It is possible to carry out business activities in the Russian Federation only if you are registered as an individual entrepreneur or a legal entity. But citizens do not always do everything according to the law and often do not want to spend time obtaining the necessary licenses and permits. If an individual without registration with the tax authorities engages in business for the purpose of making a profit, we are talking about illegal entrepreneurship. In this case, the citizen does not pay taxes and conducts activities at his own discretion, without adhering to general requirements and standards. Having identified such a fact, you should contact the regulatory authorities, who will conduct an inspection and bring the violator to justice as provided for by law.

Types of illegal entrepreneurship

Any commercial activity that is conducted without complying with applicable legal regulations is illegal. This applies to cases where the entrepreneur:

- sells goods or provides services without registering with the tax office;

- conducts activities that do not correspond to those indicated in the documentation (for example, does not repair cars, as indicated in his certificate, but is engaged in their sale);

- did not obtain a license or permit, despite the fact that this is a prerequisite for his work;

- provided the registration authority with knowingly false information, on the basis of which he received a certificate or permit.

Remote work (for example, selling goods) is also considered entrepreneurship, and it must be registered in the manner prescribed by law.

How to determine that an activity is being conducted illegally

If a woman once acted as a nanny for someone else’s child and received monetary compensation for her work, this is not considered entrepreneurship. But if she works as a nanny on a permanent basis, this will qualify as entrepreneurial activity. Stable receipt of revenue from the provision of services or the sale of goods is a direct basis for registration with the tax authorities. The following factors may indicate a lack of legal status:

- there is no photocopy of the registration certificate in the consumer corner;

- the person providing the service or selling the product refuses to present the necessary documents upon request;

- the entrepreneur works only online, makes sales through a website or social network without indicating a legal address;

- You can pay the cost of goods/services only to a bank card opened for an individual (not for an entrepreneur);

- the contract specifies one amount, but in fact the client pays more, but contributes part of the funds in cash;

- Payment is accepted only in cash, no confirmation of payment document is issued;

- there is no response to a complaint regarding the quality of goods or services, etc.

Lack of profit when carrying out illegal business activities does not relieve the violator of responsibility.

Where to go

Any person residing in the territory of the Russian Federation (including non-residents) has the right to file a complaint against illegal business. It does not matter whether he accidentally found out about the violation or used the services of an illegal entrepreneur. You can contact the following regulatory authorities:

- Territorial division of the tax service. An entrepreneur who is not registered with the tax authorities does not make mandatory contributions (to the social insurance fund, pension fund, etc.). Accordingly, a complaint to the Federal Tax Service will help to quickly establish the fact of a violation with all the ensuing consequences. It is better to submit your appeal to your territorial unit. In particular, if illegal business activity is carried out on the territory of Moscow, when filing a complaint you should be guided by the information https://www.nalog.ru/rn77/apply_fts/#t2.

- Department of Economic Security. This Office investigates economic crimes. If necessary, the submitted statement of violation will be transferred to the Prosecutor's Office or the Tax Service.

- Prosecutor's office. If there is reason to believe that the activities of an entrepreneur contradict the norms of the Criminal Code of the Russian Federation (for example, he offers services prohibited in Russia), you should complain to your territorial division of the Prosecutor's Office https://genproc.gov.ru/contacts/map/?DISTR=&SUBJ =.

- Court. A citizen will not have to personally go to court if the fact of illegal business activity is revealed. This will be done by the regulatory authorities, where he will submit a complaint and materials indicating a violation. But a citizen has the right, on his own initiative, to go to court to seek material or moral compensation for the damage caused.

Attention! A complaint cannot be submitted anonymously. If the document does not contain the applicant’s information, it will not be considered within the period prescribed by law.

How to write a complaint to the tax office

There is no legally prescribed form developed, so you can write an appeal in free form. But you need to adhere to an official business style of speech, not use colloquial expressions, and avoid excessive emotionality.

What information should be included in a complaint to the Federal Tax Service:

- Addressee's name. Here you need to indicate the full name and address of the Federal Tax Service where the complaint is being sent.

- Who is this complaint from? For an individual, indicate full name, place of residence, telephone number. The individual entrepreneur adds OGRNIP to this information. The legal entity must write the name of the organization, its details, and the full name of the person applying on behalf of the company.

- Name of the document (complaint, appeal).

- The essence of the appeal. They talk about the fact of violation of tax legislation: who and how conducts illegal business activities, what articles of the Tax Code of the Russian Federation he violates.

- Request. As a rule, here they are asked to take the necessary measures.

- How does the applicant prefer to receive the result of the complaint consideration and verification (in person, by mail, by e-mail).

