Fraud from a legal point of view

Fraud is a sophisticated and difficult to prove crime. After all, the victim usually personally transfers the rights to property or funds to the swindlers. And in order to prove the fact of theft, the victim must also have information incriminating the fraudsters. But as a rule he doesn’t have them.

In this article we will talk about the most popular types of fraud and how to prove fraud if there is no receipt or other documents confirming the fact of theft. We hope this will help you avoid falling into the trap of criminals or prove the fact of fraud.

Fraud, according to Article 159 of the Criminal Code of the Russian Federation, is the taking of someone else's property or money for personal gain. At the same time, there are two methods of fraudsters, guided by which they achieve their goal:

- Deception. For example, the victim may be provided with incorrect information regarding a transaction or forged documents, due to which he loses property or money. These could be fictitious documents for the purchase of non-existent housing, fake insurance and much more.

- Breach of trust. Often such crimes are committed by acquaintances or even relatives. The most common type of such fraud is debt without a receipt. This also includes trust relationships between firms, where one of the firms does not fulfill the promised terms of the transaction, since the signed papers were initially invalid.

Let us note that such thefts can be directed both against an ordinary person and against a legal entity. No one is safe here. But for each type of illegal action there is a clause in Article 159. It consists of 7 points, each of which indicates the type of fraud and the damage caused by it.

Fraud is a complex crime and is rarely carried out alone. Such offenses usually involve several people: the organizer, the perpetrator, the instigator and the accomplice. Therefore, when imposing punishment, the court takes into account the share of each participant in the fraud.

Article number 67 of the Criminal Code determines the punishment for each accomplice. And it is used by the court along with the main article on fraud.

Types of fraud

There are many types of scams. But we will focus on those frauds that occur most often. After all, anyone can become a victim of these “popular” methods of taking property.

With bank cards

Skimming takes pride of place among bank card fraud. The principle of theft is simple, but its implementation requires advanced devices.

A skimmer is a device that is installed by fraudsters in an ATM card reader and reads information from the magnetic strip of the card. But for theft you also need a PIN code. Therefore, criminals install a micro-camera on an ATM to record the code numbers, and sometimes an overhead keyboard is used for the same purpose. When the attackers have received the necessary information, they make a copy of the credit card and withdraw money from it.

Another simple way is to check your card. An SMS message is sent to the victim’s phone informing them that their bank card has been blocked. The same message indicates a phone number to call to sort out the situation. Particularly gullible citizens call this number, provide card details at the request of a person who introduces himself as a bank employee, and lose money from the account.

With real estate

The so-called “black” realtors are engaged in turning to the elderly or people who have problems with alcohol and fraudulently re-registering the victims’ real estate to themselves or to dummies.

Such “realtors” are not shy in their choice of funds. To achieve their goal, they can use psychotropic drugs to cloud the mind of a lonely person and deprive him of his property. Sometimes notaries also work together with such realtors to draw up an agreement.

Also, no one is immune from fraud in the primary housing market. It happens that people buy an apartment in a “building under construction” and contribute some part of its cost. But in reality it turns out that nothing is actually being built and a respectable person - a representative of a construction company - is a simple fraudster who forged documents;

Debts

Sometimes it is better to turn to a relative or friend than to a microfinance organization to borrow money.

We understand such people very well, and most importantly, we trust them. But they can enjoy our trust. We only need a verbal promise that the debt will be repaid with the salary, and it’s inconvenient to take a receipt from a colleague.

But there are other types of loans with receipts, when someone you know asks you to issue a loan for them. At the same time, he undertakes to pay the money strictly on time and even confirms the fact of the loan with a receipt. But after a while this person disappears from sight and does not answer calls.

Perhaps this person is not a fraudster, perhaps he has financial difficulties. But from the point of view of the law, such actions are regarded as fraudulent. And the fact remains - your credit history is ruined, you have lost a friend and you are facing litigation. Let's talk about them.

How to prove fraud without a receipt

Fraud is one of the most difficult types of crimes to prove. After all, in order to accuse the attacker and return money or property, you need to prove his intent. And this can be difficult.

But how to prove intent in fraud? Article 25 of the Criminal Code of the Russian Federation characterizes intent as a meaningful and deliberate action or inaction that led to socially dangerous consequences. That is, in the case of fraud, intent is understood as the desire to deceive and get the victim’s money. In short, intent is a selfish goal.

In most cases, the fact of fraud has to be proven by the victim himself.

