Check the legality and validity of the summons for questioning

A summons for questioning and some features of the procedure for this event are regulated by Art.

90 of the Tax Code of the Russian Federation in general order. According to paragraph 1 of Art. 90 of the Tax Code of the Russian Federation, a tax inspector can call for questioning as a witness “... any individual who may be aware of any circumstances that are important for the implementation of tax control,” and therefore anyone.

Despite the fact that Art. 90 of the Tax Code of the Russian Federation does not regulate exactly how a witness should be summoned for questioning; we have at our disposal a letter from the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837, which contains recommendations on summoning a witness to testify by subpoena.

Therefore, before you worry, let's determine whether you were called or not. A phone call, an e-mail, or a police officer coming to your grandmother’s house are not an official summons for questioning.

Even if the inspector called your office and personally invited you to come, you can refer to the large amount of work, being busy and nothing will happen to you for it.

What happens? According to Art. 128 of the Tax Code of the Russian Federation provides for liability for failure to appear without a valid reason or evasion of appearance, in the form of a fine of 1000 rubles.

If you received a subpoena and there is confirmation that you received it, then as a law-abiding taxpayer you are obliged to appear for questioning.

Delivery of the summons to the summoned person

It is necessary to understand how the process of transmitting a subpoena occurs. The law provides for several possibilities, which are specified in Part 2 of Article 188 of the Code of Criminal Procedure of the Russian Federation.

- Personally against signature. If the person being called is absent for some reason, then the recipient can be any relative who lives together. This is a standard method that involves the official going to the summoned person's home and serving a summons. The latter must sign for receipt. However, it is quite rare to use this method, since many do not live at the place of registration.

- Using available means of communication. Mail, phone, instant messengers, phone call. However, this method raises many questions among lawyers, since it is not clear who is really transmitting the message. When making a call, it can be difficult to prove that the official conveyed information, so they often try to use instant messengers. There is a read mark there. But you need to know who owns the phone.

- By mail at your place of work. If it is impossible to establish the actual location of the person being called, you can transmit the message through the employer. The letter is sent to the address of the company or delivered personally by an official to the person responsible for receiving the correspondence.

- On behalf of officials, it is transferred to organizations that are obliged to provide the document directly to the recipient. For example, it is known that a particular citizen must appear for a medical examination at a certain time. Then it is allowed to provide the document to the doctor who will examine this person.

Extract from Article 189 of the Code of Criminal Procedure of the Russian Federation

It is worth understanding that recipients do not always want to receive this letter. Therefore, law enforcement officials have to be creative. For example, they leave it with neighbors, put it under the door, and so on. At the same time, everything is recorded on camera, so that later it cannot be said that the letter was not received.

Important! The subpoena must be served only by legal means. If you use methods that violate the provisions of the current legislation, then the fact of delivery is recognized by the court as invalid. As a result, the information obtained during the interrogation is also rejected by the court and is not attached to the case.

If a minor is summoned, then it is necessary to act through legal representatives.

Criminal Procedure Code of the Russian Federation

Review the list of possible questions

Armed with Appendix No. 1 to the Methodological Recommendations of the Investigative Committee and the Federal Tax Service (letter of the Federal Tax Service dated July 13, 2017 No. ED-4-2 / [email protected] ), it is necessary to carefully prepare for the interrogation.

This appendix contains two lists of questions: for the general director and for an ordinary employee.

A total of 80 questions recommended for use by all inspectorates during interrogations.

Speak out the answers to the questions, because sometimes to hear the “absurdity” of an argument or hear the “double meaning”, you just need to say the phrase out loud.

Preparing for interrogation

It is necessary to prepare for the interrogation. View documents. Think through the details. Analyze the possible negative consequences of the answers. Determine the degree of frankness. What to say and where to remain silent.

If you are not confident that you can handle the stress of an interrogation, or cannot justify certain transactions that involve tax risks, go to an interrogation with a lawyer or tax attorney. He will drop Corvalol, give you confidence, control the interrogation procedure, record violations and be able to resist the inspector’s tricks. It's a lawyer. Or a tax lawyer.

Qualified legal assistance is enshrined in Article 48 of the Constitution of the Russian Federation. The inspector will not listen to the accountant explaining and, most likely, will not allow you to interrogate. If necessary, he will interrogate him separately.