- Attachments to the appeal. If there is any documentary evidence of illegal business activity, then these papers are attached to the complaint, and their name and number of sheets are indicated in the attachment.

The complaint must be signed and dated.

Important! The department has the right not to consider anonymous requests. The Federal Tax Service only accepts applications that contain personal data.

How to complain about illegal business activities

Before contacting the regulatory authority, it is important to make sure that the person who sells the product or provides the service does not have legal status. To do this, you should ask for a certificate of registration, if such a document is not freely available to clients (this is also a violation of the law). If this request is not satisfied, then this is the basis for contacting the tax service.

If a copy of the state registration certificate is posted in the consumer’s corner or the entrepreneur presents this document upon request, you should:

- Make sure that the original certificate really exists. This can be done by submitting a request to receive information from the Unified State Register of Legal Entities/Unified State Register of Legal Entities https://egrul.nalog.ru/index.html. Data will be provided according to a given criterion (this may be the name of the entrepreneur, his TIN or other information from the certificate). The downloaded statement will reflect all search results that can be used to determine the authenticity of the copy. If there is no information, we are talking about illegal business activity.

- Make sure that the certificate is not a fake. When comparing data from extracts from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs and copies, it is important to check all the information available in the documents (literally every number and letter). Fraudsters often try to use real state registration certificates from the registry, “substituting” their data in the copy. Having identified a discrepancy, you should contact the Prosecutor's Office for fraud.

- Collect a sufficient amount of evidence.

- Submit an appeal to the authorized body. If the applicant is not sure that he can cope with such a task on his own, it is better for him to use the help of a specialized lawyer;

- Make a complaint.

Information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs is provided free of charge.

Drawing up a complaint

There are no requirements for filing complaints. The main thing is that the complaint indicates to whom it is being sent, from whom and for what reason. For this purpose, the text of the complaint will need to include the following structural elements:

- addressee's name. Since we are talking about a tax inspectorate, you should indicate its identification data - name of the Federal Tax Service, territoriality, address;

- information about the sender - full name or name, address or details (or individual entrepreneur status), contact information. That is, the totality of information about the sender will vary depending on who wrote the complaint - an individual or a legal entity;

- the body of the complaint, that is, the information that the applicant wishes to bring to the attention of the Federal Tax Service;

- a request regarding what action the sender would like to take regarding the complaint. Also optional, if desired;

- date of filing the complaint;

- desired method of receiving a response (optional). By default, the response should arrive at the sender’s address indicated in the complaint;

- list of applications (optional). You can attach any documents and evidence that, in the opinion of the author, confirm to one degree or another the arguments of the complaint. Once again we draw the attention of our readers to the fact that the applicant is not obliged to classify the actions of an illegal entrepreneur. Qualification is a matter for the regulatory authority. If you want to express your opinion about whether the actions of an entrepreneur should be interpreted as a crime or an offense, then write, but there is no need for this;

- sender's signature.

It is believed that the Federal Tax Service has the right not to consider anonymous requests. This is not entirely true. The fact is that the law obliges the competent authorities to consider any reports related to committed offenses or crimes.

That is, a complaint containing information about someone’s illegal business activities will be considered even if it is anonymous.

Evidence base

The more additional materials indicating a violation the applicant can provide, the faster the appeal will be considered. In order to properly prepare the evidence base, you can directly contact the regulatory authority where the application will be submitted. The helpline or hotline will definitely tell you what materials can confirm the fact of illegal business activity. For this purpose the following are often used:

- Photographs or video footage of an office/store where goods are sold or services are provided, it is recommended to focus on the absence of a consumer corner;

- photocopies of payment receipts for the transfer of funds in favor of an individual as payment for goods/services, it is important that the purpose of the payment states what the payment was made for;

- a screenshot of a social network page or online store where goods are sold without registration;

- a copy or photograph of the false certificate that was provided to the client;

- a newspaper page or advertising brochure where an advertisement for the provision of services/sale of goods is posted (without registration it is prohibited to submit advertisements of a commercial nature);

- audio recording of a conversation with the “entrepreneur” or his authorized specialist;

- a copy of online correspondence about purchasing products or receiving services;

- an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs confirming that the entrepreneur does not have official registration;

- photocopy of the contract for the provision of services, which actually has no legal force, etc.

It is better to submit copies of materials rather than originals to regulatory authorities in order to reduce the likelihood of their loss.

Who can file a complaint

Any citizen who has reached the age of majority and has been recognized as legally competent can file a complaint regarding illegal business activities. It does not matter whether the citizen is a victim of such an offense or simply has such information.

What documents may be required

In addition to the statement, the fact of the offense must be documented.

