The RF Supreme Court clarified the concept of insurance fraud to the courts

According to the resolution, insurance fraud is a crime that is committed by deception regarding the occurrence of an insured event or by inflating the amount of insurance payment. Thus, insurance fraud is considered to be the reporting of knowingly false information about the circumstances confirming the occurrence of an insured event, the staging of an accident, an accident, or theft of insured property.

Also, the plenum of the RF Armed Forces clarified that the subject of insurance fraud should be considered “the person who carried out the objective side of this crime.” For example, it may be the policyholder, the insured, another beneficiary, as well as a representative of the insurer or an expert who has entered into a conspiracy with him.

The press service of the All-Russian Union of Insurers noted that the plenum of the RF Armed Forces classifying an unreasonable overestimation of the amount of payment as insurance fraud will have a positive effect. “Nowadays there is a practice when law enforcement officers attribute this to mistakes and other inaccuracies, but do not consider it fraud. This is also where we see the problem of not initiating criminal cases,” representatives of the union’s press service told ASN. The head of the legal department, Alexander Kozinov, also believes that the new resolution of the Plenum of the RF Armed Forces will help reduce the number of insurance frauds. “Now an expert technician will think twice before categorically overstating the amount of damage, and a medical worker, for issuing an “incorrect” disability certificate, will take into account that this may be the last “medical document” that he signs,” says Kozinov.

Igor Kushnir, director of the department of judicial work at IC MAX, believes that the new resolution of the plenum of the RF Armed Forces will help facilitate interaction between representatives of the security services of insurance companies and investigators. “In practice, liberties were taken when qualifying the act provided for in Art. 159.5 of the Criminal Code of the Russian Federation. This led to the refusal to initiate criminal cases without proper grounds,” he says. Kushnir adds that insurers are waiting for similar clarifications from the RF Armed Forces regarding crimes related to the forgery of compulsory motor liability insurance policies.

According to employees of the security department of RESO-Garantia, the new document of the judicial body addresses issues of insurance fraud “sparsely.”

However, they see the advantages of the appearance of this resolution in the ability of insurers, when drawing up complaints about deception of policyholders, to refer to specific actions that the Plenum of the RF Armed Forces indicated as examples of fraud in the insurance industry. On the subject: Insurance fraud in Russia has increased 2.5 times

Insurance Fraud

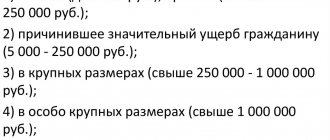

June 12, 2021 This type of fraud, as in the insurance industry, appeared in criminal legal practice relatively recently. This rule of law was added to the Criminal Code of the Russian Federation in 2012. Insurance fraud is the theft of someone else's property through deception regarding an insured event. This type of economic crime is distinguished from related offenses, suggesting a more lenient type of punishment, and carries the least social danger.

A lawyer who specializes in Art. 159.5 of the Criminal Code of the Russian Federation must understand not only the intricacies of criminal law and criminal proceedings, but also navigate civil legislation, which contains rules on insurance.

To understand the essence of this section, you need to find out what an insured event is? According to paragraph 2 of Art. 9 of the Law “On the Organization of Insurance Business in the Russian Federation”, an insured event is an event that is provided for by law, upon the occurrence of which the insurer’s obligation to pay an insurance benefit arises. An example of an insured event can be an accident, fire, death of a citizen, etc.

Deception is divided into two types - passive and active. Active deception refers to the provision of false information or the provision of false documents, which is aimed at misleading. And passive means hiding any facts. Investigative authorities most often encounter deception in the form of false documents - accident certificates, reports, and others. In considering this issue, the courts take two positions. One position is that the provision of false documents is regarded as an independent element, while others believe that these actions are a method of committing a crime. An experienced lawyer who can convince the court that providing false documents is a method of committing a crime will be able to obtain more lenient sanctions.

Basically, lawyers encounter the following typical fraud schemes:

- Providing incorrect information when applying for an insurance policy;

- Incorrect information about the insured event;

- Imitation;

- Committing intentional illegal actions.

Let's look at an example if you are faced with a similar situation and you are suspected of committing this crime. The basis for criminal liability will be the commission of an act that contains all the elements of a crime. For example, the fact that an insurance company underestimates the amount of insurance compensation is often questionable. It turns out that theft is mainly characterized by a decrease in the property mass of the victim and its reversal in favor of the perpetrator. But it turns out that when considering the situation of underestimation of insurance compensation, the injured party suffers not property damage, but the lost profit of the unpaid portion. This leads to the conclusion that if fraud is committed by understating the amount of insurance payment, then this will not constitute fraud. This act must be qualified under Art. 165 (“Causing property damage through deception and abuse of trust”).

Prices for lawyer services for this category of cases can be found here.