There is a whole list of 80 questions that are recommended by the Federal Tax Service when conducting interrogations by the Federal Tax Service and the Investigative Committee. Some questions are asked to the general director, the other part to an ordinary employee. I recommend studying them (Letter of the Federal Tax Service dated July 13, 2017 No. ED-4-2 / [email protected] ) and preparing answers.

You must understand that the inspector is also preparing for interrogation. And he already knows the answers to some of the questions. He studied data on the number of employees, found out what assets are on the company’s balance sheet, data on your problematic counterparties, the amount of taxes, the average salary of employees, the company’s turnover, and what other organizations you participate in as an owner or director. Prepare this information too. There is no point in hiding it.

And, of course, questions have already been identified and prepared on the “painful” points of your business, for which you were called in for questioning. These may be questions related to tax optimization, about your counterparties, about strange and illogical transactions, and other questions that may raise suspicions of a tax offense.

You may not be prepared for all questions of this kind. But remember – you are not taking an exam, you don’t have to remember everything and answer clearly. Your task is to prove your competence by excluding conclusions about the nominal management and the receipt of unjustified tax benefits.

But don’t give too much information. For individual transactions, you cannot remember all the circumstances, so the answers “you need to clarify”, “you need to bring up documents in order to answer reliably” will be quite appropriate.

You have the right to come to the interrogation with a voice recorder. The recording may be helpful. You are not required to warn about this. An inspector, if he records the interrogation procedure by video or audio recording, is obliged to inform you, but you are not. We quietly turned on the recorder and went.

The inspector must include the fact of video and audio recording of the interrogation procedure in the protocol.

Come to the interview at the appointed time

It is necessary to appear at the inspection at the appointed time, having with you a passport and a summons for questioning.

Some lawyers advise you to cheat and come a little later, then the inspector will have much less time for your event.

The conditions for conducting the interrogation depend on each region and each specific tax office.

This may be a separate office, or it may be an office where 10 inspectors are located at the same time and you, sitting on a chair at your inspector’s desk, will answer questions. This should not affect your answers in any way; stick to your pre-prepared strategy.

Compliance with formalities

They are summoned for questioning. A summons is issued to a specific person. It makes no sense for anyone else to go, even by proxy. They won't accept it.

A phone call, an e-mail, a police officer coming to your wife’s or neighbors’ house is not in accordance with the rules. You have the right not to react. No summons - no summons for questioning.

Advice: If an inspector calls you at work and personally invites you to come, I advise you to be polite and refer to the fact that you are busy and have a large amount of work. Nothing will happen to you for this.

The summons can be sent by registered mail. Tax legislation provides for the rule: any mail item is considered received on the 6th day, regardless of the fact of its receipt. If you receive a summons, you need to go.

Answer questions without giving unnecessary information

Your position must be firm and categorical.

As in the good old joke: Tax inspector to businessman:

- How does this happen, Dearest! Earned 1 million and spent 10 million?

Businessman sighing:

“This is how we live – we can barely make ends meet.”

Answer questions calmly, especially if the answers are already known to the inspector.

Before calling you in for questioning, the inspector has already conducted a small analysis and is already aware of:

- your position in the organization;

- what other organizations you are involved in;

- number of working employees;

- real estate owned by the organization;

- your counterparties;

- the amount of taxes paid;

- wage fund and average salary for your organization, etc.;

- information from your current account statement;

- about the company's turnover.

There is no point in hiding the information that the inspector owns.

Also, you shouldn’t invent anything, as lawyers say - “don’t mislead the inspector.” Keep your answer short.

The main thing is to remember - you are not taking an exam, and are not required to answer with an “A”; your task is exactly the opposite, after talking with the inspector, prove your competence and not give any unnecessary information other than what the tax office already has from your reporting.

You have the right to use Art. 51 of the Constitution of the Russian Federation “No one is obliged to testify against himself, his spouse and his close relatives.” The inspector must explain the provisions of this article to you before the interrogation begins.

If you use this right only on certain issues, this will arouse suspicion in the inspector and will only give him another reason to “dig” deeper. If you decide not to testify, then state this directly at the very beginning of the interrogation and do not answer at all.

If you came and changed your mind about answering the questions, except when you used Art. 51 of the Constitution of the Russian Federation, the inspector has the right to fine you 3,000 rubles for refusing to testify. according to Art. 128 Tax Code of the Russian Federation.

Controversial issues

There are several controversial nuances in which it is possible to appeal an official’s decision to prosecute due to failure to appear.