Checks and receipts, contracts for the provision of any services are suitable as evidence. In addition, newspaper advertisements or screenshots from electronic bulletin boards where an unlicensed entrepreneur is looking for a client base are suitable. Photographs confirming the fact of illegal business activity are also suitable. Voice recordings are also acceptable, but audio evidence will not be taken into account by the court if the recording is made without warning.

When will you receive a response about the measures taken?

30 days are allotted for consideration of such requests. After this period, the applicant is sent a response about the work done and measures taken. In exceptional cases, the review period may be extended by 30 days, of which written notification will also be sent.

How to compose a document

Regardless of where the complainant plans to apply, he will need a written complaint. When drawing up such a document, the following information must be indicated:

- details of the parties (applicant and recipient);

- identification data that can be used to determine where the activity is carried out (address of a page on a social network or link to an online store, postal address, etc.). If there is no accurate information, it will be difficult for the regulatory authority to identify the violator;

- the nature of the illegal act: sale of goods, rental of real estate, tire fitting, repair of household appliances, sale of alcoholic beverages, etc.;

- the systematic nature of the act, if the applicant has such information, it is important to indicate that the provision of services or the sale of goods is carried out on an ongoing basis, otherwise the requirements will be refused;

- reference to legislative acts that were violated (in particular, Articles 32 and 116 of the Tax Code of the Russian Federation, Article 15 of the Constitution of the Russian Federation, etc.);

- a list of requirements upon the fact of the complaint: conduct an inspection, assess the actions of the person specified in the complaint in terms of the presence of corpus delicti, take measures, report the results of the consideration, etc.;

- a list of additional materials;

- date and signature.

In accordance with the norms of current legislation, the submitted application will be considered within 30 days. Its registration must be carried out within 3 days from the date of receipt (regardless of how the applicant transfers it).

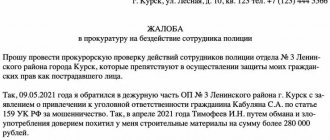

Algorithm for drawing up an application

There is no strict algorithm for drawing up an application. Of course, the employees help compile it. But we will give examples of how to compose it.

Statement on illegal business activities: sample.

As for OBEP, the statement will be somewhat different. start drawing up such a document with the “header” . It should contain information such as: the official to whom the application is addressed, information about who drew up the document, namely, full name, passport details and residential address, telephone number for contact.

The "header" should be located in the upper right corner . In addition, it must indicate that the applicant is aware that giving false testimony is subject to criminal liability. These words must be marked the current date and signature of the applicant.

Next, in the middle of the sheet you need to write the word “Statement” and in free form state your assumptions about the illegal business.

To the tax office

Here in the application it is very important to indicate such information as the applicant’s full name and place of residence. In addition, when drawing up this document, you need to clearly and clearly state the essence of the problem.

Question answer

Question: A low-quality product was purchased from an online store. The seller ignored the request for its replacement or return, despite my promise to contact Rospotrebnadzor. There is reason to believe that he is working illegally. How can I get a refund in this situation?

Answer: If the seller does not have the necessary registration documents, then there is no point in contacting Rospotrebnadzor, since it controls the activities of only legal retail outlets. In this case, it is better to immediately file a complaint with the Prosecutor's Office or the Federal Tax Service. But if the entrepreneur does not want to return the money voluntarily, then it will have to be recovered through the court.

Question: There is an illegal car wash in the courtyard of a residential apartment building (2 garages have been converted into it). An initiative group of residents has repeatedly appealed to its owner with a demand to provide registration documents. But he does not want to make contact, citing the fact that this is his private territory and he can do whatever he wants on it. What to do in such a situation?

Answer: The first thing to do is try to collect an evidence base. You can take a video of cars driving into a car wash and then leaving. This will be enough to prove a violation of the current law. If such material is available, you can file a complaint with the regulatory authority. It is preferable that all members of the residents' initiative group sign it.

Question: I am buying old washing machines and refrigerators from individuals. I act on behalf of the organization, which then disassembles them into parts. Can my work be classified as entrepreneurship and will I face administrative liability?

Answer: If you act on behalf of the employer, then, in accordance with Art. 14.1 of the Administrative Code, you do not face any liability. You do not receive income and are not an illegal entrepreneur.

How and where to report unfair business practices

Here, conscious citizens are offered several options to report an offense to supervisory authorities.

Tax

If commercial activity is carried out without the appropriate permit, the entrepreneur probably does not make the required contributions to the Pension Fund, social insurance funds and evades paying taxes.

Therefore, you can contact the territorial branch of the Federal Tax Service. Sanctions will be applied to the illegal entrepreneur in accordance with Article 116 of the Tax Code of the Russian Federation, which entails a fine of 10% of the profit acquired during the period of illegal activity, but not less than 40,000 rubles.

