08 July 2019

It seems that most people only encounter money laundering when they watch detective stories on TV. However, in reality this is not entirely true. Illegal cash withdrawal is invisibly present next to us when:

- banks block our plastic cards;

- we see advertisements about making money by accepting transfers and withdrawing cash;

- We refuse to accept bank cards for payment.

We will tell you in our article what risks an ordinary person faces when participating in illegal cash withdrawals and how not to come into conflict with the state.

Responsibility for cashing

There is no separate article of the Criminal Code of the Russian Federation for cashing out funds, however, such actions, depending on the specific cash-out scheme, can be classified as the following crimes.

Tax avoidance

For citizens, liability arises under Article 198. The sanction of Part 1 of Article 198 provides for a number of penalties, ranging from a fine of 100,000 rubles to imprisonment of up to 1 year. Part 2 applies if the amount of taxes unpaid by a person is particularly large. The maximum penalty under Part 2 of Article 198 is 3 years in prison. If cashing out took place using a legal entity, you will have to answer under Article 199 (fine of 100,000 rubles, forced labor, arrest, imprisonment for up to 2 years for the first part and imprisonment for up to 6 years with a fine for the second part).

Forgery of documents – Article 327 of the Criminal Code

This article contains 3 parts. The first provides for liability directly for the production of false documentation (restriction of freedom, arrest, forced labor or imprisonment for up to 2 years). The second part involves falsifying a document in order to hide another crime (regarding the topic under consideration, such a crime could be, for example, tax evasion) - forced labor or imprisonment for up to 4 years. And part 3 provides for liability for the use of a deliberately forged document - the maximum penalty is arrest of up to 6 months.

Illegal business activity (Article 171)

Please note Schemes for cashing out money through individual entrepreneurs are prosecuted by law and threaten the initiators and executors of fraudulent schemes with imprisonment. You can read more in a separate article.

. This article of the Criminal Code of the Russian Federation applies when cashing out money through shell companies

Such companies, as a rule, do not prepare all the necessary documents, do not register them in the register, as required by law, etc. The sanctions include penalties such as a fine, the amount of which depends on the salary of the offender, compulsory work and arrest for up to 6 months. If the investigation establishes that illegal business activities were carried out by an organized group or as a result of which the criminals received particularly large income, the maximum punishment can reach 5 years in prison (Part 2 of Article 171).

This article of the Criminal Code of the Russian Federation applies when cashing out money through shell companies. Such companies, as a rule, do not prepare all the necessary documents, do not register them in the register, as required by law, etc. The sanctions include penalties such as a fine, the amount of which depends on the salary of the offender, compulsory work and arrest for up to 6 months. If the investigation establishes that illegal business activities were carried out by an organized group or as a result of which the criminals received particularly large income, the maximum punishment can reach 5 years in prison (Part 2 of Article 171).

Money laundering

The Criminal Code contains 2 similar articles: Article 174 involves laundering money that another person acquired as a result of committing a crime and Article 174.1 – laundering money that the person himself received as a result of criminal activity. The penalties under these articles are almost the same: a fine, and in the presence of qualifying criteria (large or especially large size, organized group, etc.) - up to imprisonment for up to 7 years.

Read this article to learn more about what it means to launder money.

https://youtube.com/watch?v=U6wB9pm6OS8%3Fautohide%3D2%26autoplay%3D0%26controls%3D1%26fs%3D1%26loop%3D0%26modestbranding%3D0%26playlist%3D%26rel%3D1%26showinfo%3D1% 26theme%3Ddark%26wmode%3D

The subject and subjective side of the crime

The subject of an offense under Art. 174 of the Criminal Code of the Russian Federation recognizes an adult sane person. A prerequisite is that a person held accountable under this article must not directly participate in criminal activity in the acquisition of legalized property. At the same time, he is obviously aware of its illegal origin and aims to help the criminal in creating the appearance that the property was acquired legally.

Attention! The subject of the crime may not be aware of all the details or circumstances of the criminal activity, for example, he knows only in general terms that the sums of money represent profits from drug trafficking, without having information about specific transactions and their participants. At the same time, he agrees to cash out the money, thereby legalizing it. .

How do tax authorities detect cashing?

Even if the entrepreneurs behaved very carefully and were sure that they had thought through everything, the tax authorities have several indirect signs by which they can distinguish a fictitious transaction from a real one.

What signs are we talking about? For example,

– workers allow themselves large purchases with low wages, for example, premium cars; – the company claims significant amounts of taxes for reimbursement; – the founder or director is among the company’s counterparties; – the company opens a bank account in which many legal entities from the controlled list “sit”; – the company’s operations attract attention due to their unusualness: the company traded concrete and suddenly bought a carload of tulips; – the company’s balance sheet contains many transactions for which it is difficult to determine the market value, for example, consulting services; - source documents. .

The essence of the crime

To understand what sanctions await for violating the law in the field of finance, you first need to understand the essence of cashing out funds. Cashing means withdrawing real money from non-cash accounts, as well as transferring income into cash equivalent from bills and other securities legally. Illegal actions aimed at obtaining cash are usually called cashing. Many people without economic education confuse these two concepts, although the difference between them is huge.

The main purpose of illegal cash withdrawal is tax evasion or the use of funds for purposes other than their intended purpose. Article 172 of the Criminal Code of the Russian Federation regulates liability for cash withdrawal.

Money can also be withdrawn legally. One of the ways to legally cash out funds is to receive them through individual entrepreneurs. In this situation, responsibility for the cashing out procedure falls on the individual entrepreneur, and he has every right to withdraw from circulation and dispose of funds at his own discretion after paying taxes. Cashing out money from plastic cards of bank clients is also considered legal. Although recently there has been a rapid increase in the number of banks that help dishonest clients cash out. The state takes away the licenses of such banks and brings their founders to criminal liability.