- Sending a document by mail does not always guarantee its receipt. Often letters are taken out by third parties. Therefore, postal workers must serve the summons in person to avoid any problems.

- Sending by email or using other modern means of communication also does not guarantee receipt. It is required that a scan of the summons be sent. If the text does not comply with the current requirements, then the letter can be legally ignored.

- If information is transmitted by telephone, the parties do not see each other. This means that there is a possibility of deception. It is also impossible to prove the fact of communication, so failure to appear is allowed. However, this issue is controversial, since communication and transmission of a message are often proven through court. For this purpose, witnesses are brought in: colleagues of the official who work with him in the same office.

- Often, with the chosen preventive measure of detention, problems arise because the letter did not arrive or was received late. But such a measure of punishment is used in relation to those who deliberately ignore the requirements of an official.

An employee of the RF IC fills out a summons

Thus, if an official insists on punishment, it is possible to challenge this decision. To do this, you must submit an appeal and attach relevant evidence, if any. It is recommended to hire a lawyer who will protect the interests of the client. But you need to understand that the service is paid. A public defender is provided only to accused persons after a criminal case has been initiated.

Conducting an interrogation - step-by-step instructions

The interrogation must take place strictly according to the principles established by law. The person being interrogated is obliged to tell the truth. If it is possible to document the words, it is worth doing. There are criminal penalties for providing false information. Thus, from a witness one can become an accused. It is worth taking a closer look at how everything happens.

Step 1

Initiation of a criminal case if appropriate evidence is available.

Criminal proceedings

Step 2

Drawing up a summons for questioning to all persons related to the case. It is necessary that the documents are completed correctly. In this case, it is not allowed to interrogate several persons at the same time, as this may lead to distortion of the information received. The exception is when there is a confrontation.

Drawing up a subpoena for interrogation

Step 3

The appearance of the person summoned for questioning. The official must verify the identity using a passport or other identification document, and then inform the person about the reason for the call.

Appearance of the person summoned for questioning

Step 4

Conducting interrogation in accordance with the provisions of the Code of Criminal Procedure of the Russian Federation. If the person being called comes with a friend or relative, the latter will not be allowed into the office. You are allowed to come with a lawyer. Then the information is entered into the protocol that the person being called was not alone. It is also possible for legal representatives to be present during the interrogation of incapacitated persons or minors.

Conducting an interrogation

Step 5

Signing of the protocol by the parties.

Signing the protocol

It is worth noting that you can leave work during the interrogation. At the same time, wages are maintained. You are allowed to take with you the necessary evidence in the case. If not all information is provided during interrogation, because the person has forgotten the information and needs confirmation, then a second call is allowed. It is prohibited to conduct interrogations on the territory of the summoned person. An exception is if he is in the hospital and cannot come in person due to health problems. They can also come to a disabled person who cannot move independently.

Carefully read the interrogation protocol and make adjustments if necessary.

After you answer all the questions, or your free time has expired, by the way, notify the inspector in advance, if your time for interrogation is limited, carefully read the interrogation protocol.

Not cursorily, not casually, but by reading the questions and answers very carefully. Your task is to check whether your answers are correctly reflected in the protocol and whether there is any double meaning in them. The inspector will interpret your answers in his favor. Remember – your tasks are radically different! From the inspector - to get as much information as possible, from you - to tell as little as possible in general terms.

If you find inaccuracies or ambiguous wording in the protocol, ask the inspector to make changes. Explain what exactly you meant and what the phrase should look like.

Take control of the situation

Much depends on the behavior and answers to questions during interrogation at the tax office - both management and ordinary employees. Therefore, the course of the interrogation - like any tax control process - must be managed.

Keep all actions of the tax authority under control! It is important to understand what is happening, when and what actions the tax office is taking, assessing their legality and calculating the consequences. This is important both for minimizing financial losses from a tax audit and for high-quality collection of evidence for the possible defense of your business in court.

You should explain the rules of behavior during interrogation to all your employees who are called for interrogation by the tax office. Don't rush with answers. Do not answer “I don’t know.” If you are not sure, answer vaguely or evasively. Be sure to check and obtain the interrogation protocol.

The presence of a lawyer or tax lawyer in this case is also very useful.

An employee, worried during an interrogation, may conjecture something, misunderstand something, get confused - and fired, out of a feeling of resentment or revenge - and say too much. Preparation, analysis of the consequences, and in general - assessment of the feasibility of a visit to the tax office are mandatory actions for every call for questioning.