Here it is necessary to clarify that the tax service is more of an auxiliary rather than a punitive body. The Federal Tax Service will consider the offense only as non-payment of taxes and violation of registration deadlines. The intricacies of criminal procedural law will not be discussed here.

Prosecutor's office

This can be applied in cases where illegal conduct of business constitutes a criminal offense. In addition, a complaint is filed in cases where there has already been a complaint to the police, but law enforcement officials did not take appropriate measures. Important! To file a complaint, you need compelling reasons indicating that illegal business is actually taking place. If a neighbor in the stairwell sometimes gives manicures to other residents of the house, this does not constitute an administrative offense or a criminal offense. It’s another matter if in a neighboring apartment there is a full-fledged beauty salon without the appropriate license.

Alternative options

You can complain about illegal business to the following authorities:

- OBEP is a structural unit involved in the investigation and suppression of economic crimes. If necessary, department employees will independently redirect the appeal to the tax or prosecutor's office.

- Deputy's reception - there are such receptions in every district of the city. If lawlessness occurs in the territory under his jurisdiction, the deputy will take appropriate measures.

- Public organizations are voluntary movements that work closely with law enforcement agencies and fight for the cleanliness and legality of business.

How to make an application

There is no established template for such requests from citizens.

Moreover, each authority has internal standards for filling out applications. Therefore, regardless of the addressee, statements are drawn up according to a single algorithm:

- A cap. Usually located in the upper right corner of the form, it indicates to whom the application is addressed: the name of the supervisory authority, surname, initials and position of the head of the department. In addition, the applicant’s details, including contact numbers, are indicated here.

- Title of the document. In our case, this statement is written in the center.

- The essence of the appeal. It indicates who exactly is engaged in illegal business, the type of commercial activity, the systematic nature of the offense, and a request to take appropriate measures.

Below is the date of application and the signature of the applicant with a transcript.

Important! Such applications are not allowed to be submitted anonymously: the applicant’s details and contact numbers are a prerequisite for filling out.

The legislative framework

To correctly file a complaint, you can be guided by the following legislative acts:

- Code of the Russian Federation on Administrative Offenses dated December 30, 2001. N 195-FZ (as amended on July 31, 2020).

- Tax Code of the Russian Federation dated July 31, 1998. N 146-FZ (as amended on July 20, 2020).

- Civil Code of the Russian Federation dated November 30, 1994. N 51-FZ part I (as amended (07/31/2020).

- Federal Law “On the procedure for considering appeals from citizens of the Russian Federation” dated May 2, 2006. N 59-FZ (as amended on December 27, 2008).

- Federal Law "On the Prosecutor's Office of the Russian Federation" dated January 17, 1992. N 2202-1 (as amended on July 31, 2020).

Where to report an offense

You can contact the following organizations regarding unfair commercial practices:

- police;

- prosecutor's office;

- OBEP;

- Federal Tax Service.

If an individual entrepreneur or organization operates without a license or state registration, the illegal activity caused damage on a large scale or is associated with the acquisition of benefits on a large scale, Article 171 of the Criminal Code of the Russian Federation is applied to the attackers. The following punitive sanctions are considered here:

- Illegal entrepreneurship - a fine of up to 300,000 rubles, arrest for up to six months, compulsory work for up to 480 hours.

- An organized group or the acquisition of financial gain in an amount recognized as particularly large (exceeds 6,000,000 rubles) - a fine of up to half a million rubles, imprisonment for up to 5 years, followed by a fine of up to 80,000 rubles.

In the administrative legal field, persons convicted of engaging in illegal business are charged with Article 14.1 of the Administrative Code. The following exacting measures are imposed:

- commercial activity without registration - a fine from 500 to 2,000 rubles;

- the entrepreneur does not have a license, in cases where it is mandatory for this type of activity - a fine for individuals is 2,000-2,500 rubles, for officials 4,000-5,000, for legal entities 40,000-50,000 with the possible confiscation of manufactured goods and raw materials for their production or instruments of production;

- failure to comply with the conditions of commercial activity prescribed by the license - a warning, collection of a fine of 1,000-2,000 rubles from individuals, 3,000-4,000 from officials, 30,000-40,000 from legal entities.

- a similar act involving a gross violation - a fine for individuals is 4,000-8,000 rubles, for officials 5,000-10,000, for legal entities 100,000-200,000 with suspension of commercial activities for up to 90 days.

Download for viewing and printing:

Article 171 of the Criminal Code of the Russian Federation of June 13, 1996 N 63-FZ (as amended on February 19, 2018)

Article 14.1 of the Administrative Code of December 30, 2001 N 195-FZ (as amended on March 7, 2018)