Legal advice > Entrepreneurial activity > Crimes in the economic sphere, their characteristics and examples

With the emergence of a market economy in the world, there was a need to ensure additional criminal control over the activities of organizations. Examples of economic crimes include both illegal business and deliberately false advertising. Most often, people who have been victims of economic fraud for a long time cannot understand that they have fallen for scammers, so it is important to have an idea of possible economic crimes and ways to control crime in this area.

Economic crimes

The most common offense is bribery

Economic crimes are socially dangerous acts that are committed with the aim of encroaching on various kinds of relations in the field of finance. A significant part of such offenses is committed with the aim of suppressing the activities of an enterprise and obtaining profit from a criminal person or group of persons.

There are several types of financial crimes depending on the circumstances:

- Violation of the principles of conducting business or other commercial activities.

- Failure to meet deadlines for debt repayment (the interests of lenders are violated).

- Illegal methods of competition.

- Fraud in the field of currency exchange.

- Customs fraud.

- Non-payment of taxes.

- Actions that violate the interests of society.

The essence of economic crimes comes down to actions or inactions that lead to deception of consumers. In fact, it can also be called a crime if the store weighed the goods incorrectly, thereby deceiving the buyer.

Classification

Classification implies the division of atrocities into certain areas:

- Entrepreneurial. Types of crimes: obstruction of business activities, illegal and false entrepreneurship, etc.

- Financial. Types of crimes: in the field of loans, securities, violations when working with bank cards or cash.

- Tax office. Types of crimes: refusal to pay taxes to the state, fraudulent actions related to the repayment of customs duties, and economic smuggling.

- Innovative technologies. Types of crimes: gaining access (unauthorized) to electronic banking data, creating malware that helps delete data on loans and taxes.

In some cases, the sphere of trade and the provision of services that violate the rights of individual citizens who have fallen into the hands of fraudsters is separately identified; such atrocities as violation of the publicity of auctions, any forms of bribes and deception of consumers are also included here.

Objects and subjects of financial crimes

The subject of the crime can be a sane person who has reached the age of majority. Special subjects - store employee (seller), owner of the enterprise, etc. A subject is considered to be a person who, by any means, tries to cause damage to the state and enrich himself at its expense; there is self-interest in the person’s actions.

The object of a financial crime is what the subject encroaches on, that is, social relations.

Characteristic

Crimes of an economic nature represent a segment of crimes containing self-interest, encroaching on the right to own property of various associations (groups) of the population (buyers, joint ventures or competitors), as well as on state interests or the organization of economic activity, for the purpose of personal gain, under cover (without him) legal activities.

Until the mid-nineteenth century, the concept of economic crime was identified with property crimes. But after conducting scientific research based on an analysis of “corporate crimes” conducted by one of the best criminologists of the twentieth century, E. Sutherland, the attitude changed. The criminologist focused the attention of the legal community on the fact that the subjects of crimes of this nature are the most dangerous for the state and its structure, have a high position in society or business, commit criminal acts in the process of fulfilling social duties, pursuing personal interests or the interests of third parties (this opinion is often used in abstracts on jurisprudence).

Currently, the main features characteristic of economic crimes are considered to be:

- latency (secrecy) of preparation and commission of criminal acts;

- significant damage to society and public relations;

- as a rule, acts are committed in an organized manner, often by a group of persons;

- the crime is planned, is intentional in nature (except for the commission of acts in a careless manner);

- The motive for the crime is formed on the basis of personal selfish motives.

The main difference from other types of criminal activity is the commission of crimes of an economic nature by a special entity that is not associated with the object of control by persons in the system of economic relations that have been attacked.

Methods of offenses

The object of the criminal’s activity, in the case of economic offenses, is always finance or any other material objects that have value, but the acquisition of the object occurs under the guise of business, banking activity or under the guise of financial transactions that are not prohibited by law.

If we talk about the practical application of fraud, we can distinguish simple and complex ones:

- Simple: include the activities of individuals who are engaged in business, but do not officially register their activities and do not pay taxes.

- Complex: legally operating banks (and other financial institutions) open branches without registration, withdraw funds offshore or open a new company in order to ensure the ability to carry out certain activities illegally, without affecting the main business.

Some crimes are aimed at concealing economic activity, which includes falsifying documents, opening deposit accounts by persons who do not have the right to do so, opening new enterprises on the basis of liquidated ones, concealing income, falsifying documents on the accounting activities of enterprises, etc.

All methods of committing crimes in the economic sphere are interconnected. Law enforcement agencies are able to detect traces of atrocities only when conducting a thorough check of documentation on a number of transactions.

Known economic crimes

In the Russian Federation, 0.17% of prisoners are serving sentences for economic offenses

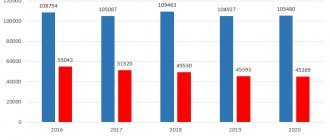

Russia is among the top five countries where economic crime against business is widespread. The situation is only getting worse every year - back in 2021, the level of economic offenses was 30% lower than now.