Copy, photograph or, as a last resort, rewrite the entire protocol

After you have read the interrogation protocol, you need to record it for yourself.

Don't remember! You will definitely forget something, interrogation is a stressful situation, do not rely on memory. Copy or photograph the protocol. If you were not allowed to do this, then you can safely just copy it onto a piece of paper or into your phone, this is your right.

In my experience, in 30% of cases repeated interrogations occur and in 100% the information from the protocol is verified with data from other sources.

Questioning a witness at the tax office

What is a tax interrogation?

When conducting tax audits, the inspectorate may use certain tax control measures. This includes interrogation. As a general rule, it is carried out on the premises of the tax office, and not on the territory of the taxpayer. Therefore, you cannot talk about any interrogation if the inspector asks you questions while in your office. It's just a conversation. Therefore, you have every right to refuse to answer his questions during such a conversation. A similar situation occurs in cases where they call you on the phone and, introducing themselves as an inspector, try to interrogate you. The Tax Code does not provide for such a form of interrogation as telephone conversations. As a result, you have every right to refuse to communicate on the phone with such a person and hang up.

Do not forget that in exceptional cases, interrogation may be conducted at the witness’s place of residence. These cases include illness, old age and disability, and therefore the witness is deprived of the opportunity to appear at the inspection. At the same time, at the discretion of the inspector, the interrogation may in other cases be carried out outside the tax office. Regardless of the location of the interrogation, tax officials must follow the procedure and procedure for recording the results of the interrogation. Without this, the interrogation turns into an ordinary conversation that has no legal force.

When can inspectors invite you for questioning?

Tax inspectors can question witnesses not only as part of tax audits, but also without these audits. If the interrogation takes place during a tax audit, then its type does not matter: desk or field. In addition, an invitation for questioning may come even if the audit is not carried out in relation to you or your company, but when your counterparty or his counterparty is being checked. Simply put, there are many cases where inspectors have the right to question witnesses. Sometimes tax officials may question witnesses before a tax audit begins. This is done in order to identify facts confirming the inspectors’ assumptions about possible violations of tax legislation by the taxpayer. In this regard, a reasonable question arises: can the results of such an interrogation, conducted outside the scope of the audit, be evidence in a tax dispute? There is no definite answer, because... courts look at this differently. According to some judges, it is impossible to refer to such interrogations to confirm a tax offense (resolution of the Volga District Court of February 13, 2017 in case No. A55-11768/2015). Other judges think differently. They believe that the interrogation record is appropriate evidence, regardless of whether it was carried out as part of the audit or not (resolution of the North-Western District Court of Justice dated January 25, 2019 in case No. A66-15990/2017, West Siberian District Court of Justice dated August 14, 2018 on case No. A27-23447/2017 and AS of the West Siberian District dated September 26, 2017 in case No. A27-19003/2016).

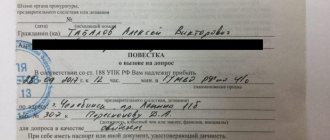

How do tax officials summon you for questioning?

Tax officials can call for questioning by sending a corresponding subpoena to the witness. Its form must correspond to the model approved by the letter of the Federal Tax Service of Russia dated January 15, 2019 No. ED-4-2/ [email protected] There is no other procedure for calling for questioning. Thus, inspectors cannot call you for questioning over the phone or by sending a letter in any form. The agenda must include:

- address, date and time of the interrogation;

- the name of the inspection calling for questioning;

- name of the company or full name of the person in respect of whom the inspection is interested in information that may be known to the witness;

- the name of the tax control event within the framework of which the need for interrogation arose.

Unfortunately, the law does not define the procedure for sending this subpoena. This means that tax authorities can also send it by email. However, uncertainty in the law allows a witness to ignore a subpoena if it is received in this way. A witness cannot be held accountable for failure to appear for questioning if the tax authorities do not have evidence of notifying him of the upcoming questioning. When sending a summons by email, it is impossible to prove that it is the witness's mail, and that it was he who opened the electronic mailbox, and that he is obliged to check it daily.

