Purpose

Theft is a type of illegal act, the assignment of responsibility for the commission of which is assigned to the criminal code. The statute of limitations is a special factor that includes a certain time interval, after which a person who has committed an unlawful act is not subject to criminal liability; the application of such legislative provisions is regulated by Article 78 of the Criminal Code of the Russian Federation, namely part 1:

- two years after committing a minor crime;

- six years after committing a crime of average gravity;

- ten years after committing a serious crime;

- fifteen years after the commission of a particularly serious crime.

There is one important point that concerns the suspension of the time interval taken into account, it is described in Part 3 of Article 78 of the Criminal Code of the Russian Federation: the statute of limitations “is suspended if the person who committed the crime evades the investigation or trial or from paying a court fine imposed in accordance with Art. . 76.2 of this Code. In this case, the limitation period is resumed from the moment of detention of the specified person or his surrender.” That is, if a person who has committed a crime deliberately evades investigation or trial, “SD”

suspended until detention or until voluntary confession.

Here it should also be clarified what actions are meant to evade investigation and trial. The fact of evasion is considered to be when, from the moment the charge is brought against the suspect or from the moment the sentence is passed, the accused or convicted person hides from deserved responsibility, and it does not matter in what form this manifests itself (active or passive).

Term

The statute of limitations for criminal prosecution for theft is regulated by Article 158 of the Criminal Code of the Russian Federation.

Theft refers to the theft of personal property owned by another person. In case of theft, property is taken secretly while its owner does not suspect anything.

According to Article 158 of the Criminal Code of the Russian Federation, theft has several subtypes:

- Theft of someone else's property by illegally entering the victim's home;

- Theft of someone else's property, accompanied by harm to the life and health of the theft victim;

- Theft of someone else's property by a group of persons (by conspiracy);

- Theft of property from the victim’s personal belongings, pockets of his clothing or bag;

In addition, when determining the statute of limitations, the size of the theft plays an important role. Thus, for grand theft the statute of limitations will be increased.

According to Part 1 of Article 158 of the Criminal Code of the Russian Federation, the statute of limitations for ordinary theft is 2 years.

For theft under Part 2 of Article 158 of the Criminal Code of the Russian Federation, the thief can be prosecuted for six years.

For theft under parts 3 and 4 of Article 158 of the Criminal Code of the Russian Federation (on a large and especially large scale), the offender can be held accountable for 10 years.

Result: the statute of limitations for criminal prosecution for theft under Article 158 of the Criminal Code of the Russian Federation ranges from two to ten years.

Categories

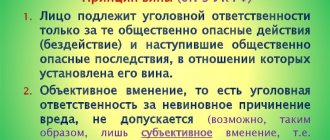

As can be seen from Part 1 of Article 78 of the Criminal Code of the Russian Federation, depending on the severity of the act committed, the “SD” will depend. That is why, first, it is necessary to determine how the legislator qualifies types of crimes according to the gravity of the act committed (15 of the Criminal Code of the Russian Federation):

- minor gravity - an act for which a punishment not exceeding three years of imprisonment is provided;

- average severity - for intentionally no more than 5 years, for carelessness no more than 3 years of imprisonment;

- serious - no more than 10 years of imprisonment;

- especially serious - more than 10 years or more severe.

When does the deadline count?

The beginning of the period from which the countdown of the period during which the offender can be held criminally liable begins the day after the commission of the criminal act.

The end of the period during which the offender is brought to justice occurs:

- After the judge makes a decision on the case and it comes into force;

- After the statute of limitations for the crime has expired;

Info

If a criminal is found to have committed several crimes, then the statute of limitations for each is calculated separately.

Statute of limitations for theft

So, Article 158 of the Criminal Code of the Russian Federation, which spells out the types of liability provided for secret theft (theft), depending on the qualification, provides for the following limitation periods:

- Part 1 - 2 years;

- Part 2 - 6 years;

- parts 3 and 4 - 10 years.

Theft even on a particularly large scale (Part 4 of Article 158 of the Criminal Code of the Russian Federation), and this is an amount of 1,000,000 rubles, is not recognized as a particularly serious type of crime, since the prescribed punishment is less than 10 years of imprisonment, namely: punishable by imprisonment of up to ten years with a fine in the amount of up to one million rubles or in the amount of wages or other income of the convicted person for a period of up to five years or without it and with restriction of freedom up to two years or without it.

These provisions should be analyzed using an example:

In the city of Arkhangelsk, the court of appeal in September considered the appeal of the convicted person regarding the previously passed sentence. The essence of the matter was as follows. In March 2015, the convict secretly stole (committed theft) money in the amount of 3,000 rubles from the victim’s bank card. During the consideration of the case by the court of first instance (in May 2017), all the evidence provided about how exactly this crime was committed was taken into account, confirming the legitimacy of the accusation, and as a result, the court issued a conviction for theft under Part 1 Article 158 of the Criminal Code of the Russian Federation. It is also worth noting that the convicted woman did not deny her guilt, but even returned part of the stolen funds with a verbal agreement with the victim about the imminent return of the rest of the amount, which only benefited her during the consideration of the case. The Court of Appeal, having considered the statement of the convicted person, ruled that the verdict under Part 1 158 of the Criminal Code of the Russian Federation was pronounced correctly, but clarified that the trial court erroneously did not apply the provisions of Art. 78 of the Criminal Code of the Russian Federation, since the “SD” had expired, and the defendant did not carry out any actions (passive or active) to evade a possible investigation and trial, using Art. 78 of the Criminal Code of the Russian Federation and 24 of the Code of Criminal Procedure of the Russian Federation overturned the verdict of the trial court.

This example clearly demonstrates the importance of competent application of the law, even if your initial demands were not satisfied, and you and your lawyer are confident in the legal validity of your demands, you should contact higher authorities.

On the statute of limitations for bringing to criminal liability for tax crimes

In order to answer the question whether crimes, liability for the commission of which is provided for in Art. 198 and 199 of the Criminal Code of the Russian Federation “Tax Evasion” are ongoing, it is necessary to analyze the nature of this legal phenomenon.

The essence of the statute of limitations is to extinguish the offense, which deprives the state of the power to prosecute a suspect, bring him to trial, find him guilty and impose punishment.[1]

From the point of view of the theory and practice of criminal and tax law, we can conclude that the institution of the statute of limitations for bringing to responsibility for tax crimes and offenses implements the same legal values:

- a humanistic idea, according to which, firstly, the threat of responsibility cannot dominate a person throughout his entire life, and secondly, bringing to responsibility after a certain period of time turns into unjustified revenge and therefore loses its meaning and necessity from the point of view of the general and special prevention, although the act objectively committed by the person has not completely lost its social danger;

— civil legal consciousness, according to which a criminal act or inaction loses public resonance over time, is smoothed out in people’s memory, and there is no point in bringing it up again;[2]

— the goals of achieving stability of the rule of law, legal certainty, stability of the existing system of legal relations;

— ensuring the possibility of collecting and securing evidence of an offense (crime);[3]

The above statements have deep national historical roots[4] and are supported by international practice.[5]

There are isolated exceptions when the statute of limitations may not apply due to a particularly high public danger: crimes against peace and humanity, terrorism, particularly serious murders. Tax crimes are not rare and are not considered particularly serious by law.

What is a continuing crime?

Continuing crimes are an act or omission associated with subsequent long-term failure to fulfill the duties imposed on the perpetrator under threat of criminal punishment.[6]

A continuing crime is terminated due to:

- actions of the guilty party (turning himself in, fulfilling the instructions of a judicial act in case of malicious failure to comply with a court decision);

— actions of law enforcement agencies (detention of a person);

- other circumstances that terminate the crime (reaching adulthood, death).

The termination of a crime on the specified grounds is called the actual termination of a continuing crime.[7]

Based on these definitions, it is clear that crimes committed by omission can be ongoing. These are, first of all, various types of evasion of legal obligations.

Surprisingly, in criminal law theory there is no consensus on whether non-payment of tax (tax evasion) is a continuing crime.

Thus, in the textbook “Criminal Law of Russia. Parts General and Special: a textbook” (edited by A.V. Brilliantov), tax evasion from an individual (Article 198 of the Criminal Code of the Russian Federation) is given as an example as a continuing crime.

In the textbook for universities “Criminal Law of the Russian Federation. General part: textbook for universities" (edited by V.S. Komissarov, N.E. Krylova, I.M. Tyazhkova) we read: "Take, for example, evasion of taxes and (or) fees from an individual committed on a large scale (Part 1 of Article 198 of the Criminal Code). This is a crime of minor gravity, therefore, the statute of limitations for it will be 2 years. If the statute of limitations is calculated from the day when an individual should have paid the tax, but did not, then after 2 years he may legally not pay the tax, since the statute of limitations has expired.”

In neither the first nor the second example, the authors explain their conclusion.

But the interpretation of the criminal law cannot be twofold: this grossly violates the constitutional principle of equality of citizens before the law and the court.[8]

How is it really?

To find the right answer, we will use various research methods.

Literal interpretation of the objective side of the crime

It is known that the criminal law cannot be interpreted broadly: the method of literal interpretation makes it possible not to distort the will of the legislator.