In 2012, more than a billion rubles worth of products were stolen from the Minsk Automobile Plant. A group of 26 people was divided into 3 conditional groups, each of which had its own responsibilities: the first hid part of the manufactured products, the second took it out of the plant, and the third sold it.

Unfortunately, this is not the only case where people at the head of large enterprises falsify documents for the purpose of profit.

Property crimes

The subject of a crime against property is someone else's property that has been violated. We are talking about movable and immovable property, pets, and securities.

Characteristics of crimes against the interests of the service in commercial and other organizations

The object is the normal activities of private organizations that are not government agencies. An additional object for some crimes are the legitimate interests of citizens and their rights, state and public interests, and the health of citizens (Articles 201, 202, 203 of the Criminal Code of the Russian Federation).

Possible crimes:

- abuse of official powers;

- abuse of powers of a notary, auditor;

- abuse of powers of private detective agencies or security services;

- bribery of an official.

The subject of a crime is a person who has certain responsibilities in any commercial or non-profit organization that is not a government agency.

Encroachment on legitimate business activity

Doing business without registration is the most common economic crime

Obstructing legitimate business activities is an abuse of official power. If obstruction has been proven, then liability arises on the basis of Art. 169. of the Criminal Code of the Russian Federation, in some cases under Art. 285 of the Criminal Code of the Russian Federation. According to the Constitution of the Russian Federation, every citizen has the right to carry out legal business activities, the infringement of which can be carried out in various ways:

- unlawful refusal to register an individual entrepreneur;

- unjustified refusal to issue a license for certain types of activities;

- restriction of the rights and legitimate interests of an individual entrepreneur by an official.

The above crimes are considered minor crimes.

Certain official documents – permits, licenses, etc. – can be the subject of a crime.

Crimes encroaching on the state monopoly in the field of economic activity

Art. 181 of the Criminal Code of the Russian Federation regulates the rules for the manufacture and use of state marks, which are placed on jewelry and confirm the content of precious metal in the product.

According to the Federal Law of March 26, 1998 “On Precious Metals and Precious Stones,” the production of hallmarks and its placement are a state monopoly.

Possible illegal actions:

- making a stamp;

- usage;

- sales;

- forgery of the state seal (stamp).

The subject of the crime is the state mark, with the help of which a single sign is applied to all jewelry, confirming the presence of a percentage of gold or silver in the jewelry.

Customs and tax crimes

Non-payment of taxes is grounds for liability

The main object of a customs crime is relations of a regulatory nature in relation to the movement of goods across the border and the receipt of customs payments into the state budget.

An additional objective is the safety of citizens, since there are frequent cases of weapons and ammunition, explosives and other dangerous substances being smuggled across the border. The corpus delicti is considered material, and criminal liability occurs if the amount of smuggling exceeds 250 thousand rubles. The subject of a crime can be a person who has reached the age of 16 and is declared sane.

Art. 198 of the Criminal Code of the Russian Federation – evasion of taxes or fees from individuals. Criminal liability in accordance with the article occurs when the income tax return is not submitted to the tax service and tax evasion is evaded.

The subject of the crime are taxes and fees that citizens of the Russian Federation are obliged to pay on the basis of the legislative framework. The punishment depends on the methods of evasion and the amount that the state did not receive from the taxpayer.

Criminal actions encroaching on the established procedure for foreign economic activity

Illegal export of raw materials, equipment, and food products is smuggling. This type of crime is an encroachment on the established procedure for foreign economic activity.

Among the most popular crimes of this nature, it is worth noting failure to return to the territory of the Russian Federation:

- heritage items;

- currency funds.

People most often try to transfer narcotic or other prohibited substances across the Russian border.

The length of criminal punishment depends on the crime itself and can range from 1 to 7 years.

Offenses encroaching on the established procedure for the circulation (turnover) of valuables

Gold is a common target of crime

Art. 191 of the Criminal Code of the Russian Federation regulates the punishment for illegal trafficking of precious stones and pearls. The danger to society lies in the disruption of the economic activity of the state in the sphere of circulation of precious metals and stones.

The object of the crime is the procedure for the circulation of precious stones and pearls established by the state. The objects of crime are various precious metals, precious stones, pearl products (with the exception of household and jewelry).

Encroachment on material and other benefits of consumers

Consumer fraud is discussed in Art. 200 of the Criminal Code of the Russian Federation. The danger to society from such an offense lies in the fact that the normal activities of trade or the provision of services on a paid basis are stopped, the authority of organizations providing such services is undermined, and consumers are subject to property damage.

The consumer is the victim. Responsibility for the crime committed is borne by trade, catering and public utilities enterprises in any form of ownership.

Consumer deception can also be carried out by individuals registered as individual entrepreneurs. The crime may include misrepresentation, defrauding the buyer, or other means of deception.