Cash issuance is issued using a cash receipt order or using a corporate bank card. Each company's accounting policy specifies the limit that can be removed and must be accounted for. A person who has withdrawn a certain amount must provide receipts and other documents that can confirm the expediency of the expense or return the withdrawn money within a few days. If the employee argues for the costs or returns the amount, then cashing out is considered legal and does not entail criminal liability.

How they do it

To avoid such taxes, entrepreneurs use the cashing service. Cashing turns official money in accounts into unofficial cash in a safe. And the entrepreneur pays wages from unofficial money. Cashed money is not listed anywhere, so it is not subject to tax. It seems like savings.

An entrepreneur enters into an agreement with a special seemingly harmless company that provides information services. The contract price is the amount that needs to be cashed out, plus a percentage for the service.

The entrepreneur pays the invoice and signs the work completion certificates. They say that the information service has been provided.

Non-cash money goes to the account of this company. But she will not provide any services: she will transfer this money to some other company. Then another and another. So money jumps along the chain between several seemingly unrelated companies. In fact, these firms are part of a cashing network.

When the money has traveled a long way, it is cashed out in some clever way: through an unscrupulous bank, a fake depositor, using payment systems.

After a short time, a specially trained person contacts the entrepreneur and gives him the cashed money.

For an entrepreneur, it looks like this: “Paid one bill, received cash.” For the tax authorities it looks like this: “The company paid for the contractor’s services, nothing suspicious.” But in fact, a whole group is working.

how to cash out money

Is it legal to withdraw money from accounts?

Controlling authorities cannot completely prohibit the issuance of money from accounts, but inspection organizations carefully check monetary banking transactions and try to ensure that all of them are carried out in accordance with the legislation of the Russian Federation.

The consequences of illegal circulation of funds are the impoverishment of regional or federal budgets by the required amounts, the spread of corruption schemes in the country and the lack of pension money in the accounts of people who receive the money they earn in cash “in envelopes.” Firm managers and private entrepreneurs try to justify illegal fraud with the tax burden and the desire to pay wages to employees on time and in the required amount, especially since some of the hired people provide services to the employer without official registration.

We need cash to quickly resolve issues among bureaucrats and uninterruptedly supply the production process with the required materials. For enterprises that cooperate with state and municipal services, such cashing out is theft of incoming federal funds, despite the existing responsibility.

Cashing through mobile operators

A legal entity transfers money to the personal account of an individual subscriber. Then the contract is terminated. The subscriber will receive the funds (balance) remaining in the account in cash at the mobile operator's cash desk.

How do they catch cashers in this case? It's quite simple here. Since 2021, all mobile operators have been forced to comply with Law No. 115-FZ. Now they must monitor transactions worth more than 100 thousand rubles, include them in the list of suspicious ones, and transfer the information to tax authorities.

How shell companies cash out money

Today, it is possible to check counterparties (that is, other organizations that are involved in cashing out). You can see how many companies were registered per person and how efficiently they work (calculates funds to the budget and funds).

Such firms, by type of activity, can be represented in any organizational and legal form or be associated (have as one type of activity) the issuance of microfinance loans.

The scheme is extremely simple:

- Using fake documents or personal data, the use of which is prohibited, salary projects are drawn up at the bank (photos of the salary card holder can even be taken);

- the main company transfers money for an imaginary service and waits for the money to be withdrawn through bank cards;

- cash is transferred with a percentage for intermediation withheld.

Many such companies are opening, some of them transfer money among themselves in order to confuse their tracks.

The essence of cashing out

In the age of the credit card system, there is no particular need to own a large amount of cash. So why are they cashed out? There are several legal options:

- To issue wages to employees.

- To make social payments (sick leave, benefits, etc.).

- Payment to suppliers (under agreed conditions).

- Reporting to employees for current needs (business trips, etc.).

- For a loan (in exceptional cases).

In addition, cash withdrawal may be carried out for purposes not provided for by law:

- To withdraw a company from circulation with minimal taxation.

- For the purpose of theft.

- To finance illegal, shadow operations.

- To issue wages “in an envelope”.

- From distrust in the banking system.

Where do you cash out?

There are many proven schemes for transferring money from an account into crisp bills. Some of the methods are legal, some are not very legal, or are clearly criminal. Owners and managers of enterprises, as a rule, are well versed in legislation and know how to make money. However, if you need to receive any amount in cash, they act in approximately the same way. They call the accountant and say: “You give me such and such an amount, and then you will spend it somewhere.” So large sums hang in the sub-report without being written off.

An experienced accountant closes one report every three months and immediately opens the next one. If you don't do this, questions cannot be avoided.

We have already considered the first and most common method of cashing out money. This is the issuance of money to an employee, who then must report for this amount in documents. This also has its pitfalls. For example, purchasing industrial water filters for a company in cash and at an inflated price will certainly raise questions among law enforcement officers. They won’t be able to blame you directly, but they will probably ask about the availability of a sanitary report indicating that your water does not meet the standards and check the presence of a filter using inventory reports. As a result, the purchase amount will most likely go negative.

Of course, the largest cash-out operations are carried out with the participation of banking industry employees. Great opportunities are also provided by wholesale companies and large construction companies.

Cash withdrawals are often carried out on counter flows. In a particular case of this scheme, 5 - 6 companies begin to urgently transfer money to each other. After a dozen such operations, it is almost impossible to understand the scheme. If no obvious crime is revealed, then after three years, on the basis of clause 1 of Article 113 of the Tax Code of the Russian Federation, the statute of limitations will come into force. After this period, the decision on administrative proceedings can be challenged in court. (Chapter 24 of the Arbitration Procedure Code of the Russian Federation). The provisions of Art. 109 of the Tax Code of the Russian Federation on exemption from liability.