The elements of the crime are described in the law: “tax evasion by failure to submit a tax return (calculation) or other documents, the submission of which is mandatory in accordance with the legislation of the Russian Federation on taxes and fees, or by knowingly including in a tax return (calculation) or such documents false information."

In order for the composition to be complete, the taxpayer must commit two actions simultaneously: fail to pay tax and distort tax reporting.

This disposition allows us to come to the conclusion that as soon as these actions are committed, the crime is over. Subsequent actions to make amends for the damage caused are not relevant to the moment of its completion: correction of statements and (or) repayment of arrears.[9]

A method for comparing the disposition of legal norms governing homogeneous legal relations

In tax legislation, a similar offense “Non-payment or incomplete payment of taxes or fees” has a broader objective side. According to Part 1 of Art. 122 of the Tax Code of the Russian Federation, an offense can be committed not only as a result of an understatement of the tax base, other incorrect calculation of taxes (fees), but also other unlawful actions (inaction) of the taxpayer. But even such a “rubber” composition does not allow arbitration courts to consider this offense committed by failure to pay the arrears declared (existing and recognized) by the taxpayer.

Thus, the Supreme Arbitration Court of the Russian Federation explained that Art. 122 of the Tax Code of the Russian Federation provides for liability for non-payment or incomplete payment of tax amounts as a result of underestimation of the tax base, other incorrect calculation of tax or other unlawful actions (inaction). When applying these provisions, courts should proceed from the fact that the taxpayer’s inaction, expressed solely in the failure to transfer to the budget the amount of tax indicated in the tax return or tax notice, does not constitute an offense established by Article 122 of the Tax Code of the Russian Federation. In this case, penalties will be collected from him.[10]

If a taxpayer has filed an inaccurate tax return, the 3-year statute of limitations for bringing him to tax liability begins to run from the date of filing this return established by law. The logic of such application of Art. 113 of the Tax Code of the Russian Federation is clear: the administrator (tax authority) has the legal opportunity to verify the accuracy of the declaration during a desk or field tax audit, the duration of which is limited to 3 years.

In paragraph 14 of the resolution of the plenum of the Supreme Court of the Russian Federation dated March 24, 2005 No. 5 “On some questions that arise for the courts when applying the Code of the Russian Federation on Administrative Offenses” it is said that “a continuing administrative offense (action or inaction) that is expressed in long-term continuous failure to fulfill or improper fulfillment of the duties assigned to the violator by law. Failure to fulfill the obligation provided for by a regulatory legal act by the deadline established therein is not a continuing administrative offense.”

The Tax Code of the Russian Federation defines both the deadline for submitting tax reports and the deadline for paying taxes for each tax. Consequently, tax offenses, which are essentially administrative, cannot be ongoing.

Method for comparing similar crimes

The Constitutional Court of the Russian Federation declared the legal position that the taxpayer does not have the right to dispose at his own discretion of that part of his property that is subject to contribution to the treasury in the form of a certain amount of money, and is obliged to regularly transfer this amount to the state, since otherwise the rights and protected rights would be violated by law the interests of other persons, as well as the state. The collection of a tax cannot be regarded as an arbitrary deprivation of the owner of his property - it represents a legal seizure of part of the property arising from a constitutional public legal obligation.[11]

Based on this legal position, a taxpayer who deliberately fails to pay the due tax to the budget on time is unlawfully saving property that is subject to contribution to the treasury. If this involves entering false information into the tax return that affects the amount of payment, such actions are similar to fraud (Article 159 of the Criminal Code of the Russian Federation).

But fraud, even on a large scale, is not considered a continuing crime. None of the commentators of the Criminal Code of the Russian Federation known to the author proposes to consider fraud committed up to the return of stolen property to the victim.

Analysis of qualifying features

For tax legislation, the size of the arrears does not matter for the qualification of actions as an offense.

In criminal law, the amount of arrears matters.

According to Note 1 to Art. 199 of the Criminal Code of the Russian Federation, the large amount in this article is calculated for three financial years in a row. If we assume that the crime under Art. 199 of the Criminal Code of the Russian Federation lasts and is expressed in long-term non-payment of the same tax arrears that arose in a certain tax period, then legal uncertainty arises: which three financial years in a row should be taken into account: the first three, the last three, the three in the middle or some others.

Since the composition of Art. 199 of the Criminal Code of the Russian Federation is material, and the financial results of each tax period are different, then the situation is real when, taking into account tax overpayments, a large amount will be accumulated in some periods, but not in others. The Supreme Court did not give any clarification on this issue, although such legal uncertainty in criminal law is unacceptable (contradicts Article 4 of the Criminal Code of the Russian Federation).