According to Article 74 of the Criminal Procedure Code of the Russian Federation, the following may be used as evidence in court:

- testimony of the victim and suspect;

- testimony of witnesses and victims;

- testimony and/or expert opinion. This applies, for example, to technical means that fraudsters could use to scam a bank card. Sometimes the victim himself needs to obtain an examination, sometimes the court also turns to them;

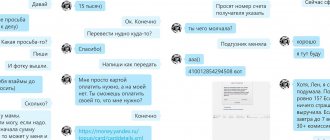

- material evidence of fraud. These include fake contracts, conversation recordings, screenshots of correspondence, and even the funds themselves that the scammers have taken possession of. Physical evidence can include anything that is relevant to the case and can prove the criminal intent of the accused.

When answering the question of whether it is difficult to prove fraud, it is worth taking into account the materials that are in the possession of law enforcement officers. Sometimes a statement and a receipt or SMS message from scammers about a blocked credit card are enough. Sometimes the testimony of witnesses may be enough.

Much depends on the offense itself and its execution. But remember, the more physical evidence, and the more logical your testimony, the higher the chance of punishing the attackers and returning the stolen money or property.

What can and should be done before filing a lawsuit

Before going to court, you can use other defense options. In many cases, this will be more effective than waiting for the dispute to be resolved. Even if pre-trial settlement of the dispute does not bring results, it will help:

- collect evidence to go to court (for example, such evidence could be correspondence with a bank);

- resolve some controversial issues out of court (for example, the bank may agree to recalculate, unblock an account or refinance a loan at a reduced rate);

- show the court the good faith of the plaintiff, who tried to resolve the issue peacefully (for example, this will be important when collecting compensation for moral damage).

Is it possible to sue immediately after a violation is discovered? It depends on the subject of the dispute and the nature of the violations. For example, if the bank committed a violation of consumer rights, it is necessary to follow the claim procedure for resolving the dispute. Some violations require filing a complaint with the Financial Ombudsman. Therefore, we recommend that you consult with our lawyers before suing, for example, Sberbank or any other credit institution.

If it is impossible to prove fraud

But it also happens that fraudulent actions cannot be proven. More often than not, this happens due to the fault of the victims themselves. We are talking about a debt without a receipt. Without a document confirming the loan, witnesses and materials that could at least indirectly prove the offense, it will be extremely difficult to bring the attacker to justice.

In such cases, lawyers advise resorting to peaceful negotiations and trying to come to an agreement with the person who borrowed the money. But if your conversation does not go well, and the attacker continues to deny the fact of receiving your money, then there is one more option.

Important! Peace negotiations cannot be evidence in court. There is no need to record them or take pictures of the correspondence of the conversations. Also, testimony cannot serve as evidence if the loan amount does not exceed 10 minimum wages.

If peace negotiations are unsuccessful, you should contact the police. But before this, you need to send a letter to the debtor with notification of receipt. The letter must indicate all the details of the case.

After the debtor receives the letter and cannot deny the fact of its receipt, you can file a statement with the police. It must indicate the date, time, place of transfer of money, the name and address of the debtor and the time that has passed since the moment the debt must be repaid. At the end of the application there must be a request to conduct a check of the suspect.

To identify signs of a crime, the debtor will be called to the police. If during interrogation the suspect states that he is going to return the money, then no criminal case will be initiated. In this case, the police will issue a resolution, which will become the main evidence in court if the debtor does not return the money within the prescribed period.

Contacting law enforcement agencies

You should contact the police in the following cases:

- immediately after contacting the bank - for reliability;

- if more than 1-2 days have passed since the transfer;

- if the bank refuses to return your money.

Of course, you will need to complain not to the bank - it is very difficult to return money that the user transferred of his own free will (even after being deceived). By refusing you in this case, the bank will not violate your rights.

Feel free to contact the police regarding fraud:

- Write a statement, describe the problem in detail, indicating all the circumstances and details, with information about the date, amount, information about the scammers known to you.

- Attach a document that will confirm that you have already contacted the bank and outlined your problem.

- Add any other documentation that is relevant to the case. For example, a receipt that reflects the transfer, bank statements, printouts of correspondence or the contents of messages, etc.

- Receive a document stating that your application has been accepted.

On average, the investigation of such cases lasts up to two months.

Contacting the police will be more productive. Law enforcement agencies have the right to request information about persons to whose cards certain funds were transferred. This can identify the scammers.

How events can develop further:

- The owner of the card to which you transferred the money will be interviewed.

- Representatives of the investigation will analyze what evidence is available and whether it is sufficient to constitute a crime.

- If there are sufficient grounds, the fraudster will be charged.

- If not, known information about this person will allow you to file a civil lawsuit (regardless of the decision of the investigators).

It happens that the police refuse to accept your statement or do not react to it in any way. In this situation, contact the prosecutor's office and file a complaint with a request to oblige the department employees to start working. Even if there is really little basis for accusations at this stage, it is important for you to establish the identity of the card owner.