When working with VAT payers, the scheme is simple. This is the purchase of a product or service (sometimes imaginary) at an inflated price, also with a kickback. This is absolutely illegal and requires prior agreement with the counterparty. But sometimes small legal entities are also used. Such as individual entrepreneurs or LLCs.

Basic stages of money laundering

Money laundering is carried out in three stages:

- Peeling. Initially, money obtained illegally is “diverted” from its real source. For this purpose, funds are withdrawn abroad, transferred to the accounts of individuals or legal entities.

- Accommodation. Funds are introduced into the legal cash flow by any available means. As a rule, at this stage the attacker already has fictitious confirmation of the source of their income.

- Integration. This is the final stage when the appearance of legitimate possession of wealth is created. The owner of funds can freely withdraw them, transfer them to any accounts, and purchase various items and real estate.

After passing through three main stages, the money is reinvested in illegal activities. The process can be repeated an unlimited number of times or carried out once, to legalize a large amount and spend it further, for example, a bribe.

Sometimes some steps are skipped. For example, if the money is immediately deposited into a bank account, its implementation is no longer required. But this is a risky step, since the bank will definitely inquire about the origin of the income and without documentary evidence the account may be frozen. Also, integration is not always carried out, that is, the “laundered” money remains in different accounts and is used as needed. In some cases, the situation requires you to wait a certain period of time before proceeding to the third stage. But concealing the true source of funds and obfuscating the tracks is mandatory.

What are the consequences of illegally withdrawing money through an individual entrepreneur or LLC?

Money laundering is strictly punishable under the laws of the Russian Federation. The state regulates this area and strives to protect law-abiding citizens. Recently, you can often find information in the press that the Central Bank is depriving the licenses of banks that participate in cash-out schemes. Persons creating shell companies and their entire management team bear full responsibility to the fullest extent of the law.

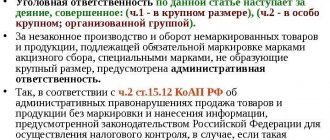

There is no article in Russian criminal legislation that specifically implies liability for illegal cash withdrawal. Responsibility depending on the cash-out scheme is prescribed in a number of articles. Namely:

- In a scheme where cashing out involves avoiding paying taxes, the liability of an individual is specified in Article 198 of the Criminal Code of the Russian Federation, for a legal entity - Art. 199 of the Criminal Code of the Russian Federation. An individual faces a fine of up to 300 thousand rubles or imprisonment for up to 1 year. The organization will have to pay a fine of up to 500 thousand rubles; the management team faces a sentence of up to 5 years, often with a ban on holding certain positions in the future.

- If the fact of complicity of one person in concealing funds that, according to the law, must be taxed is revealed, then this unlawful act falls under Art. 199 clause 2.

- In case of detection of the fact of forgery of various documents, Art. 327. In accordance with this article, fraudsters face restriction of freedom for up to two years.

- In case of illegal business – Art. 171. Conducting the activities of an individual entrepreneur in ways contrary to the laws of the country is punishable by up to 6 months.

- For false entrepreneurship - Art. 173. The managers of a fly-by-night company are liable up to imprisonment for up to 7 years.

- Money laundering is regulated by several articles 174 and 174.1. For this act, fraudsters face a large fine of 120 thousand rubles; in extreme cases, imprisonment for a term of 4 to 15 years. The punishment depends on the severity of the offense, namely on whether the defendant is the owner of funds that were obtained illegally.

Based on the foregoing, it is clear that when attempting to illegally cash out funds, the fact of any fraudulent action falls under criminal liability. When creating an individual entrepreneur or LLC, you should not expect that an individual will avoid liability. The illegal method is very easy to pull off.

Cashing out in itself is not criminal in nature, but it is often accompanied by concealment of funds; they are withdrawn in order to hide them from government services. In this case, liability may fall under several articles at once.

Any individual who participated in an illegal act is liable for tax evasion on the income from the activities and on the entire amount in the individual's personal account. In addition, actions may qualify as aiding and abetting tax fraud.

The state's obligation to regulate relations between market participants leads to the fact that all processes become significantly more complicated for law-abiding actors.

A person cannot always pull off a difficult financial scheme on his own, so often an entire group engaged in illegal activities is tried as an organized criminal group.

Where to report

- To the police department.

- To the prosecutor's office. Contacting this authority is necessary, especially if the police are inactive.

- You must write a statement about an economic crime to the OEB.

- To the reception rooms of deputies or to public organizations.

https://youtube.com/watch?v=9MZyN7Pb_fI%3Ffeature%3Doembed

“Cash out” in Russian: how it works and what the consequences are

Typically, commercial payments are made non-cash. But sometimes money is for urgent current expenses or “gray” salaries. And some entrepreneurs simply want to save money and pay less taxes, or simply receive money for personal use, circumventing the law. The simplest scheme used by unscrupulous businessmen is to turn to one of the “cash-out platforms,” says a former ICR investigator, and now a partner at the Law Office ZKS Law Office ZKS Federal Rating. Criminal Law group 16th place by revenue per lawyer (less than 30 lawyers) 41st place by revenue Company profile Sergey Malyukin. The “performers” will do everything themselves; the “client” is only required to transfer funds via “bank transfer” to the desired account.

Typically, such schemes involve shell companies that do not pay taxes and submit reports with zero figures. They are registered in the names of denominations - homeless people and students who agreed for a small sum to be listed as the founders of companies.

But some businessmen act independently. They register an individual entrepreneur and transfer money there for “fictitious services.” After this, the required amount is withdrawn from the individual entrepreneur’s account and brought to the bank, Malyukin explains the scheme.

There are also newer ways. The head of Rosfinmonitoring, Yuri Chikhanchin, said a year ago that the courts, the FSSP and the notary are used to withdraw funds. A fictitious debt is created, which is repaid through a notary's deposit account or by presenting a notary's writ of execution. In 2019, the volume of such transactions amounted to 5 billion rubles. and exceeded 2.5 times the figures for 2018.