Events of the year 2021

In North Ossetia, which consistently ranks in the top ten, the insurance fraud index increased by almost 20 percent, and the overall economic crime rate increased by 111 percent.

“People with low social responsibility, especially in the most disadvantaged regions, are looking for any ways to make money, including criminal ones,” noted an expert of the information project “Insurance: Public Expertise”, head of the committee for quality control of products and services in the insurance sector of the Association consumers of Russia" Andrey Krupnov.

According to him, we are talking about both active participation in criminal groups and the involvement of respectable citizens with a “clean” reputation who are faced with financial difficulties in fraudulent schemes as perpetrators.

— In the first half of 2019, the share of cases initiated on claims of insurance fraud sent by insurers to law enforcement agencies amounted to 22.5 percent compared to 19 percent for the same period last year. These figures show the activity of the Ministry of Internal Affairs and the strengthening of interaction between law enforcement officers and insurers, which allows them to more often identify cases of insurance fraud,” Sergei Efremov, vice-president of the All-Russian Union of Insurers (VSU), told RG.

In North Ossetia, the insurance fraud index increased by almost 20 percent, and the overall economic crime rate increased by 111 percent.

According to ARIA statistics, in the first quarter of 2021, insurers sent 3,005 complaints about cases of insurance fraud to law enforcement agencies, in the second quarter - already 3,844, in the third - 3,580, in the fourth - 3,073. In the first quarter of 2021, 3,444 complaints were sent, in the second — 3113. In the structure of requests, 90 percent are cases of compulsory motor liability insurance.

— Of course, 22.5 percent out of 100 is not a very high proportion; the number of refusals to initiate cases is large. We need more active interaction between insurers and law enforcement,” said Sergei Efremov.

The level of cases initiated varies among individual insurers and depends on the quality of the material that companies send to the Ministry of Internal Affairs. The BCC has developed guidelines for insurers so that they correctly fill out applications.

3.5 billion rubles amounted to damage from insurance fraud in the second quarter of 2021

Insurers are not always able to collect the necessary evidence. This is due, in particular, to the time frame allocated for consideration of such cases - 20 days. In addition, insurers do not have enough rights to fully collect evidence - all the information they collect must be double-checked by investigators when deciding whether to initiate a criminal case.

Cases of insurance fraud, according to Sergei Efremov, are mainly dealt with by criminal investigators and local inspectors. They do not always have enough competence to understand the complex economic aspects of such cases. “We need to look for methods to speed up the process of considering insurance fraud cases,” Efremov concluded.

Experts from the “Insurance: Public Expertise” project believe that the Insurance History Bureau, which began operating on August 1, 2015, helps in the fight against insurance fraud. It contains information about clients of insurance companies under MTPL and comprehensive insurance contracts: information about accidents and insurance payments. Over four years, insurers submitted information about 16.5 million contracts and 2.5 million losses to the database. This information helps to identify insurance fraud, since the client’s history is now seen not only by the company in which he is insured, but also by the market as a whole.

Infographics "RG" / Mikhail Shipov / Evgenia Noskova

Russia will speed up the return of money to victims of fraud

As Deputy Minister of Finance Alexey Moiseev told Izvestia, the new mechanism will make it possible to quickly respond to information about a crime and “slow down” funds.

“We propose to legislatively enable the Bank of Russia and the Ministry of Internal Affairs to quickly respond to information about fraud and quickly obtain a court decision to block further actions,” Moiseev said.

According to the Prosecutor General's Office, every fifth case of theft in Russia is related to the theft of money from a bank account - in 2021, scammers through the Internet and cellular communications defrauded Russians of about 150 billion rubles. At the same time, according to Izvestia’s source, it is possible to return stolen money only in 10% of cases.

“When fraudsters steal a certain amount, the money leaves both the person’s pocket and the bank, so the bank cannot return it. There is no blocking mechanism to ensure that the funds remain in the bank - they are sent further to the accounts of the attackers. And when a person comes to the police and a case is initiated, the investigator cannot immediately seize the money - he must first send a request to the banks, find out from which account and where the funds were written off, send a letter to the bank so that they are blocked if they are still in the account, - but, of course, they are no longer there. They are either cashed out or transferred to online wallets,” said the publication’s interlocutor.

Evgeniy Ivanov, a lawyer at the European Legal Service, noted that it is almost impossible to return stolen property in such cases - a statement to the police, initiation of a criminal case, and investigator requests to banks about the details of the transaction require too much time. Ivanov suggested that if the Russians have the opportunity to “slow down” transactions with stolen money, then compensation for damage will speed up.