If inspectors decide to call a representative of the taxpayer to give explanations, they may send not a subpoena, but a notice of summoning the taxpayer to give explanations. Its form was approved by order of the Federal Tax Service of Russia dated 05/08/2015 No. ММВ-7-2/ [email protected]

Thus, a summons and notices are different documents for summoning for questioning. The fundamental difference between them is that a subpoena is sent to any person for questioning, while a notice is sent only to the taxpayer to provide explanations.

Who can be called in for questioning?

The law practically does not limit the circle of persons who can be questioned by tax officials. Any person who has or may have information valuable for a tax audit can act as an interrogated witness. In this case, it does not even matter whether he actually has the information that interests the inspectors. Only the assumption of the tax authorities is enough to call a person for questioning. Usually the manager, founder, chief accountant and other employees of the company, including former employees, are called in for questioning. During audits, the tax office systematically interrogates employees who are not middle and senior managers - engineers, technicians, loaders, builders, drivers, etc. The specific list of potential people who may be interviewed depends on the goals of the inspectors. For example, if inspectors want to check the reality of the work performed by a contractor, they can invite his manager, foreman and employees who may have performed the controversial work for questioning. That is, those people who can confirm or refute the inspectors’ assumptions will be interrogated.

Who cannot be questioned under any circumstances?

Tax officials do not have the right to interrogate people who, due to their young age, physical or mental condition, cannot correctly perceive circumstances. These people include children under the age of 14, the deaf, the blind and people with mental disabilities. In addition, people who have information necessary for inspectors due to their official duties cannot be interrogated. For example, lawyers, notaries, doctors, clergy, auditors. The listed persons, referring to paragraph 2 of Article 90 of the Tax Code, may refuse to testify during interrogation. This reason for refusal will be valid and will not entail negative consequences for the person. However, the law does not give you the right to determine whether you are a witness or not, or have “valuable” information or not. This is the right of the tax authorities. If you or your employee are called, then you need to appear. Even if, under the terms of paragraph 2 of Article 90 of the Tax Code, you cannot be questioned. You still need to come and, if there are grounds, referring to this provision of the law, inform the tax inspector that you cannot be questioned.

Why do tax officials call for questioning?

The purposes of calling for interrogation can be different - from finding out the details of a transaction with the taxpayer being audited, to searching for hidden tax offenses that a witness may accidentally mention during interrogation. Interrogation is one of the most important evidence that inspectors refer to when identifying a tax violation. As an example, let’s consider a situation where the inspectors have doubts about the reality of the goods delivered to the taxpayer. In this case, tax officials can question your warehouse workers, loaders, as well as drivers and the supplier’s manager. It will be difficult to refute the tax authorities’ arguments about the unreality of the delivery if during interrogation:

- warehouse employees and loaders will report that they did not see goods from the disputed supplier in the warehouse;

- the supplier's manager will report that he is a nominee director and does not actually participate in the life of his company;

- drivers will testify that they never delivered the supplier’s goods to your warehouse.

When considering tax disputes, courts pay considerable attention to the analysis of such interrogations. They willingly include them in court case materials as evidence. Therefore, you should not treat the interrogation as some kind of formal procedure that is not of fundamental importance for the tax audit.

If everything is clear with working employees, then the question arises: why does the inspector need testimony from fired employees? There are several reasons for this:

- the former employee most likely will not remember the details of the transaction of interest to the inspectors and will answer “I don’t remember” or “that didn’t happen.” In turn, tax authorities can interpret such an answer as follows: the employee did not confirm the reality of the transaction, which means it did not exist and the documents for this transaction are fictitious. And this is the basis for refusing to deduct VAT and accounting for expenses incurred in the transaction;

- the employee may be offended by his former employer, and therefore, during interrogation, he will tell about the facts of violation of tax laws known to him by the employer. This will help inspectors formulate additional claims against the taxpayer and increase the amount of arrears accrued to him.

What might they ask during interrogation?

Inspectors usually know what they want to find out from the witnesses they are questioning. That's why they prepare a list of questions in advance. Specific questions depend on the situation and circumstances of the tax audit. Although inspectors have the freedom to ask questions, there is a list of recommended questions. It was approved by letter of the Federal Tax Service of Russia dated July 13, 2017 No. ED-4-2/ [email protected] These questions are intended for cases when tax authorities want to find out the procedure for selecting and checking counterparties. At the same time, inspectors have complete freedom in the formulation of questions that they can ask during the interrogation of a witness.

All questions that can be addressed to the interrogated director can be divided into three categories:

1) Formal questions. In essence, these are general questions. As an example, the following standard questions for a manager can be cited:

- When did you join the company?

- What education do you have?

- Who appointed you to the position of manager?

- Who handled the registration of new employees?

- How many people work in your company?

- Name your main suppliers and customers.

- Who does accounting and tax accounting in your company?

- How does your company search for and select new suppliers?

2) Questions related to suspicious facts about the work of your company for inspectors. For example, tax officials may be interested in questions regarding a specific counterparty. Here are typical questions a manager might hear during an interrogation:

- Why did you choose this particular counterparty to conclude the transaction?

- Did you check him before signing a contract with him?

- Who in your company is responsible for selecting new contractors?

- Did you personally meet with a representative of the counterparty before concluding the transaction?

- What kind of relationship do you have with the manager of the counterparty: business or friendly?

- Have you personally visited your counterparty's office?

- Who in your company communicates with this counterparty regarding the execution of the terms of the contract?

3) The most critical questions. This category of questions relates to a specific transaction or supply in respect of which the tax authorities suspect a tax offense. If they have assumptions that illegal tax savings have occurred within the framework of a specific transaction, then the inspectors will definitely ask the director all the questions that interest them. Examples of such questions include the following:

- Who brought goods from the supplier to your warehouse?

- What transport was this product used to deliver to your company?

- Did the drivers who delivered the goods have powers of attorney issued by your supplier?

- Which of your employees checked the quality and completeness of supplies from the counterparty?

- What are the names and positions of the employees who unloaded the goods brought to you?

- Where in your company is the goods purchased from the supplier stored, and which employee was responsible for storage?

- Which of your employees is responsible for accounting and posting of this product?

Popular mistakes made by witnesses during tax interrogation.

1) Witnesses often mistakenly believe that they can refuse to answer any questions, citing Article 51 of the Constitution. She allows not to testify against herself and her relatives. There may be situations when the inspector asks the witness what his job is in the company. And the witness will refuse to answer the question, since this article of the Constitution allows this. It must be taken into account that refusal to testify about the work of the company is illegal. This is indicated in the appeal ruling of the Sverdlovsk Regional Court dated November 29, 2017 in case No. 33a-20436/2017. Also, a refusal to testify about the work duties performed by a witness may be considered unlawful (appeal ruling of the Nizhny Novgorod Regional Court dated December 27, 2017 in case No. 33A-15220/2017). Thus, one should not be mistaken about the universality of Article 51 of the Constitution, which will not help if the question asked by the inspector is not related to the identity of the witness.

2) Witnesses do not always check the credentials of the inspector who conducted the interrogation. Before starting, we recommend asking the relevant tax employee to present his official ID. The absence of such a document or refusal to present it in expanded form may indicate that this person lacks authority to conduct an interrogation.

3) During the interrogation, witnesses may begin to fantasize and independently come up with facts that they have forgotten or that they do not know. Such assumptions by a witness may negatively affect the conclusions of the tax authorities and the results of the entire audit. If the inspector finds out that the witness was making up answers to questions, then such a witness may be prosecuted for knowingly giving false testimony. Thus, when answering an interrogation, you must be guided by the facts known to the witness, and if the answer is not known, you should not invent it based on your assumptions and guesses. Such cases are possible when the job responsibilities of the witness being questioned do not include the circumstances that the tax authorities are asking about. For example, an accountant may be asked about the transport used by suppliers to deliver the disputed goods. In this case, the accountant, without actually working in the warehouse and not accepting goods, cannot know about these vehicles. However, in such situations the witness does not always answer that the circumstances are unknown to him. Instead, he begins to share his assumptions and ideas with the inspector.

Tips and recommendations for those who are planning to go to the tax office for questioning.

1) First, during the interrogation, the tax inspector asks the witness to present a passport in order to fill out the first page of the interrogation protocol, and some will also want to take a copy of the passport. However, only law enforcement agencies can check identification documents; tax officials do not have the right to demand a witness’s passport, much less make copies of it. They can fill out a protocol based on the information they have, and the witness has every right to refuse to present a passport to the inspector.

2) Then the tax authorities ask you to sign a paragraph stating that the witness is familiar with the responsibility for giving false testimony. The most interesting thing about this is that they usually don’t talk about responsibility. Therefore, you can write “not familiar” and sign.