And over the nine months of 2021, the volume of illegal cash withdrawals using executive documents has almost doubled, said Ilya Yasinsky, director of the financial monitoring department of the Bank of Russia. According to him, the volume of such transactions is constantly growing, although in general there is less and less cashing out.

Thus, the security forces will consider a crime a scheme when non-cash money is sent through shell companies through fictitious transactions in order to ultimately withdraw it into cash. And the “customer” uses such operations precisely for illegal purposes. For example, save on taxes, spend “cash” on bribes, kickbacks or things prohibited in circulation.

The Federal Tax Service, in its letter, developed three years ago together with employees of the Investigative Committee, explains how to find out during tax audits that a particular enterprise is purposefully using illegal schemes. Suspicion should be raised by:

- “complex and confusing” transactions;

- moments when a company often spends money on services whose market value is difficult to determine;

- paid consultations on certain issues.

The taxpayer has business relations with companies that have the characteristics of one-day companies: they do not have staff and premises for work, the manager does not receive income, the organization itself opens many current accounts, and also in banks not at the place of registration.

The letter provides advice not only to inspectors who accompany an on-site tax audit, but also to law enforcement officials on what to look for, how to prove guilt and what papers to examine.

Deputy head of the Federal Tax Service for the Sverdlovsk Region, Marina Ryabova, explained how her colleagues contact “cashers”: “During on-site inspections, tax officials request information about the movement of money through bank accounts.” At the same time, they are especially interested in transfers to the accounts of private individuals, and then they deal with them, Ryabova said. For example, the security forces detained the Tambov “cashers” when they found out that the attackers had registered 20 companies that were not engaged in any legal financial and economic activities. The criminals opened personal accounts in banks for 170 citizens, whose passports were fraudulently taken away.

How to be judged for “cash out”

There is no term “cash out” in the legislation, so participants in such schemes are prosecuted under various articles. “Clients” – for non-payment of taxes (Article 199 of the Criminal Code), and the organizers and employees of “cash exchange sites” – for illegal banking activities (Article 172 of the Criminal Code). Additionally, they may be charged with several more offenses, Malyukin lists: “From the illegal circulation of means of payment (Article 187 of the Criminal Code) to the transfer of money to foreigners using forged documents (Article 193.1 of the Criminal Code).”

In the Nizhny Novgorod region, the practice of bringing entrepreneurs who ordered “cash out” to criminal liability under Art. 187 of the Criminal Code (illegal circulation of means of payment). They are punished for using a payment order based on a fictitious agreement.

Sergey Shuldeev, lawyer at AB Q&A

Until mid-2014, there was no unified approach to how to qualify the actions of “cashers” who are not bank employees. Often, the courts considered their crimes as “illegal entrepreneurship” (Article 171 of the Criminal Code), which is punished more leniently than “illegal banking activities” (Article 172 of the Criminal Code), recalls adviser Kazakov and partners Kazakov and partners Federal Rating. group Bankruptcy (including disputes) (high market) group Environmental law group Antitrust law (including disputes) group Natural resources/Energy group Land law/Commercial real estate/Construction group Criminal law 12th place By revenue per lawyer (more than 30 lawyers) 25th place By number of lawyers 27th place By revenue Company profile Alexey Anufrienko: “Usually the courts were limited to suspended sentences.”

- Illegal entrepreneurship (Article 171 of the Criminal Code) as part of an organized group is punishable by a fine of up to 500,000 rubles. or in the amount of wages or other income of the convicted person for a period of one to three years, or forced labor for a term of up to five years, or imprisonment for a term of up to five years with a fine of up to 80,000 rubles. or in the amount of wages or other income of the convicted person for a period of up to six months or without it.

- Illegal banking activity (Article 172 of the Criminal Code) as part of an organized group is punishable by forced labor for up to five years or imprisonment for up to seven years with a fine of up to 1 million rubles. or in the amount of wages or other income of the convicted person for a period of up to five years or without it.

The situation changed six years ago, when the Constitutional Court allowed any citizens to be held accountable under Art. 172 of the Criminal Code (Decision of the Constitutional Court dated July 17, 2014 No. 1743-O). Since then, “illegal banking activities” have been the main ingredients for participants in “cash-out” schemes, says Anufrienko. According to statistics from the Judicial Department of the Supreme Court, the number of people convicted under it is increasing. If five years ago there were only 816 people, then in 2019 4,938 people were sentenced.

True, the punishments for the most part are not the most severe. About half of all sentences are suspended sentences and fines. Only a few hundred people are sent to colonies on these trains each year – for the most high-profile cases. Thus, in Rostov-on-Don a year ago, banker Alexander Grigoriev was sentenced to a real prison term (case No. 1-5/2019 (1-41/2018; 1-432/2017;)). He and his accomplices stole about 2.1 billion rubles. from Zapadny and Doninvest banks. Now he faces nine years behind bars.

The court found that from December 2013 to September 2014 in Moscow and Rostov-on-Don, criminals using forged documents issued obviously non-repayable loans to shell companies registered under dummies. During the investigation, law enforcement officers found and seized property of the accused worth 2.5 billion rubles. Grigoriev played an active role in the Laundromat (“Moldavian scheme”). In this way, Russian clients wishing to withdraw money abroad were served. Bank clerks deliberately made mistakes in payment orders. They changed the details of correspondent accounts of Russian banks in the divisions of the Central Bank with the details of correspondent accounts of the same banks within Moldindconbank, Open Media explained in their investigation. And when the money arrived in Moldova, it was written off based on forged decisions of bailiffs (allegedly Russian companies owed something to Moldovan companies). In reality, dollars were bought with this money, then they were credited to Moldindconbank correspondent accounts at the Bank of New York, investigators from the Ministry of Internal Affairs describe the scheme. As a result, the money ended up in foreign companies controlled by Laundromat clients.

