some cases the Code of Administrative Offenses and the Criminal Code of the Russian Federation. You can complain about the inaction of the tax authorities, about entrepreneurs operating without a cash register, about the decision on an audit conducted by the Federal Tax Service, etc. The appeal must be made in writing. In this article we will look at how to file a complaint with the tax office about illegal business.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Illegal business

Illegal business activity is understood as activity that a citizen conducts without registering a legal entity or individual entrepreneur (we are talking about the systematic receipt of profit from running a business), or activity without a license, when one must be required.

Fines for such violations are established in Art. 116 Tax Code of the Russian Federation, Art. 14.1 Code of Administrative Offenses of the Russian Federation and Art. 171 of the Criminal Code of the Russian Federation. The violator may also face correctional labor or imprisonment. It all depends on the severity of the violation.

Entrepreneurial activity may be indicated by the testimony of counterparties, clients, wholesale purchases, advertising, the presence of papers on the sale of goods and services, etc., therefore, these are the factors that the Federal Tax Service will check after receiving an application about illegal entrepreneurship.

The illusion of harmlessness of unauthorized trade

Often unauthorized trade takes place directly from the ground. Street sellers have neither permits nor health certificates confirming the safety of their purchases. Thus, during unauthorized trade there are no documents confirming the safety of food and industrial products.

Behind a grandmother selling knitted items or herbs on the street, there are often resellers who have put the trade on stream. Similar facts of unauthorized trade have been repeatedly uncovered by law enforcement officials.

District police officers carry out raids throughout the assigned territory, with the task of identifying places where unauthorized trade is present. Persons conducting illegal sales are warned of the illegality of their actions and must vacate unauthorized areas. In case of refusal, the police are called, reports of administrative violations are drawn up against the offenders, and fines are imposed for unauthorized trading.

How to write a complaint to the tax office

There is no legally prescribed form developed, so you can write an appeal in free form. But you need to adhere to an official business style of speech, not use colloquial expressions, and avoid excessive emotionality.

What information should be included in a complaint to the Federal Tax Service:

- Addressee's name. Here you need to indicate the full name and address of the Federal Tax Service where the complaint is being sent.

- Who is this complaint from? For an individual, indicate full name, place of residence, telephone number. The individual entrepreneur adds OGRNIP to this information. The legal entity must write the name of the organization, its details, and the full name of the person applying on behalf of the company.

- Name of the document (complaint, appeal).

- The essence of the appeal. They talk about the fact of violation of tax legislation: who and how conducts illegal business activities, what articles of the Tax Code of the Russian Federation he violates.

- Request. As a rule, here they are asked to take the necessary measures.

- How does the applicant prefer to receive the result of the complaint consideration and verification (in person, by mail, by e-mail).

- Attachments to the appeal. If there is any documentary evidence of illegal business activity, then these papers are attached to the complaint, and their name and number of sheets are indicated in the attachment.

The complaint must be signed and dated.

Important! The department has the right not to consider anonymous requests. The Federal Tax Service only accepts applications that contain personal data.

Practical difficulties

Violation of trade rules can lead to various consequences:

- there is no proper control over product quality, which can lead to poisoning, other damage to health, and citizens purchasing goods that do not meet standards;

- the seller does not bear full responsibility to the buyer and does not fall under the rules “On the Protection of Consumer Rights”.

In addition, trading in unauthorized places leads to disruption of architecture and pollution of the surrounding area. The state suffers losses because individuals do not pay taxes.

Most often, violations are carried out because citizens do not understand the essence of the legislation. Also, additional complexity is caused by bureaucratic problems and the need to incur significant costs.

So, you can open an individual entrepreneur inexpensively and quickly. Under the simplified taxation system, taxes will also be insignificant. But contributions to the Pension Fund, Social Insurance Fund and Federal Migration Service will amount to 40,874 rubles for 2021 and will increase to approximately 50 thousand rubles in the coming year. With little income, citizens will continue to violate norms.

Option two is to reduce the burden for beginning entrepreneurs or increase penalties for violations. It is not entirely clear which path the state will choose.

In practice, it can be difficult to determine what kind of violation we are talking about. The person selling the goods does not always have to have the status of an entrepreneur, for example, if he sells products from his own garden. In some cases a tax liability arises, in others there is not.

In addition, the relevant authorities are not always willing to deal with such problems. If trafficking does not cause harm to citizens, organizations or the state, it most often goes unpunished.

If fines are imposed against individuals, they rarely lead to the cessation of such activities in the future. The sanctions against them are too light. It is easier for citizens to pay a fine than to register individual entrepreneur status and receive obligations to pay taxes and fees.

However, if we are talking about trading without a license, the situation is somewhat more serious. As a rule, a permit is required when selling dangerous or restricted goods. Accordingly, the punishment for the absence of a document will be more serious.

For example, the illegal sale of alcohol-containing products by individuals leads to a fine of 30 to 50 thousand rubles (clause 1). An individual entrepreneur, according to paragraph 2 of the same article, will pay from 100 to 200 thousand rubles.

Read: Can an individual entrepreneur use his personal account for payments?

How to file a complaint

You can submit a complaint to the territorial body of the Federal Tax Service in person or through a representative by proxy at the document acceptance window. You will need to have with you identification documents and a second copy of the complaint, on which, when accepting the documents, the tax officer will mark receipt.