Method by contradiction (constitutional restrictions)

Defenders of the doctrine of a “continuing tax crime” proceed from the fact that the crime is terminated voluntarily by the taxpayer (by paying arrears) or by force by the tax authority (indisputable collection). But in this interpretation, in the event of failure to repay the arrears for material and other reasons, the crime will be eternal.

If we assume that the taxpayer (the person responsible for paying taxes by the organization), having already been convicted of tax evasion, continues not to pay these taxes, and there is nothing to recover from him, this will mean that he is again subject to criminal liability, since according to this logic, even after being punished, he still continues to commit this crime.

But repeated criminal punishment for the same crime contradicts paragraph 2 of Art. 6 of the Criminal Code of the Russian Federation and Part 1 of Art. 50 of the Constitution of the Russian Federation.

The fundamental principle of legal certainty of tax legal relations has been repeatedly confirmed and defended by the Constitutional Court of the Russian Federation with reference to the provisions of the Constitution of the Russian Federation.[12]

This principle is manifested, among other things, by limiting the time period during which the taxpayer suffers tax burdens and bears tax risks:

— storage of taxpayer documents (subclause 8, clause 1, article 23 of the Tax Code of the Russian Federation);

— conducting on-site tax audits (clause 4 of Article 89 of the Tax Code of the Russian Federation);

— statute of limitations for bringing to tax liability (clause 1 of Article 113 of the Tax Code of the Russian Federation).

Bringing to criminal liability for tax evasion outside the storage period for tax-significant documents and a possible tax audit violates the constitutional principle of legal certainty and the right to judicial appeal against actions and decisions of public authorities (Article 46 of the Constitution of the Russian Federation).

But the institution of the statute of limitations for bringing to responsibility also serves the purpose of ensuring the possibility of collecting and securing evidence of an offense (crime) (see above).

The above arguments, obtained by different methods, confirm one conclusion: tax crimes, liability for which is provided for in Art. 198 and 199 of the Criminal Code of the Russian Federation are not lasting.

[1] See the ECHR Decision of March 27, 2014 in the case “Matytsina v. Russian Federation”

[2] See Alexey Rarog Criminal Law. A common part.

[3] Resolution of the Constitutional Court of the Russian Federation of July 14, 2005 N 9-P.

[4] As one of the developers of the Judicial Statutes of 1864, A.A., believed. Kvachevsky, such a rule as the abolition of penalties due to limitation was introduced by the legislator into the Code for the following reasons. Firstly, to ensure the rights of the guilty person, for whom “the accusation after a long time becomes unfair and burdensome, because time has taken away from him the means of justification, methods of defense, at the same time giving rumor and slander the opportunity to exaggerate the significance of guilt.” Secondly, “in the interests of a fair investigation and trial, since evidence of the guilt or innocence of the accused disappears over time, which can give rise to judicial errors.” Thirdly, due to the age of the crime committed, since “it does not threaten public order in any way, the impression of it is erased in the minds of the population and society becomes indifferent to it. See Kvachevsky A. On criminal prosecution, inquiry and preliminary investigation of crimes according to the Judicial Charters of 1864: in 3 hours / A. Kvachevsky. - St. Petersburg. : Type. F.S. Sushchinsky, 1866. - Part 1. - 352 p.

[5] ECtHR Judgment of 22 June 2000 in the case of Coem and Others v. Belgium, Judgment of the European Court in the case of Jelic v. Croatia, § 52.

[6] Criminal law. Textbook in 5 volumes (edited by N.F. Kuznetsova).

[7] Criminal law. General part (edited by Rarog A.I.)

[8] See Part 1 of Art. 19 of the Constitution of the Russian Federation and Art. 4 of the Criminal Code of the Russian Federation.

[9] Fontanta .ru. from 06/10/2019 “Even for our looking glass this is too much.” Lawyer Vadim Klyuvgant about the abolition of the statute of limitations for tax crimes.

[10] See paragraph 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 “On some issues arising when arbitration courts apply part one of the Tax Code of the Russian Federation.”

[11] See Resolution of the Constitutional Court of the Russian Federation of December 17, 1996 N 20-P.

[12] See, for example, Resolution of the Constitutional Court of the Russian Federation of March 28, 2000 No. 5-P.

Aggravating circumstances

The punishment for an offense will be more severe if the following circumstances exist:

- an item has been stolen from the owner’s clothing or bag;

- the crime was committed not by one person, but by several people;

- the damage from the offense is particularly large;

- an intruder entered the property owner's apartment.

