The topic of the new material is: is a court fine in a criminal case a criminal record or not? It’s worth saying right away that the answer will be negative - no.

A new type of monetary recovery appeared in 2021. It led to a simplification of legal proceedings and in some cases accelerated compensation for damage caused by a crime. But confusion among citizens still remains.

In this connection, it is necessary to talk about all the details down to the smallest detail. This is the goal of the article brought to the attention of the reader. Materials from judicial practice and final recommendations will complete the picture.

Judicial fine as a measure of criminal law nature

We need to start with theory. According to Article 104.4 of the current Criminal Code (Criminal Code of the Russian Federation), a judicial fine is a sum of money imposed by the court as a result of the abolition of criminal liability. In essence, the conversation is about payment for refusal of further prosecution.

There are 2 conditions under which a suspect or accused has the right to count on a loyal outcome of the case.

The first is the commission of an act classified as non-serious or moderately serious for the first time. Here it is appropriate to provide a reference to clause 16.1 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of June 27, 2013 No. 19 (hereinafter referred to as Resolution No. 19), which states that several crimes are not an obstacle to terminating a criminal case.

A person is considered to have committed a crime for the first time if he meets the criteria listed in paragraph 2 of Resolution No. 19. It is interesting that a previously convicted citizen can also apply for a fine, provided that he managed to have his criminal record expunged or it has already been expired.

The second condition is compensation in full for the damage caused by the accused and third parties acting in his interests. This includes payment of monetary compensation to the victim and voluntary return of stolen property. Other legal ways to make amends are also possible: apologizing, helping with treatment.

A few words must be said about the size of the fine. It is determined based on the nature of the crime committed, the financial situation of the defendant, and other factors.

According to Art. 104.5 of the Criminal Code of the Russian Federation, if a monetary penalty is provided for the committed act, then the judicial penalty should not exceed 50% of the maximum amount. When the corresponding article of the code does not provide for a fine, the upper limits are set at 250,000 rubles.

The consent of the suspect is required to terminate criminal proceedings. The law does not provide for taking it from the victim.

Is a court fine a criminal record?

By virtue of the provisions of Art. 86 of the Criminal Code of the Russian Federation, a criminal record is the result of a person being convicted of a crime, regardless of its severity. In turn, when determining the final measure of responsibility for the defendant, the court is guided by the types of punishment provided for by law, including a criminal fine.

But the imposed court fine is not one of them. Moreover, it is inextricably linked with the closure of the criminal case. Accordingly, there is no discussion about the conviction and the associated criminal record.

There is another difference between a judicial fine and existing punishments. The imposition of a judicial fine in a criminal case is formalized not by a verdict, but by a court order.

However, there is still one option when imposing a fine entails a criminal record. This happens when the amount determined by the court was not paid on time. Then the accused is brought to criminal liability based on the crime he committed.

Is the director always liable if the company fails to pay taxes?

No not always.

The director has his own responsibilities, and the chief accountant has his own. If the director is not involved in accounting and, due to his official duties, did not choose contractors who turned out to be dubious, then it is very difficult to accuse him of tax evasion.

The courts take this point into account and examine whose responsibilities include the preparation and submission of declarations, as well as the selection of counterparties.

In our practice, there are cases when the tax office came with an on-site audit to a company and assessed an additional amount of more than 50 million rubles. A criminal case was opened against the director under Part 2 of Article 199 of the Criminal Code of the Russian Federation. The reason is the company’s connection with shell companies, which is why, according to investigators and the tax office, the taxpayer did not pay additional taxes.

However, we managed to prove that the director was not guilty and got the criminal case dismissed. Previously, he had already contacted us for comprehensive director protection services, thanks to which the company had:

- Regulations on contractual work.

- Due diligence clause.

- Regulations on the selection of counterparties and other documents.

In our case, the director did not select counterparties. He had contact only with counterparties-customers, and not with suppliers. Suppliers were searched and verified by other company employees. Therefore, the director could not bear any responsibility for the fact that some contractors turned out to be dubious.

Practice of applying court fines

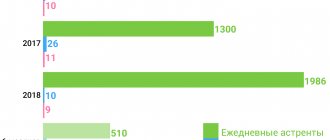

Precedents indicate that, if there are grounds, petitions are granted. The initiators of establishing a monetary payment are the investigative authorities, the defendants themselves. The opinions of the prosecutor's office and the injured party are also taken into account.