But the Kazan “cashers” got off with suspended sentences and fines, although in three years they cashed out more than 4.5 billion rubles. What saved the criminals from the colony was that they repented and made a deal with the investigation (case No. 1-410/2017). They worked according to a standard scheme: they registered companies in the names of dummy persons, through whom they “drove” the customers’ money. At the same time, the accomplices worked in specially rented apartments, and for the purpose of secrecy they communicated with clients exclusively through Viber and Telegram.

When the scale of criminal activity is serious, then those involved in such cases are also charged with Art. 210 of the Criminal Code (“Organization of a criminal community”). It was on this basis that Sergei Magin and his accomplices, who cashed out 122.2 billion rubles, were convicted. (Case No. 01-0004/2016). Perm investigators also managed to prove an organized criminal group. They uncovered a group that included at least 13 people, including the son of the vice-president of the All-Russian Sambo Federation and the manager of the Sberbank office. The convicts were able to withdraw about 1 billion rubles. (Case No. 22-1083/2019).

The state is fighting against “cashers” and is achieving success in it. This is evidenced by the fact that these “services” are becoming more and more expensive. Their price is already comparable to the tax burden for businesses in the general taxation system.

Sergey Egorov, managing partner of EMPP EMPP Federal rating. group Arbitration proceedings (medium and small disputes - mid market) group Family and inheritance law group Environmental law group TMT (telecommunications, media and technology) group Corporate law/Mergers and acquisitions (high market) group Criminal law 15th place In terms of revenue per lawyer (less 30 lawyers) 33rd place by revenue

According to lawyer Feoktistov and partners Feoktistov and partners Federal rating. Group Criminal Law of Dmitry Danilov, Art. 210 of the Criminal Code, it is appropriate to charge attackers if the “cash-out platform” consists of at least four people who act together and not independently. That is, they have a common cash desk and a single decision-making center. At the same time, according to Art. 210 of the Criminal Code attracts the widest possible range of people, Malyukin emphasizes: “Sometimes even couriers who delivered documents under fictitious transactions are punished.”

The latest trend in tactics and strategies for working in such cases is to bring to justice nominal managers, data about which is in the Unified State Register of Legal Entities. And based on their testimony, they calculate the address of the “cash exchange site”, as well as other participants in the criminal scheme, says the managing partner of EMPP EMPP Federal Rating. group Arbitration proceedings (medium and small disputes - mid market) group Family and inheritance law group Environmental law group TMT (telecommunications, media and technology) group Corporate law/Mergers and acquisitions (high market) group Criminal law 15th place In terms of revenue per lawyer (less 30 lawyers) 33rd place by revenue Sergey Egorov. Although some can be difficult to reach. The modern level of technology allows beneficiaries of such schemes to feel at ease abroad, notes partner Romanov & Partners Law Firm Romanov & Partners Law Firm Federal Rating. group Criminal law Company profile Matvey Protasov.

“Cashers” may also be convicted of illegal creation of companies (Articles 173.1–173.2 of the Criminal Code). We are talking about the registration of shell companies, which criminals use as dummies for their schemes. If investigators establish that criminals bought such organizations ready-made on the black market, then there will be no structure, Danilov claims.

Risks of “criminal” for participants of “cash schemes”

– “Cash-out customers” – the management of the company and its chief accountant. Who is responsible for financial reporting in the company and is responsible for tax evasion (Article 199 of the Criminal Code).

– “First-level executors” are the founders, director and chief accountant of a shell company that was used in a criminal scheme (Article 171 of the Criminal Code and Article 174 of the Criminal Code).

– “Second-level executors” – bank employees (Article 172 of the Criminal Code).

Mikhail Osherov, Chairman of KA Osherov, Oniskovets and partners Osherov, Oniskovets and partners Federal rating. group Criminal law group Dispute resolution in courts of general jurisdiction.

“Cash out” may also appear in the investigation of other compounds. If money received under a government contract is cashed out and it cannot be proven that it was spent for its intended purpose, then this can be classified as fraud (Article 159 of the Criminal Code), says Vladimir Kitsing from Knyazev and Partners Knyazev and Partners Federal Rating. Group Criminal Law A profile is a method of committing another crime.

A similar situation occurred in the Seventh Studio case. According to her former chief accountant Nina Maslyaeva, at the request of Yuri Itin, another person involved in the case, she “set up cashing.” The chief accountant admitted that only 90 million rubles. went to the implementation of the theater project “Platform”, and another 120 million rubles. were kidnapped. Maslyaeva claimed that she appropriated 5 million rubles from this money. The defense was able to confirm that all the performances took place, but the exact cost of them cannot be established. As a result, the accused received suspended sentences specifically for fraud (case No. 01-0033/2020).

According to Danilov, the investigation may impute Art. 159 of the Criminal Code when cashing out money, if he finds out and proves that the recipient of state funds “withdrew” them in order to appropriate them for himself. A hired director who agrees to participate in “cash out” schemes also risks. If the founder of the company declares that such transactions took place without his knowledge, and the money was not returned to the company, then the top manager will be convicted of theft, the lawyer warns.

According to the managing partner Bolshakov, Chelysheva and partners Bolshakov, Chelysheva and partners Federal rating. group Criminal law Company profile of Arthur Bolshakov, recently the founders themselves often seek to initiate criminal proceedings against the hired manager. It can be very difficult to prove that funds were withdrawn at the direction of the owners, the expert states.

It is difficult to investigate such crimes. Some “cash exchange sites” may be “protected” by security forces, Egorov assures. You also need to check a large number of counterparties of fly-by-night companies. Such companies are typically liquidated every three years and their records destroyed, Keatsing notes. The use of foreign companies or firms with accounts in foreign banks will add complexity to the investigation, explains Mikhail Osherov, Chairman of the Osherov, Oniskovets and Partners Federal Rating Agency. group Criminal law group Dispute resolution in courts of general jurisdiction.