This is important to know: The statute of limitations for an individual loan

In order for the injured citizen to be able to protect his rights in the event of theft, it is advisable for him to resort to the services of professional lawyers/attorneys.

Illegality of refusal to accept a statement of theft

The procedure for accepting statements about committed or impending crimes is determined by the Instruction approved by order of the Ministry of Internal Affairs of Russia dated August 29, 2014. According to its requirements, the duty station of each police department is obliged to receive citizen statements about crimes at any time of the day. They must be immediately registered in the Incident Report Book. Each application is assigned a registration number, and the citizen is given a notification coupon. It states:

- information about the employee who accepted the application;

- document registration number;

- name of the police department, its address and office telephone number;

- date of receipt;

- signature with transcript of the police officer who issued the notification ticket.

The document is handed over to the applicant, who signs for its receipt. Police officers do not have the right to refuse to accept a statement. In addition, they are required to register it in any form. Refusals on the grounds that the application was drawn up in an improper form or that the person who became the victim of thieves is absent are not lawful.

If police officers refuse to accept or register a statement, this is a reason to contact:

- to the head of the internal affairs body - at a personal meeting or through a written appeal;

- to the prosecutor's office - at a personal meeting or through a written application;

- to court.

Note!

When appealing, it is necessary to have evidence of illegal actions (inaction) of police officers. At a minimum, witness testimony should be obtained.

Samples

Theft reports are the same no matter where they are sent. Only the content of the main descriptive part changes depending on the circumstances under which the theft was discovered and what exactly was stolen. You can use samples provided on the Internet.

If the application is drawn up at the police department, then it can be filled out by an employee of the Ministry of Internal Affairs himself, based on the words of the injured party. However, it would be more correct to entrust the writing of this document to a lawyer. A professional will indicate as many significant details as possible, remove unnecessary information, and eliminate inaccuracies.

For theft

The limitation period for theft is regulated by Art. 158 of the Criminal Code of the Russian Federation.

Definition of the term "theft"

Theft is the theft of someone else's property, or rather its removal without warning the owner.

There are different types of thefts. For example:

- theft that occurred during entry and stay in someone else's home;

- theft, during which the owner of the property was harmed;

- theft committed by a group of persons;

- stealing items from the owner's clothing or bag.

Theft must meet the following criteria:

- have a selfish character;

- the owner of the property should not know about the incident;

- be an illegal act;

- cause damage to the owner of the property.

For ordinary theft, the term is two years, for major theft - 10 years.

Terms of consideration

In total, a theft statement submitted (directed) to the police can be considered for no more than thirty days. The period begins to count from the moment the application is registered. During this period, a decision will be made to initiate or refuse to initiate a criminal case. In cases requiring additional verification of information, sending requests to various structures and organizations, the review period may be extended, but not more than thirty days.

Whatever the decision of the police officers, the applicant must be sent an official decision on the appeal (Federal Law “On the procedure for considering appeals from citizens of the Russian Federation” dated May 2, 2006 No. 59-FZ).

Note!

The body of inquiry, the investigative structure are obliged to accept for consideration, verify the report of a committed (imminent) theft and make a decision no later than 3 days from the date of receipt of the report (Part 1 of Article 144 of the Code of Criminal Procedure of the Russian Federation).

In what cases is the statute of limitations not taken into account?

According to Article 78 of the Criminal Code of the Russian Federation, the statute of limitations for bringing to criminal liability is not taken into account when committing the following crimes:

- Terrorist acts;

- Hostage taking (according to Chapters 3 and 4 of Article 206 of the Criminal Code of the Russian Federation);

- Seizure and hijacking of a ship (or other waterborne vehicle) or aircraft (in accordance with Part 4 of Article 211 of the Criminal Code of the Russian Federation);

- Initiation, development of strategy and conduct of military operations;

- Use of illegal methods of warfare;

- Extermination of a people (genocide);

Bottom line: a person/group of people involved in one of the above crimes can be prosecuted regardless of the statute of limitations.

When is the best time to write an application?

Theft is a type of crime that is more likely to be solved if it is reported to law enforcement as early as possible. As soon as the fact of secret theft is discovered (for example, upon arrival at your own apartment), you must immediately report it to the relevant structures. Moreover, a call to the emergency telephone line is enough for professionals to arrive and conduct an initial inspection of the scene. It is then that you can immediately submit the necessary application, if the victim is able to do so. Otherwise, the information will be taken from his words and compiled accordingly by law enforcement officials. Later, when the victim comes to his senses and remembers details that are important for a comprehensive consideration of what happened, you can supplement the information transmitted to the police.