There are examples when a court fine was imposed at the appeal stage. Here the reason lies in the non-compliance with the law by the courts of first instance.

In many cases, the penalties exceed the amount of damage. However, the accused agree with them, since there are no adverse consequences in the form of a criminal record. Well, as an illustration of what has been said, a description of several court decisions is given.

Determination of the court fine at the appeal stage

The lawyer, in the interests of his client, appealed to the Stavropol Regional Court against the decision of the district court. In accordance with it, the defendant was found guilty of committing actions provided for in paragraph “c” of Part 2 of Art. 158 of the Criminal Code of the Russian Federation - theft on a significant scale. As a result, the court imposed a fine on her in the amount of ten thousand rubles.

The appeal stated that the defendant committed a crime of moderate severity for the first time. In addition, she apologized to the victim and returned her stolen mobile phone. Therefore, the first instance had every reason to terminate the criminal case and limit itself to a court fine.

The appeal ruling dated 08.20.2020 in case No. 1-280/2020 noted that the court committed procedural violations. Thus, he did not close the criminal case despite the presence of existing grounds for this. Therefore, the deficiency was corrected by the appellate court. She stopped the criminal prosecution of the citizen and imposed a court fine of 10,000 rubles on her.

Judicial fine initiated by the investigator

The investigation department petitioned the court to terminate the criminal case and impose a court fine against the citizen accused under Part 1 of Art. 264.1 of the Criminal Code of the Russian Federation – driving while intoxicated by a person previously brought to administrative responsibility. The appeal states that during the investigation, the man admitted his guilt and compensated for the harm by making a donation.

The defendant, for his part, supported the motion. The representative of the prosecutor's office also agreed with him.

As a result, by decision of the Osinovsky District Court of the Kemerovo Region dated November 27, 2020, the criminal case was discontinued in case No. 1-380/2020. The defendant was sentenced to a fine of 5,000 rubles. with a payment term of 2 months.

Statement from the defense

The Bizhbulyak Interdistrict Court of the Republic of Bashkortostan considered a criminal case against a citizen accused of stealing honey from a friend in the amount of 2,000 rubles. At the court hearing, the defendant, as well as his lawyer, filed petitions for release from criminal liability with payment of a court fine.

The court found that the defendant committed a crime of medium gravity for the first time. He compensated the victim for all damages. In addition, the victim confirmed in writing that there were no claims.

As a result, by a resolution dated November 26, 2020, in case No. 1-139/2020, the citizen was released from criminal prosecution. At the same time, he was imposed a fine of 5,000 rubles. with a two-month payment period.

When there are several defendants

The Kamyzyaksky District Court of the Astrakhan Region considered a criminal case against two citizens accused of committing a crime under Part 3 of Art. 256 of the Criminal Code of the Russian Federation – illegal fishing. It was established that the defendants caused damage in the amount of more than 13 thousand rubles through the prohibited catch of 4 pike perch.

During the trial, the defendants filed a motion to close the criminal case with payment of a court fine. It indicated an admission of guilt and voluntary compensation for the harm caused.

The court confirmed the existence of grounds for termination of proceedings. As a result, by the verdict of November 27, 2020, the defendants were released from criminal punishment. At the same time, they were given a fine of 20 thousand rubles each.

How exactly are tax crimes committed?

Article 199 of the Criminal Code specifies exactly how companies evade paying taxes:

- They do not provide tax returns, calculations or other documents that they must provide in accordance with the Tax Code of the Russian Federation.

- Include knowingly false information in a tax return or calculation.

What are other documents? These are extracts from the sales book, from the book of income, expenses and business transactions, calculations of advance payments, annual reports on the activities of a foreign organization, documents confirming the right to tax benefits.

What is knowingly false information? For example, if a company performs any work on its own, but indicates in the primary documents that this work was performed by a counterparty. This means that the company can deduct VAT and take expenses into account when calculating corporate income tax. This is deliberately false information.

Procedural features of imposing a judicial fine

They are described in detail in Chapter 51.1 of the Code of Criminal Procedure of the Russian Federation. In particular, exemption from criminal prosecution with the imposition of a fine on the citizen is possible both at the stage of investigation and while the case is in court.

When it comes to the pre-trial stage, then according to Art. 446.2 of the Code of Criminal Procedure of the Russian Federation, if there are grounds, the investigator, the inquiry officer, with the approval of the management, shall issue a resolution to initiate a petition before the court, the subject of which will be the termination of the criminal case with the imposition of a court fine. As stated in paragraph 25.1 of Resolution No. 19, this is only possible with the consent of the suspect or accused.