Criminal liability in accordance with Article 200 of the Criminal Code of the Russian Federation occurs only when consumers are deceived in a significant amount, that is, the amount of deception must exceed 1/10 of the minimum wage.

The crime becomes complete only when the fact of deception is committed; if the seller was caught in an attempt to deceive, then this is not a crime, but only an attempt to deceive the consumer.

Fraud

Fraudsters take advantage of all the achievements of modern technology

Economic fraud can easily be confused with economic crime. It will be easier to understand with the help of an example - for example, if an entrepreneur took out a loan and disappeared with the funds without paying the debt to the bank, then this is fraud, since the act was thought out and planned in advance, and if the entrepreneur did not disappear anywhere, but does not pay the debt due under certain circumstances, it is a crime.

History of the development of legislation on liability for crimes in the sphere of economic activity

In 1845, the first criminal code appeared in Russia. Already in this document there was a chapter “On crimes and offenses against property and the treasury.” The chapter “On Violation of Coin Statutes” dealt with punishment for counterfeiting coins and government securities - the offender was deprived of all rights and sent into exile for 8-10 years, depending on the severity of the crime.

If it turned out that the criminal was a citizen engaged in the production of coins and securities, then the term was increased from 10 to 12 years.

Before 1922, there were virtually no changes in the area of economic offenses. Only in the RSFSR code of 1922 were articles added on the punishment of citizens who did not pay taxes in favor of the government.

In 1926, the Criminal Code of the RSFSR developed articles relating to economic crimes (theft of state property, mismanagement, waste, etc.)

In 1960, articles concerning state crimes already appeared, which included crimes such as smuggling, sale of counterfeit money, and illegal currency transactions.

From 1991 to 1994, there were changes and additions to the chapter “Economic Crimes”. It was during this period that criminal liability for the production and sale of low-quality goods and speculation was abolished. Articles were introduced for illegal price increases, concealment of income, and unauthorized extraction of amber.

All ideas adopted in 1991-1992 were retained and adopted in the new Code of 1996.

Limitation period

Now, after clarifying the basic definitions, let’s move on to studying the features of attracting criminals accused of the group of violations under consideration.

The statute of limitations for financial crimes is a legal institution that regulates the time limits for which punishment is likely to be imposed on the offender. This period starts from the moment the offense is committed.

As for the duration of this time period, the legislation here is guided by the severity of the offense. These points are indicated in Article 78 of the Criminal Code. General rules establish the following criteria in such situations:

- minor violations require a 2-year waiting period;

- acts of moderate gravity require a six-year sentence;

- serious crimes carry a period of 10 years;

- Particularly serious offenses increase the statute of limitations to 15 years.

These standards say that during the specified time the investigation has the right to collect evidence and transfer the case to court. If this period has expired, criminal proceedings will not be initiated due to the statute of limitations.

Important! In situations where the accused is absconding, the period in question is suspended. .

The statute of limitations for such offenses limits the period when the investigation has the right to bring the culprit to justice. Accordingly, such circumstances allow the renewal of the statute of limitations if the offender is likely to repent and turn himself in. The second option is to detain the offender by representatives of law enforcement agencies. Let’s look at the nuances of the time being described in more detail, because current legal standards require a set of specific characteristics.

Peculiarities

The standard described above for suspending the limitation period due to the impossibility of identifying the culprit is considered the first distinguishing feature. The same criterion is used in a situation with evasion of payment of a court fine, which is allowed by Art. 76.2. In this situation, we are talking about replacing criminal punishment for people who have committed an illegal act for the first time with economic sanctions.

The second feature that presupposes a statute of limitations for economic crimes is the court’s decision on the application of this measure to people facing capital punishment. This point is interpreted by lawyers as follows: if the court decides that it is impossible to apply the appropriate punishment due to the expiration of the statute of limitations, the defendant will avoid this fate.

Civil aspect

Now let’s look at the features of the statute of limitations for recovery of economic crimes in the field of civil law. This point becomes a logical criterion due to the specificity of the crime. Considering that financial fraud causes material losses to the injured party, the likely filing of a claim for damages cannot be ruled out.

In this situation, lawyers are guided by the general limitation period of three years. However, even in this situation, there is a possibility of suspension and extension of the specified time. In this case, the total period during which it will be possible to file a claim is 15 years. At the end of the specified time, the court rejects applications demanding compensation for damages.

Economic crime investigation

Recent studies in the field of economic offenses have shown that fraud is the most common case in Russia - the number of cases initiated under this article is almost 2 times higher than for other offenses (with the exception of theft and trafficking in drugs and illegal drugs).

The work of uncovering economic crime is carried out by special units of the Ministry of Internal Affairs of the Russian Federation. Each division has its own departments for uncovering atrocities in various fields of human activity - mechanical engineering, metallurgy, agriculture, etc. If we are talking about a threat to the state, then the FSB of the Russian Federation gets involved in the work.

Watch a video about the peculiarities of the methodology for investigating bribery and other official crimes: