Concept of criminal liability

The term “criminal liability” is used many times in various articles of the Criminal Code of the Russian Federation, in the titles of sections (section IV “Exemption from criminal liability and punishment”; section V “Criminal liability of minors”) and chapters (chapter 4 “Persons subject to criminal responsibility"; Chapter 14 "Peculiarities of criminal liability and punishment of minors") of the Code. However, the concept of criminal liability is not defined by law.

Criminal liability is a type of legal liability (along with civil, administrative, disciplinary and material).

Criminal liability as a category of criminal law is inextricably linked with crime. Criminal liability as a type of legal liability is the obligation to give an account specifically for a crime - a socially dangerous act committed guilty of guilt, prohibited by the Criminal Code of the Russian Federation under threat of punishment (Part 1 of Article 14 of the Criminal Code of the Russian Federation).

Criminal liability is the obligation provided by criminal law for a person who has committed a crime to bear responsibility for the crime committed and to suffer the negative consequences of his behavior imposed by the state in accordance with criminal law.

Other scientists the concept of criminal liability as a negative assessment of an act and the person who committed it on the part of society and the state, as well as the suffering of negative consequences by this person if a criminal penalty or other measures of a criminal legal nature are applied to him upon release from punishment. Moreover, in this context, release from punishment means release from punishment, release from serving a sentence and release from actually serving a sentence.

Basis of criminal liability

The law recognizes the commission of an act containing all the elements of a crime as the basis for criminal liability (Article 8 of the Criminal Code of the Russian Federation). In this definition, the legislator combines three concepts - act, crime and corpus delicti.

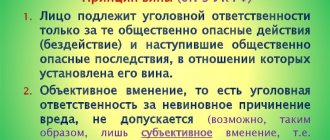

In the concept of crime given in Art. 14 of the Criminal Code of the Russian Federation, it is defined as an act that has signs of public danger, criminal wrongfulness, guilt and punishability.

Apart from the act, no other circumstances, such as the social status of a person, his origin, religion, nationality, etc., can serve as the basis for liability and give rise to criminal legal relations.

In determining the basis of criminal liability, the relationship between the concepts of a crime and the elements of a crime can be traced. In Art. 14 of the Criminal Code of the Russian Federation provides an abstract concept of a crime, defined as a socially dangerous act committed guilty of guilt, prohibited by the Criminal Code under threat of punishment. But crime does not exist in reality at all. There are specific crimes: murder, theft, robbery, etc. In order to establish whether a specific act is a crime, it is necessary to determine whether it (the act) contains the elements of any crime. Only in this case can the act be spoken of as a crime.

The corpus delicti is a set of objective and subjective characteristics provided for by criminal law that characterize a socially dangerous act as a crime. Its presence in a specific socially dangerous act serves as a necessary and sufficient basis for bringing to criminal responsibility the person who committed this act.

The norms of the Special Part of the Criminal Code of the Russian Federation describe the signs that reflect the specifics of a particular crime, and the norms of the General Part of the Criminal Code describe the signs that are characteristic of all crimes without exception.

The absence of at least one of the elements of a crime means its absence and, therefore, the absence of grounds for criminal liability. The commission of an act containing all the elements of a crime is the only and sufficient basis for criminal liability.

The composition of any crime is formed by four groups of signs, distinguished by its elements. An element of a crime is understood as a structural part of the composition, consisting of a group of signs corresponding to various aspects of the crime. There are four elements in total:

the object of the crime is the social relations protected by criminal law, which are encroached upon by the crime;

the objective side of the crime is the external manifestation of the crime in reality. It includes the following features: an act, socially dangerous consequences, a causal relationship between the act and its socially dangerous consequences, time, place, setting, method, instruments and means of committing a crime;

the subjective side of a crime is the mental activity of a person directly related to the commission of a crime. The content of the subjective side of the crime is characterized by such legal characteristics as guilt, motive and purpose;

the subject of a crime is a person who has committed a criminal act and, in accordance with the law, is capable of bearing criminal liability for it.

Criminal liability arises only for the crime committed. Acts that, although outwardly similar to crimes, are not crimes due to low social danger or its complete absence are not crimes and cannot serve as a basis for criminal liability. The criminal law includes such acts as causing harm during necessary defense (Article 37 of the Criminal Code of the Russian Federation), extreme necessity (Article 39 of the Criminal Code of the Russian Federation), reasonable risk (Article 41 of the Criminal Code of the Russian Federation), etc.

What is tax evasion?

The crime of evasion of taxes or fees can be expressed as:

- failure to submit a tax return, calculation or other documents, the submission of which is mandatory;

- inclusion of knowingly false information in a tax return, calculation or such documents.

Inclusion of knowingly false information can be done by:

- deliberate failure to reflect data on income from certain sources, objects of taxation;

- reduction in actual income;

- distortions in the amount of expenses incurred that are taken into account when calculating taxes (for example, expenses deducted when determining total taxable income).

Deliberately false information may also include data that does not correspond to reality about time, the period of expenses, income received, distortion in the calculations of physical indicators characterizing a certain type of activity, etc.

Previously on the topic:

Responsibility for loss of primary documents

Incorrectly claiming a tax deduction is not fraud.

Forms of implementation of criminal liability

The criminal law provides for several forms of implementation of criminal liability:

1) imposing a sentence to be served by the convicted person is the most common form of implementation of criminal liability. If a person is found guilty of committing a crime, he is given a guilty verdict, which imposes a punishment determined by a specific period and amount, which is a measure of state coercion and contains a restriction of his rights and freedoms. From the day the court's conviction comes into force until the criminal record is expunged or removed, a person convicted of committing a crime is considered to have been convicted (Article 86 of the Criminal Code of the Russian Federation). As follows from Part 6 of Art. 86 of the Criminal Code of the Russian Federation, only expungement or removal of a criminal record cancels all legal consequences associated with a criminal record provided for by the Criminal Code of the Russian Federation. The termination of a criminal legal relationship also means the termination of criminal liability.

2) assignment of punishment with exemption from serving it . The court may find a person guilty of committing a crime, sentence him, but release him from actually serving it. This form of implementation of criminal liability is:

- suspended sentence (Article 73 of the Criminal Code of the Russian Federation);

- exemption from punishment due to illness (Article 81 of the Criminal Code of the Russian Federation);

- release from serving a sentence upon expiration of the period of deferment of serving the sentence (Part 3 of Article 82 of the Criminal Code of the Russian Federation);

- release from serving a sentence upon expiration of the deferment of serving a sentence for drug addicts (Part 3 of Article 82.1 of the Criminal Code of the Russian Federation);

- exemption from serving a sentence due to the expiration of the statute of limitations for a court conviction (Article 83 of the Criminal Code of the Russian Federation);

- amnesty (Article 84 of the Criminal Code of the Russian Federation).

When applying these measures, the implementation of criminal liability consists of issuing a conviction, which reflects a negative assessment of the committed act on the part of the state, censure of the person who committed this act and the imposition of a punishment, which, on the grounds specified in the law, is not actually served. Termination of a criminal legal relationship and, therefore, criminal liability is associated with the timing of expungement or expungement of a criminal record, which depends on the type of measure applied. Thus, a person who has been given a conditional sentence (Article 73 of the Criminal Code of the Russian Federation) is considered to have no criminal record after the expiration of the probationary period (clause “a”, Part 3 of Article 86 of the Criminal Code of the Russian Federation). Persons released from punishment are considered to have no criminal record (Part 2 of Article 86 of the Criminal Code of the Russian Federation). Thus, a person released from serving a sentence due to the expiration of the statute of limitations for a court conviction is considered not to have been convicted after the expiration of the statute of limitations.

3) conviction of a person without imposing punishment . The court, having found a person guilty of committing a crime, makes a guilty verdict without imposing punishment. The implementation of criminal liability in this case consists of issuing a conviction, reflecting a negative assessment by the state of the committed act and censure of the person who committed it. In this form, the implementation of criminal liability occurs upon release from punishment due to a change in the situation (Article 80.1 of the Criminal Code of the Russian Federation), as well as release from punishment of minors (Article 92 of the Criminal Code of the Russian Federation). Criminal legal relations and criminal liability cease with the court's verdict of guilty.

When will a fine be imposed for non-payment of taxes?

For the convenience of taxpayers, a separate chapter of the Tax Code of the Russian Federation is devoted to each tax. It specifies the deadline for making mandatory payments, as well as sanctions for non-compliance. For example, Chapter 25 is devoted to corporate income tax. According to Art. 287 of the Tax Code of the Russian Federation, legal entities calculating monthly advance payments on actually received profits must pay the budget monthly - before the 28th day of the month following the reporting month. For taxpayers paying quarterly, a different deadline is established - no later than the 28th day of the month following the reporting period. Another example is for property tax payers—citizens. Owners of apartments, houses and garages pay the budget once a year: they must pay in full for the previous year before December 1 of the next year (Article 409 of the Tax Code of the Russian Federation).

After the expiration of the period established by law and the identification of arrears (debt), the Federal Tax Service makes a decision to hold the defaulter accountable, and also sends a demand for payment of a mandatory payment. That is, tax officials send a notice of the need to pay the budget and at the same time hold them accountable: they issue a fine for late payment of taxes, the amount of which is also provided for by the Tax Code of the Russian Federation.

Let's take the same examples - corporate income tax and property tax for individuals. In both cases, the sanctions provided for in Art. 122 of the Tax Code of the Russian Federation. The fine for tax evasion ranges from 20 to 40 percent of the amount that did not reach the state treasury in a timely manner. Additionally, the violator will be fined for non-payment of taxes. True, they are calculated based on the results of payment of the arrears themselves, since penalties are charged for each calendar day of delay. Based on Art. 75 of the Tax Code of the Russian Federation, it is:

- for citizens, including those who have received individual entrepreneur status - 1/300 of the key rate of the Central Bank of the Russian Federation established in the current period;

- for organizations - 1/300 of the rate of the Central Bank of the Russian Federation for delays up to 30 calendar days (inclusive) and 1/150 of the rate starting from the 31st day.

Compulsory measures used as exemption from criminal liability

Separately, it is necessary to highlight educational measures applied to minors (Article 91 of the Criminal Code of the Russian Federation), as well as other measures of a criminal legal nature (Section IV of the Criminal Code of the Russian Federation), which include compulsory medical measures, confiscation of property and a judicial fine.

Compulsory educational measures have a dual legal nature: they can be used as a type of exemption from criminal liability (Article 90 of the Criminal Code of the Russian Federation) and a type of exemption from punishment (Article 92 of the Criminal Code of the Russian Federation). The use of compulsory measures of educational influence as an exemption from criminal liability, as a general rule, means the absence of implementation of criminal liability - a refusal to implement it at the will of the state.

Compulsory measures of a medical nature , although they are coercive in nature, do not in themselves constitute the implementation of criminal liability, since they are used to cure persons suffering from mental disorders or improve their mental state.

Confiscation of property as another measure of a criminal law nature is enshrined in Chapter. 15.1 of the Criminal Code of the Russian Federation. It is not a coercive measure addressed to the person who committed the crime. Confiscation in the sense of Art. 104.1 of the Criminal Code of the Russian Federation - determining the fate of property associated with a crime.

A judicial fine (Article 104.4 of the Criminal Code of the Russian Federation) acts as a type of exemption from criminal liability (Article 76.2 of the Criminal Code of the Russian Federation) and as such represents the absence of implementation of criminal liability - the state’s refusal to implement it.

What is tax or duty evasion

Evasion of taxes and fees means that an organization deliberately failed to fulfill its obligation to pay a tax or fee.

Evasion of taxes and fees involves non-receipt of funds into the budget.

Responsibility arises in case of tax evasion at any level: federal, regional or local.

More on the topic:

They will “talk to tax evaders in a new way”