What is missing from the legislation?

To effectively combat cash-out, law enforcement agencies have enough powers, Malyukin is sure. Nevertheless, illegal businesses continue to operate, as the tax burden on businesses has not eased in recent years. And the coronavirus crisis will definitely not “convince” entrepreneurs to abandon such tax savings and salary payments “in envelopes.”

Although the Federal Tax Service has issued a letter on how to prove deliberate non-payment of taxes and “cash-out”, this is not enough, Nikita Merkulov, lawyer for Zabeid and partners of Zabeid and partners of Federal Rating, is sure. Criminal Law group. In his opinion, a “blurred” interpretation of the term “cash out” allows you to “see a black cat in a dark room when there is none”: “A law enforcement officer can find a crime where there is none, and a potential attacker will not even know that his actions are illegal.” . To get rid of such risks, the expert suggests deciphering the concept of cashing out at the level of federal law.

- Alexey Malakhovsky

- criminal process

How do semi-legal cash out options occur?

In the practice of Russian business, another option for cashing out funds from the current account of a legal entity is actively used - working with individual entrepreneurs, since all income of an individual entrepreneur is his personal funds, and he can withdraw any amounts from his current account without any documentary confirmation.

There are quite a lot of variations of cashing out using an individual entrepreneur, some of them are contrary to legal requirements, others are a normal option for optimizing tax payments.

For example, some companies transfer all their employees to individual entrepreneurs, thereby avoiding the cost of paying personal income tax, contributions to extra-budgetary funds, and also reducing the tax base by classifying payments to individual entrepreneurs as expenses. In addition, payments are often made in larger amounts and the employee must return part of the funds to the employer. This option largely violates current legislation, and is therefore an undesirable way to cash out funds.

You can also cash out by working with counterparties who have the status of individual entrepreneurs. In this case, the funds are transferred to pay for goods or services purchased for the needs of the LLC.

The individual entrepreneur must provide reporting documents on the transaction, and in some cases the transaction must be documented. For example, payment for the rental of vehicles must be confirmed not only by the act of provision of services and waybills, but also by the rental agreement. With this option, you can get cash in the following way:

- The paid goods or services were not actually purchased, and the individual entrepreneur transfers the transferred funds to the representative of the LLC;

- The cost of goods and services according to the documents is higher than the real one; the difference in the cost of the individual entrepreneur is also transferred to the LLC.

This option involves paying a certain percentage to the entrepreneur for his services in withdrawing cash, as well as processing documents. This option is also on the verge of the law.

A more legal option is for an individual entrepreneur to participate in the management of a legal entity. This option provides that instead of the sole executive body of the LLC in the company, these functions are performed by a manager - an individual entrepreneur who has the appropriate OKVED. The management agreement specifies the terms of payment of remuneration, which can be equal to the entire volume of net profit.

This option does not cause suspicion on the part of supervisory authorities, but only in cases where:

- The manager of the individual entrepreneur is not the founder of the LLC under management;

- An individual entrepreneur performs the functions of a manager in relation to 1-2 legal entities. The law does not limit the number of companies under management, but practice shows that a large number of LLCs under the control of one individual entrepreneur raises certain questions among tax authorities;

- A legal entity actually carries out commercial activities, that is, the receipt and expenditure of funds in reasonable amounts is carried out on current accounts.

This option is not always acceptable, but practice shows that it is quite suitable for small businesses if all legal requirements for managing a legal entity are met.

It is quite possible to cash out money in a legal way. The owner and manager of a legal entity only needs to determine the option that best suits the specifics of their business. You should not resort to dubious cash withdrawal schemes, since responsibility for such actions has now been significantly tightened, and control over transactions on current accounts of legal entities has also been strengthened. Control over the cash funds of organizations is also being tightened; for example, a cash register for LLCs and individual entrepreneurs will in the very near future have to ensure the online transmission of information on each transaction to the tax service server.

According to data from https://megaidei.ru/organizaciya-biznesa/obnalichit-dengi-s-raschetnogo-scheta-ooo

Bank card blocking

The state obliges banks to decisively combat the cashing out of illegal income. This is done on the basis of Federal Law No. 115, which is called “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.” If a financial institution does not prevent the identified money laundering process, it risks receiving a huge fine or even losing its license.

Therefore, banks block accounts that contain dubious transactions.

. The full list of transactions that raise suspicions with the Central Bank is publicly available and takes up 19 A4 sheets. The main signs of suspicious activity are as follows:

- a large sum of money is deposited into your bank card account and quickly cashed out;

- sums of unknown origin arrive regularly and are also cashed out.

If a transaction comes under suspicion, the financial institution refuses to carry it out and blocks the card. The funds remain in the account, but their owner is temporarily deprived of access to the money. To unblock the account, he must provide the bank with an explanation of where and on what basis the money is coming to his card.

who received a money transfer from his relative

may come under suspicion and have his card blocked A card can also be blocked due to a failure in the system (for example, after a regular transfer in the amount of 1,000 rubles).

To solve the problem, a law-abiding card holder will have to contact bank employees and explain who made the transfer and why

. Sometimes one call to support is enough. Sometimes you have to give explanations in writing. It happens that the solution to the problem is delayed for a long time and is accompanied by various complications.

If you receive transfers from relatives quite often, then we advise you simply not to cash out the money, but to pay by non-cash method

wherever possible. Transparent financial transactions do not raise suspicion among banks.

If you are an individual entrepreneur, then it is necessary that all funds received into your account be supported by documents

(service agreements, invoices). It is also advisable to have certificates from the tax office confirming payment of all due contributions. Then, when withdrawing money from your current account to a debit card and further cashing out, you will be able to prove to bank employees the legality of the origin of this amount of money.

How can an LLC withdraw money from its current account?

There are several ways to withdraw money from your LLC current account. Let's look at each of them in detail.