The resolution, petition with all collected materials is sent to the district or magistrate court, depending on the jurisdiction (Article 31 of the Code of Criminal Procedure of the Russian Federation). Copies of the document are also intended for the accused, victim and civil plaintiff.

The decision on the merits is made in a separate meeting, which is scheduled within 10 days. In this case, the citizen himself, his lawyer, the victim and the prosecutor participate in the court. As a result, a decision is made to satisfy the petition and assign the amount of a court fine, or to refuse. It can be challenged on appeal within ten days.

In a situation where a decision on a monetary penalty is made at the stage of court hearings on the case, a decision is also made at any time before the judge leaves for the deliberation room. A prerequisite is the consent of the defendant. Next, on the basis of the judicial act, a writ of execution is prepared, which is subsequently sent to the bailiffs.

For what amount can directors be held criminally liable under a tax article?

Let’s imagine that the company transferred 8 million rubles to a shell company. with VAT for certain services. At the same time, the company:

- counted these 8 million as expenses when calculating income tax;

- applied a deduction from input VAT.

What additional amount will the tax office charge based on the results of a tax audit if it is discovered that the counterparty is a shell company?

- VAT for RUB 1,220,338. (8,000,000/118 * 18). After all, the operation in connection with which the company applied a VAT deduction did not actually take place.

- Income tax - 1,355,932 ((8,000,000 - 1,220,338) * 20%).

- Fine: 1,030,508 - ((1,220,338 1,355,932) * 40%). We add up the amount of VAT and income tax paid and subtract 40% from it.

A fine of 40% of unpaid taxes is imposed if the non-payment was intentional - this is a prerequisite for initiating a criminal case. If a company did not pay taxes because the accountant made a mistake or did not know that the company should pay them, then there is no crime.

How to pay a court fine in a criminal case

The entire process is supervised by bailiffs (Article 103.1 of the Federal Law “On Enforcement Proceedings”). In relation to the corresponding amount, a decision is made to initiate enforcement proceedings. It contains both the payment deadline and the necessary details. Often, payment information is indicated in the court order itself.

The easiest way to make a payment is at any bank institution. To do this, you need to correctly identify its purpose. The emphasis is placed not only on the mention of a court fine, but also on the details of the court decision. It is permissible to pay money in your personal online banking account, as well as on the SSP website, followed by printing a receipt and having it certified by the bank.

In any case, the payment document is presented to the bailiff. The maximum period is 10 days after the end of the payment period. This will become the basis for closing enforcement proceedings.

What to do if a criminal tax case has already been initiated against the director?

If a criminal case has already been initiated, then it is necessary to involve experienced lawyers specializing in taxes to protect your interests. They are the ones who must analyze the situation, assess the risks and work out further tactics and line of defense.

To do this, witnesses may be questioned, documents may be presented, including those confirming the reality of the transaction, due diligence and commercial diligence may be exercised, a financial analysis of the results of controversial transactions may be carried out, and procedural grounds may be used to deem a number of evidence inadmissible. As practice shows, these actions can only be carried out by a lawyer practicing in this area.

If you don't pay, what are the consequences?

They are spelled out in Part 2 of Art. 104.4 of the Criminal Code of the Russian Federation. Thus, if payment is not received at the appointed time, the court fine is canceled and the citizen may be subject to real criminal prosecution. Accordingly, he has a criminal record.

Technically, everything happens as follows. If the sanctions are not paid, then 10 days after the deadline, the bailiff sends to the court a proposal to cancel the fine and resolve the issue of bringing the person to criminal liability. Such actions are prescribed in Part 6 of Art. 103.1 “Federal Law on Enforcement Proceedings”.

The issue related to the abolition of the fine is resolved in a court hearing with the participation of the bailiff, the debtor and his representative, the prosecutor. In particular, it becomes clear why the money was not deposited. Attention is drawn to this in paragraph 19 of Resolution No. 19. And if it turns out that the reasons for the delay were valid - hospital treatment, loss of earnings, sanctions will remain in force.

When the decision to impose a fine is cancelled, the court, in accordance with Art. 446.5 of the Code of Criminal Procedure of the Russian Federation sends the case materials to the investigator or prosecutor's office. Well, then the proceedings in the existing criminal case are conducted according to the general rules of procedural law.