3) It’s not worth answering questions in detail; inspectors won’t appreciate it. Since interrogation is usually carried out on cases of long ago, it is worth answering all questions with the following phrases: “I don’t remember, because it was a long time ago”, “I need to refresh my memory on this question”, “I will need to clarify this question” . You must also always remember that a witness has the right to refuse to answer some questions, citing Article 51 of the Constitution.

4) Tax officials also often like to obtain sample signatures from witnesses, but they do not have the right to do this. Again, due to the fact that the selection of signature samples is an operational investigative activity that tax authorities are not authorized to carry out.

5) During interrogation, tax officials can exert psychological pressure on a witness through threats, promises, intimidation, ambiguous wording of questions, and so on. In order to protect the witness from this influence and to ensure that the interrogation procedure complies with all legal requirements, it is advisable to ensure that an authorized representative of the witness is present at the interrogation. This fully complies with the provisions of part 1 of article 48 of the Constitution and paragraph 1 of article 26 of the Tax Code. The authority of the representative (lawyer or attorney) must be confirmed by a notarized power of attorney or attorney's order.

6) The results of the interrogation are documented in an appropriate protocol, the contents of which should be checked by the witness before signing. You should not treat this procedure formally and sign the protocol without checking its text. There are cases when tax officials record the witness’s answers in the protocol not verbatim, but by distorting them. In this regard, the meaning of the testimony may change significantly. Situations are possible in which the inspector’s question is spoken orally in one format, but the protocol contains a completely different wording that has nothing to do with the question asked of the witness. In addition, it is possible that the inspector made typos and other errors when drawing up the protocol. If these circumstances are identified, you must do one of the following:

- ask the tax authorities to reprint the protocol, correcting errors, or

- sign the protocol and write all your comments in it.

Thus, we recommend that before signing the protocol, you carefully read its contents and check the correctness of the questions and answers recorded in it.

7) During the interrogation, you can state the need to take a break or ask to reschedule it for another day. This can be justified by your poor health. If you are refused, you can ask the inspector to reflect this in the protocol. If the inspector refuses to do this, then you have the right to enter your comments into the protocol yourself. The wording of your comment in the protocol may be as follows: “The tax inspector ignored my request to interrupt the interrogation for 1 hour due to poor health, continuing to ask me questions.”

To prepare the head of the company for interrogation, you need to understand which counterparties are of interest to the tax authorities. This can be determined based on the inspectors’ requirements for the presentation of documents and explanations. After this, you will need to rehearse your answers to possible questions from inspectors. The ideal option is a situation where, when going for an interrogation, the manager knows in advance what questions he may be asked and what answers he needs to provide.

To prepare the head of the company for interrogation, you need to understand which counterparties are of interest to the tax authorities. This can be determined based on the inspectors’ requirements for the presentation of documents and explanations. After this, you will need to rehearse your answers to possible questions from inspectors. The ideal option is a situation where, when going for an interrogation, the manager knows in advance what questions he may be asked and what answers he needs to provide.

9) It is best to contact lawyers and advocates. They will help in analyzing the list of possible questions, preparing to answer them and accompanying the witness during interrogation. The presence of a lawyer or attorney at the interrogation can protect the company and its manager from problems associated with violation of the interrogation procedure and tax authorities putting pressure on the witness.

How long can the interrogation last?

The Tax Code says nothing about the duration of the interrogation. The timing of the interrogation is regulated by another document - the Criminal Procedure Code, according to which the interrogation cannot continuously last more than 4 hours. As a result of this uncertainty in the Tax Code, inspectors are not prohibited from conducting time-consuming interrogations lasting more than 4 hours.

What happens if you don't show up for questioning?

If you decide to ignore the invitation for questioning and do not come to the inspection, this may result in a fine. Its size is only 1,000 rubles. But if you come for questioning, but refuse to answer questions or give false answers, then the witness may also be fined. But in this situation the fine will be 3,000 rubles.

How is a tax inquiry processed?

After the witness answers the last question asked of him, the inspector begins to draw up a protocol of the interrogation. The protocol is drawn up in a special form, which is determined by order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected] From September 2021, tax authorities are required to provide the witness with a copy of such a protocol. Previously, they did not have such a duty.

How to challenge a tax interrogation protocol?

The protocol may be recognized by the court as inadequate evidence in a tax dispute if it contains certain violations. For example, when resolving a dispute, the court may not take into account the protocol if it lacks the following information:

- information about the inspector who conducted the interrogation;

- information about the place of interrogation;

- witness signature;

- a note that he has been warned of liability for refusing to testify.