- Payment of wages. This is the simplest and most obvious method, but not the most profitable. By paying contributions to funds from your salary, giving the state 13% in the form of personal income tax, you will lose about a third of the amount.

- Dividend payment. Members of the company have the right to receive profits from the activities of the LLC. Dividends can be paid from the company’s net profit and distributed among participants in proportion to their share in the authorized capital. In this case, we give only 13% of personal income tax to the state. The bad news is that dividends can be paid no more often than once a quarter. In addition, Article 29 of the Federal Law of 02/08/1998 No. 14-FZ “On LLC” contains a ban on the payment of dividends in a number of cases.

- Issuing a loan. The company can issue a loan to any individual, including members of the company. A loan agreement is drawn up (preferably with a small percentage) for any period, at least 10 years. True, sooner or later the loan will have to be repaid, so this method of cashing out is only good in case of an urgent need for cash.

- Withdrawal for expenses. A suitable option is when an LLC performs any work for itself or purchases goods, paying the counterparty in cash. A check is filled out at the bank, and “current expenses” can be indicated in the payment purpose. The downside is that all expenses must be supported by documents, and the bank will charge a commission for the transaction. It is also necessary to comply with the write-off standards for expenses, which are set out in Article 264 of the Tax Code of the Russian Federation.

- Travel expenses. An ideal reason to withdraw money from your current account. But employees will be required to submit advance reports. With a large number of employees, monthly travel expenses amount to quite a decent amount.

The listed ways to get cash can certainly help you solve the problem. However, experienced businessmen advise not to get carried away with cashing out, but to try to spend most of your expenses (car, communications, travel, household appliances, etc.) as company expenses. In this case, there will not be a great need for cash.

In conclusion, a few words about liability for illegal cash transactions. Officials are brought to criminal liability with charges of violating tax laws, tax evasion, forgery of documents, etc. Banks lose their license. Heavy fines and imprisonment are used as punishment. Therefore, it is better not to succumb to the temptation to participate in “gray” combinations, but to receive income from business through legal methods.

Refusal to accept a bank card for payment

It is quite possible that illegal cash transactions occur when they refuse to accept a plastic card for payment (with 5% cashback), for example, in a restaurant. The waiters’ arguments in such cases can be very different (“no connection with the bank”, “the terminal is broken”, etc.). The cafe staff may even offer you to pay the bill in cash for a good discount (about 10%). There have been more and more stories on the Internet about discounts when paying in cash lately.

Why is this happening? In a world dominated by non-cash payments, it is becoming increasingly difficult for people making illegal transactions to receive large amounts of cash in their hands. In this situation, retail outlets are used as cash aggregators

(most often - catering establishments).

Sellers do not carry out trading transactions paid in cash through the accounting department. Restaurant managers then sell the cash they collect from customers to criminals or shady businessmen.

. Interested parties pay for cash banknotes non-cash (for example, they transfer money to a cafe for non-existent banquets). The cost of “cache” on the shadow market reaches ten or more percent of its face value.

Of course, there is nothing illegal about paying your bill at a cafe in cash at a good discount (but it’s a pity to lose cashback and not get a discount). However, it is still unpleasant to realize that the establishment where you are currently eating may be associated with the world of crime.

We also advise you to read our article “Blocking of a payment card at the initiative of the bank: why it happened and what to do now.”

moneyzz.ru

Heading:

Interesting articles about finance and financial literacy

Tags:

BANK CARDS LAW PERSONAL EXPERIENCE FRAUD

Why are illegal cash-out schemes used?

In practice, there is an opinion that cashing out is always accompanied by legalization (laundering) of income. It's not like that at all. Very conscientious companies want to reduce the state’s “pressure” on the revenue side and withdraw some funds for their own use in a simple way.

It should be noted that cashing out may be associated with false entrepreneurship or fraud and does not necessarily have the ultimate goal of diverting money from the tax burden. . Therefore, when qualifying a crime, if it is discovered, investigators study:

Therefore, when qualifying a crime, if it is discovered, investigators study:

- all essential features of an unlawful act;

- special attention is paid to optional characteristics;

- entities that acted in a single financial chain;

- what related crimes were committed.

Thus, illegal schemes can only be a “screen” for other more complex crimes that pose a serious threat to society.

Responsibility of individual entrepreneurs for cash withdrawal

Detection by control bodies of facts of violation of cash circulation by business entities leads to liability in accordance with the norms of current Russian legislation. First of all, punishment is provided for officials involved in fraud. Banks that facilitate illegal money laundering face official revocation of their licenses.

Cashing out money through an individual entrepreneur is a liability under the articles of the Criminal Code of the Russian Federation:

- Stat. 171 – carrying out illegal business leads to a maximum penalty of arrest for up to six months or a fine of up to 300,000 rubles.

- Stat. 174 – fraudulent money laundering, depending on the size, leads to a maximum sentence of forced labor of up to 5 years or a fine of up to 1,000,000 rubles. The exact penalties depend on whether the individuals colluded and the aggregate amount of illegal money laundering.

- Stat. 198 – intentional evasion by a citizen from paying tax obligations and fees leads to maximum fines of up to 500,000 rubles. or arrest up to 3 years.

- Stat. 199.2 – knowingly deliberate concealment of taxable funds entails a fine of up to 2,000,000 rubles. maximum or arrest up to 7 years.

- – falsification of documentation, including leading to punishment of officials in the form of arrest for up to six months or correctional labor for up to 2 years.

Conclusion - in this article we looked at what liability for cash withdrawal through an individual entrepreneur is provided for by the criminal legislation of the Russian Federation. The elements of crimes are presented in accordance with the norms of the current criminal and civil legislation of Russia. If the committed act can be qualified as administrative, the norms of stat. 15.30 Code of Administrative Offenses – fine up to 50,000 rubles. against officials or removal from office for up to 2 years.