“In general, if the new procedure is properly organized, it will allow faster tracking of the movement of funds - if the scammers’ scheme is initially simple (transfer money from the victim’s account and withdraw it through a third party’s card). But taking into account the availability of electronic instant transfer systems, fast payments and foreign payment instruments, during the time the theft of funds is detected and the police are contacted, the money can be easily withdrawn,” said Ivanov.

RTM Group manager Evgeniy Tsarev believes that the government’s initiative will not greatly improve the situation regarding the return of stolen money. “The procedure proposed to be introduced by the Ministry of Finance will, in theory, reduce the period to several days, or at best, hours. However, in this case, minutes count. As a rule, having received the money, the scammers carry out two or three more transfer operations and the stolen money is already withdrawn from the ATM,” Tsarev said.

Senior lecturer at the Department of Banking at Synergy University Anton Rogachevsky suggested that the mechanism implies the possibility of freezing suspicious transactions, which could lead to permanent blocking of personal accounts.

“The system will be unable to recognize in large volumes of transfers whether a transaction is suspicious or not. Therefore, there are two options: either select some criteria that will distinguish a regular transfer from transferring money to scammers (which is practically impossible), or set standard criteria, and the program will block all payments, slowing down work processes,” the expert noted.

Previously, “Sekret” wrote that telephone scammers tried to deceive Moiseev himself - the official wanted to sell a child’s bed through a free ad service. He was answered by a girl who said that she wanted to make a purchase and transfer money. To receive them, you need to call the code from the SMS, she said. Then the deputy head of the department realized that he had encountered scammers.

Photo: Pixabay, Pixabay License

Insurance fraud will increase by 17% in 2021

The number of cases of fraud in the insurance industry in 2021 will return to the level of 2019, Izvestia reports citing Sergei Efremov, vice-president of the All-Russian Union of Insurers (VSU). He estimates the figure will rise by 17% to about 12,000 cases. According to insurers, the most popular fraud schemes are retroactive registration of compulsory motor liability insurance, sale of invalid policies and imitation of the theft of expensive cars.

- The Central Bank will fight the purchase of e-OSAGO in offices

April 29, 11:14 - The Central Bank will oblige insurers to disclose information about intermediaries

May 13, 9:18 - The Supreme Court defended the owner of the car in a dispute with the insurance company

April 19, 16:28

According to estimates from the largest insurance companies, very often compulsory motor liability insurance is issued retroactively, after an accident, since up to 15% of drivers do without policies at all or drive with fake ones. But such schemes are usually uncovered, because cameras make it possible to record the exact time of the accident. With the growing popularity of CASCO, fraud has become widespread, in which supposedly stolen expensive cars are actually transported to Central Asian countries. In addition, criminals often sell invalid policies electronically or try to obtain unreasonably inflated insurance payments.

Insurers expect that by the end of the first quarter of 2021, the number of frauds with MTPL, CASCO and civil liability insurance contracts will increase by 10–20% compared to the same period last year.

Sergey Efremov, on the contrary, believes that the indicators for the first quarter will be close to those in 2020, but will significantly exceed the amount of fraud in subsequent quarters of the same year. According to an ARIA representative, amid the coronavirus pandemic and restrictions, the activity of insurance fraudsters has decreased significantly.

If in 2021 about 12,000 applications about such schemes were filed with the police for a total amount of 8 billion rubles, then in 2020 the same figures amounted to 10,000 complaints and 5.5 billion rubles. damage. In 2021, their level will likely return to pre-pandemic levels, Efremov believes.

Fraud in the auto insurance market has increased due to the pandemic

Along with insurance abuses, the BCC expects an increase in fraud in property and liability hedging agreements, where people often try to backdate agreements to get paid for damages that have already been caused. Efremov noted that with compulsory motor liability insurance it is becoming increasingly difficult to use new abuse schemes, so fraud in hedging health and property will grow faster.

Moreover, if three years ago only 10% of claims from insurers involved professional fraudsters, now their share is about half of the total number of claims. Experts note that against the backdrop of declining incomes due to the pandemic, rising exchange rates and other negative factors, many people are increasingly willing to inflate the amount of damage, not realizing that they are breaking the law.

- Pravo.ru

- criminal process

Based on practice, but does not always take into account the law

On November 14, the Plenum of the RF Armed Forces considered the draft resolution “On judicial practice in cases of fraud, misappropriation and embezzlement,” which consists of 35 points regulating the application of criminal law in the field of economic crimes. After discussing the document, it was decided to send it for revision.

More than 10 years have passed since the previous Resolution of the Plenum of the Armed Forces of the Russian Federation “On judicial practice in cases of fraud, misappropriation and embezzlement.” The increasing complexity of the forms and methods of implementing civil legal relations, legislative changes and issues of practical application of the novelties of the criminal law relating to liability for theft have led to the need for clarification on the most problematic elements of fraud, misappropriation and embezzlement.