Previously, courts recognized protocols as inadequate evidence if they contained formal violations (some details were missing or the protocol did not comply with the established form). But recently the approaches of judges have changed. Now they say that taxpayers need to study the content of the wording in the protocols, and not build a defense solely on misspellings in the last name or failure to indicate the exact address of the interrogation. Consequently, the content of minor formal errors in the protocol does not entail its automatic cancellation and recognition as inadequate evidence.

If you have any questions, you can contact us by phone: 8 926 84 88 777 (WhatsApp, Telegram)

Telegram channel “Taxes and Law”

And lastly

Interrogation by the tax office as a witness has nothing in common with interrogation by investigative authorities.

You cannot be detained. You can interrupt the interrogation at any time when there is a need and continue it another time or after a short break. You came to the tax office to fulfill your duty as a conscientious taxpayer - nothing more.

Just because you were called in for questioning, your rights did not become less or they were limited - no. Remember this, hold your position, and then you have every chance of passing the interrogation with minimal consequences.

I wish the readers of klerk.ru that the recommendations I give you will never be useful to you!

URGENTLY!

Hurry up to understand FSBU 5/2019 “Inventories” before you are fined . The easiest way is a short but complete advanced training course from accounting guru Sergei Vereshchagin

- Duration 25 hours for 1 month

- Your ID in the Rosobrnadzor register (FIS FRDO)

- We issue a certificate of advanced training

- The course complies with the professional standard “Accountant”

View full program

Should I go or not?

For an official, failure to appear for questioning is considered indirect evidence of a tax violation. And by the courts too.

For evasion of appearance or failure to appear without a good reason, Article 128 of the Tax Code provides for liability in the form of a fine of 1000 rubles. Wrongful refusal of a witness to testify or giving knowingly false testimony entails a fine of 3,000 rubles.

But the financial consequences can be much more significant. For example, failure to appear for questioning by the general director or chief accountant may serve as a formal basis for refusing a VAT refund based on the results of a desk audit.

Failure to appear for questioning may affect future judicial prospects - judicial authorities are critical of further claims and testimony of an official who ignored a summons for questioning to the tax office, believing that the questioning of a witness should take place at the pre-trial stage of the case.

Who can be summoned for questioning? Anyone. Any employee. And those who were fired too. More often, officials are called - the director and chief accountant. If the director is “nominal” and during the interrogation the inspector reveals this, the real owner of the business (beneficiary) will be invited for interrogation.

So should we go or not? Advice: go. As a law-abiding citizen, demonstrating confidence. Get ready and go for interrogation.

Are tax authorities required to provide a copy of the protocol?

From September 3, 2021, the tax authority is obliged to hand over a copy of the protocol to the witness in person against signature (Clause 6 of Article 90 of the Tax Code of the Russian Federation).

Moreover, we strongly recommend that you obtain a copy of the interrogation protocol. This is necessary so that the tax authority does not have the opportunity to correct any formal shortcomings after the end of the interrogation.

It is important to keep in mind that a copy of the protocol is given to the interrogated person, and not to the taxpayer being audited.

The tax authority often does not attach documents to the inspection report that confirm the legality of the taxpayer’s actions, referring to clause 3.1. Art. 100 of the Tax Code of the Russian Federation, which provides for the obligation of the tax authority to attach to the act only documents confirming facts of violations of tax legislation. And if the violation is not confirmed by the protocol, then it is not necessary to attach it to the inspection report.

That is why the taxpayer is interested in identifying all persons summoned for questioning as part of the audit in order to obtain from them copies of the interrogation protocols and refer to them as evidence of the economic feasibility of doing business.

Can I send a lawyer or a representative by proxy in my place for interrogation?

A witness has the right to use legal assistance when giving explanations as a witness, but not to replace himself with another person, including a representative by proxy. Interrogation of a representative (lawyer) instead of a witness is unacceptable, regardless of whether he has a power of attorney providing for such powers (decision of the Federal Tax Service of Russia dated April 11, 2018 No. SA-3-9 / [email protected] ).

At the same time, the Federal Tax Service of the Russian Federation does not deny that a lawyer has the right to make comments that must be included in the protocol or attached to the case. But the witness gives answers to questions during interrogation independently (letter of the Federal Tax Service of Russia dated October 30, 2012 No. AS-3-2 / [email protected] ).