You can also send documents by registered mail with a list of attachments and acknowledgment of delivery. The notification will be proof that the department has received the request.

For your information! You can file a complaint through a special service of the Federal Tax Service. You will need to fill in all the required fields, write the text of the complaint, attach documents, leave your contact information and click the “Submit” button. Also, if you have a personal account on the tax office website, you can submit an appeal through it.

After receiving and considering the request, the department will send a response. The review period is 30 days from the date of registration of the complaint. The Federal Tax Service may contact the sender to obtain the necessary information.

Sample complaint to the tax office about illegal business from a legal entity

To the Interdistrict Inspectorate of the Federal Tax Service No. 9 of Izhevsk for UR, address: 426000, Izhevsk, st. K. Marx, 130 from Alexey Alekseevich Smirnov, General Director of Gladiolus LLC, address: 426008, Izhevsk, st. Osinovaya, 12A, tel., email

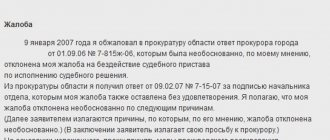

Complaint

I, Aleksey Alekseevich Smirnov, General Director of Gladiolus LLC, report the known fact of entrepreneurial activity without registration with the tax authority. Lyubimov Nikolay Nikolaevich, born in 1994, living at Izhevsk, st. Avangardnaya, 234, apt. 300, is engaged in the wholesale and retail sale of cell phones. A sales point has been opened in the Asia shopping center at the address: Izhevsk, st. Zimnyaya, 13A, office. 6. This citizen has repeatedly contacted our organization with an offer to supply us with a batch of cell phones (letter attached).

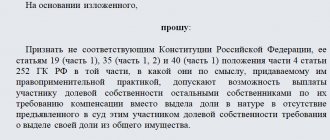

Based on the above and in accordance with Article 116 of the Tax Code of the Russian Federation, I ask you to take action and report the result of consideration of my appeal by mail to the address: 426008, Izhevsk, st. Osinovaya, 12A, Gladiolus LLC.

Application:

Letter with a proposal for cooperation dated November 20, 2021 from Lyubimov N.N. for 1 l.

Smirnov / A.A. Smirnov November 25, 2021

Where to report unauthorized trading

In some cities of the country, street trading is completely prohibited. You can get information about whether trading on the streets of your city is allowed from the district consumer market department. You can complain about unauthorized trade to the district administration of the city, the Ministry of Internal Affairs (Administration or Department of Economic Security), law enforcement agencies (police), and the tax service. A complaint about unauthorized trading can also be sent to the prosecutor.

In Moscow, you can complain about unauthorized trade to the same authorities. You can leave a message about unauthorized trading in St. Petersburg on the Administration website https://rgis.spb.ru/map/PromoMapPage.aspx

A single example of a big problem

It was not for nothing that the leadership of the Ministry of Industry and Trade of the Russian Federation drew attention to the special successes in the fight against the underground in the tobacco market. In Russia, cigarettes are the product category with the fastest growing share of the shadow segment. Since 2015, its share has increased 15 times, as a result of which the budget has lost tens of billions of rubles annually. In 2021, this amount amounted to at least 100 billion rubles.

Today there are practically no states left on the world map that are unfamiliar with the problem of illegal tobacco products. According to World Bank estimates, global economic losses from tobacco smuggling and counterfeiting amount to $40-50 billion annually.

Much remains to be done in the fight against illegal tobacco trafficking in Russia. But the measures taken can also be called turning points, at least on the tobacco front. For the first time in five years, it was possible to create conditions for stopping the growth of the share of illegal cigarettes. As representatives of the Ministry of Internal Affairs said, since the beginning of the year, about 770 million packs of cigarettes have been withdrawn from circulation, and in less than a year, about 1,000 criminal cases have been initiated related to violations of the rules for the import or sale of cigarettes.

This year, a number of important bills have begun to be adopted, which will further increase pressure on the illegal market. Thus, in the first reading, the State Duma adopted new rules for the import of unlabeled tobacco products. “There is a legal limit for the movement of unlabeled alcoholic products and it is not enough to effectively combat illegal tobacco products. The introduction of such a limit will no longer allow individuals to claim that a car filled with unmarked products is a product for personal use or as a gift,” Vasily Gruzdev, director of government relations at JTI Russia, said at the forum.

Also in the State Duma in October of this year. A bill was adopted in the first reading to introduce a single minimum price for tobacco products, below which manufacturers and importers will not be able to register retail prices for cigarettes. A minimum price already exists for alcohol and has proven itself in the fight against trafficking in illegal products.

The fight against tobacco counterfeiting and smuggling is an example of a collective response to a problem, when the efforts of executive authorities, law enforcement agencies, regulators, public organizations and business are coordinated. The mentioned proposals are supported both by the industry itself and by the Ministry of Industry and Trade and the Ministry of Internal Affairs.

Some pressing issues were also discussed at the forum, drawing on international experience. For example, the project of “depersonalization” of cigarette packs, the so-called. plain package, which implies a uniform design of the packaging and the removal of any brand images from it. Australian expert Professor Sinclair Davidson said that in his country, the introduction of the plain package in the tobacco industry did not lead to a decrease in the number of smokers, but increased the spread of illegal cigarettes. Russian retailers noted that in our country this will not bring a positive result, but it will simplify the work of the criminals who produce counterfeit goods.