Popular illegal cash-out schemes

Article 172 of the Criminal Code of the Russian Federation severely punishes illegal cash withdrawals, but this does not reduce the number of fraudulent schemes. A fairly popular method is to register a one-day company. The essence of the scheme is that one of the real companies transfers funds to the account of a shell company in payment to it for any services rendered. After funds are received into the account of the fictitious company, they are withdrawn from the bank, and the company itself is liquidated.

In this case, no one is held accountable, since a one-day permit is issued for a homeless person or a person with an alcohol or drug addiction. There are, of course, cases when a one-day permit is issued using a found passport, then the owner of this passport, who may not even know about the fraud, will be held accountable.

A fairly common illegal cash-out scheme involves one of the employees taking out a large loan under the guarantee of the employing company. Further, the loan is not repaid by this employee and the employing company is the debtor to the bank. The company deposits funds into the bank account by bank transfer, and the cash is used for personal purposes. The employee himself sometimes does not even suspect the situation, since the loan is issued on a fake passport.

Illegal withdrawal of funds can be issued under the guise of a legal withdrawal of funds by an individual entrepreneur. As mentioned above, each individual entrepreneur can dispose of funds from the capital at his own discretion. A company that wants to withdraw a certain amount bypassing taxes transfers this money to the individual entrepreneur’s account in payment for some services. Most often, they use a product whose turnover is difficult to track; for example, a company indicates that it uses intellectual property developed by a specific individual entrepreneur.

The amount of payment is not regulated, since it is impossible to objectively evaluate intellectual property. After the individual entrepreneur cashes out the amount, he gives most of it to the fraudulent company, and retains a certain percentage of the amount for himself for the service provided.

Payment for services between all enterprises is made by bank transfer, therefore, in order to cash out LLC funds, it is necessary to find a justifiable reason. Often certain amounts are written off as business expenses. This is the most banal method, but scammers will not be able to earn a large amount of money using this method. The second option is to pay dividends. Once a quarter, the legislator allows the founders to receive dividends from profits, but 9% tax is paid for this.

If payments are made under the guise of dividends, but the tax is not calculated or dividends are accrued more often than once a quarter, then the permitted cashing out turns into cashing out.

An illegal method of cashing out can be carried out by issuing a loan to one of the founders. The period within which the debt must be repaid is determined by the organization itself; accordingly, it can be at least half a century. The founder cashes out the money and uses it at his own discretion, but if the company is not going to be liquidated, then the money will have to be returned after a specified period. Although, in most cases, the company is called bankrupt and liquidated.

A banal scheme for cashing out using cards is a company’s statement about the theft of a corporate card. Along with the application, cash is withdrawn from the company account. Law enforcement agencies are searching for the attacker, but they have not found it, because the management of the enterprise itself is interested in this. Considering that each bank insures itself by issuing such corporate cards, the company will not pay the amount withdrawn by the “attacker”.

Large companies in the Russian Federation cash out money by issuing bills. A valuable document is issued to a certain citizen, who supposedly buys this bill for a designated amount. The amount required to purchase the bill of exchange is transferred by the company organizing the transaction itself. After the bill is drawn up, its “owner” comes to the bank and receives cash on a completely legal basis.

How they try to fight

The state is fighting cashing through the tax office, the Ministry of Labor, banks and the Ministry of Internal Affairs.

Tax officials check companies for suspicious transactions that may look like cashing out. The manager may be held accountable.

The Ministry of Labor checks that employees are paid salaries according to the law.

Banks must closely monitor their customers' accounts and look for suspicious transactions. Any self-respecting bank has a special department that looks for potential cash withdrawals among payments and receipts. If a company is suspected of cashing out, the bank sounds the alarm. If the bank itself is suspected of cashing out, the Central Bank closes it quite quickly.

The Ministry of Internal Affairs has a department for combating economic crimes, which investigates cash-out schemes and uncovers criminal groups associated with cash-out.

It’s difficult to fight cash withdrawals, because cashers know how to hide, confuse their tracks and falsify documents. From the outside, it is difficult to distinguish a cash-out company from a normal honest company: in terms of money and papers, they will be very similar. And if you close everyone, then many honest companies will come under fire.

Algorithm of actions

There is an easy way to withdraw funds:

- A person turns to an entrepreneur who provides services, for example, transport, repair work, consultations. Some individual entrepreneurs indicate their activity as providing intellectual, household, and reference services to Russians. Individual entrepreneurs come to them to withdraw cash.

- A citizen pays for any service by bank transfer to the account of an individual and pays a 6% tax. The recipient withdraws the cash and returns it to the payer with a percentage deduction.

- The law does not establish a price for intellectual services and consultations, so the tax office will not be able to prove that the amounts are too large or that citizens often make non-cash transfers to each other.

Semi-legal methods of cashing out funds are:

- citizens' bank accounts;

- shell companies;

- dummy organizations that are registered only on paper.

An easily verifiable method is cashing out through services. All legal methods are associated with the Internal Revenue Service and are subject to tax in the amount established by law.

Business owners have the right to withdraw cash in any amount as long as they can demonstrate need. The founders have the right to transfer money as dividends 2 months after the clause is included in the documents.

How to do it right

Everyone who lives and works in Russia pays taxes - even if they don’t know it.

When you receive a salary, your employer is required by law to pay five times:

Actually, your salary;

Tax on personal income - on roads, schools, housing and communal services, Ministry of Emergency Situations, transport

Contribution to the pension fund - for pensions of current and future grandmothers

To the social insurance fund - for benefits, sick leave and maternity leave

To the health insurance fund - for your medical care, if suddenly something happens, God forbid

If you receive a legal salary of 100 thousand rubles, then your employer pays another 14 thousand for taxes and about 30 thousand for funds. In total, to pay 100 thousand in hand, the employer must spend about 150 thousand rubles.