Fraud in the Russian Federation is considered an economic crime provided for in Article 159 of the Criminal Code, which consists of appropriating someone else’s property (money, material rights) by misleading the victim or through deception.

Criminal cases for fraud are initiated upon the application of citizens, which are presented to the internal affairs bodies in person or on the official website of a law enforcement agency.

What to do if you become a victim of scammers

If a person understands that he has become a victim of fraud, he should not try to deal with the scammers on his own. Such actions may fall under articles of the Criminal or Administrative Codes and harm the victim herself. To punish fraudsters, it is necessary to contact law enforcement agencies as soon as possible.

Fraudsters operate according to different schemes and a single mechanism of action in the fight against them cannot be determined. However, if fraud is suspected, the victim is obliged to protect himself and collect as much evidence of fraud as possible:

Note!

- You cannot get rid of documents, checks, bank statements that have been received.

- All negotiations with scammers must be recorded and correspondence saved. If communication with crooks does not involve documentary evidence, it is necessary to attract witnesses.

- It is necessary to require from fraudsters documentation about the company, company, organization on behalf of the person they are acting on.

This data will serve as evidence and will help to recover the stolen amount from the scammers in court, as well as receive compensation for moral damage caused. If the fraud involves the transfer of personal data - bank accounts, cards, transfer of funds - you need to contact the bank as soon as possible to change passwords and increase protection.

Fraud is easier to prevent than to detect and prove. Therefore, it is important to be alert:

- do not trust unverified people and companies;

- collect maximum information about new business partners in open sources;

- demand documents confirming the authority of strangers introducing themselves as employees of the organization;

- all transfers of money must be documented;

- You cannot transfer personal data, information about passwords, codes, account numbers to third parties.

To prove the fact of fraud, the presence of stolen funds or property is not enough; it is important to identify the deliberate desire of one of the parties to deceive the other. If the scammers, through an invented promotion and further benefit for the client, took a certain amount from him and did not return it, the actions will be considered fraudulent if it is proven that the scammers did not initially intend to return the money taken.

In legislation, fraud is divided according to the severity of the crime, the presence of aggravating circumstances and types. Proven fraud may fall under both the Administrative and Criminal Codes. When causing damage in the amount of:

- up to 1000 rubles - faces forced community service for up to 50 hours or administrative arrest for up to 15 days, as well as a fine of five times the amount of damage, but not less than 1 thousand rubles;

- up to 2,500 rubles - a fine of at least 3 thousand rubles, arrest from 10 to 15 days, or work up to 120 hours.

If the funds were not stolen, but material damage was caused to the victim’s property, then these actions fall under Article 7.27.1 of the Code of Administrative Offences, which requires a fine of at least five thousand rubles.

If fraudsters have taken possession of property worth more than 2,500 rubles, their actions fall under Articles 159-159.6 of the Criminal Code, according to which fraud is theft or acquisition of the right to own property by deception or abuse of trust. Damage fraud:

- especially large – more than 20 million

- large – more than 3 million;

- significant - more than 10 thousand;

Depending on the amount of damage, fraud is punished:

- imprisonment for up to 2 years;

- restriction of freedom for up to 2 years or arrest for up to 4 months;

- compulsory labor, correctional labor, or forced labor;

- a fine of up to 120 thousand rubles or up to the annual income of the attacker.

Also, punishment and types of fraud in the Criminal Code are divided according to the status of the offenders:

- a group of persons;

- using professional authority;

- in the business sphere - deliberate failure to fulfill obligations under the contract.

The maximum punishment for such crimes is up to 10 years or a fine of up to 1 million rubles.

For an individual who has committed fraud in these areas of lending, insurance and others, the fine can be up to 120 thousand rubles, and if the crime is committed by conspiracy among a group of people and the damage exceeds 6 million, they face up to 10 years in prison.

Directorate “M” will fight against scammers in Moscow

At the height of the economic crisis, groups of fraudsters flourished in Moscow, so the headquarters of the capital’s police decided to send a new special unit to them. A department with the letter “M” is being created at the MUR, which will include all the former specialized departments of the criminal investigation department. Operatives will fight high-tech scams, fraud in the social and banking sectors, and in the real estate market. The department will recruit the best of the best: within two months, the internal security service and personnel officers of the Main Directorate of the Ministry of Internal Affairs for Moscow will sift through MUR operatives who want to serve in “M.” Life figured out what Department “M” was and what scammers it had to fight.

A Life source in the intelligence services said that a large-scale reorganization has begun at the Moscow Criminal Investigation Department. The former 4th Operational Investigation Unit (ORCh) will now become the backbone of a new unit - Directorate “M”. The ORCh operatives themselves now face an official “purgatory.”

— ORCh employees were removed from the staff, and those of them who showed themselves on the positive side were offered positions in the new department. Formally, the 4th ORCh will be reorganized into the 3rd and will be called Directorate “M,” a source told Life.

Operatives who have not received such an offer will have to find a job or transfer to other units of the Main Directorate of the Ministry of Internal Affairs in Moscow. They were given two months to do everything.

The new directorate will bring together all the Metropolitan Police units that have been fighting fraud. “M” will have departments for the main types of fraud: housing, financial, banking, social and high-tech.

“The exact number of departments and their names have not yet been finalized,” a source told Life.

As for the leadership of the new department, according to Life, it could be headed by the former deputy chief of police of the Altai Territory, Colonel Pyotr Shmera. Now he is the deputy head of the MUR.

The reason for creating a new department at the MUR was the situation with fraud in Moscow. In April 2021, Deputy Head of the Moscow Criminal Investigation Department Stanislav Tyapkin admitted that since the beginning of the year, more than 3 thousand different scams have already been registered. This is almost 20% more than in 2015. Fraudsters are thriving: in 2015 there were almost 20 thousand crimes. Compared to 2014, the growth was 32%. These are only those scams that investigators learned about from statements from victims.

The reason for the surge in scams is clear to criminal investigators - the economic crisis. People try to save on everything, which scammers take advantage of, trying to make money on their greed, gullibility and simplicity.

According to the observations of criminal investigators, almost half of the scams in Moscow are related to high technology - fake websites, online stores, mobile communications, free classifieds sites. On the latest sites, scammers committed about 1.5 thousand scams.

The most popular scams among scammers are performances with relatives in trouble, calls allegedly from the bank about blocking a card or suspicious debiting of money, removal of damage, treatment, assistance in solving problems with criminal cases and inspections, one of the criminal investigation detectives told Life.

Traditionally, people lose the most money in real estate scams. In 2015, almost 250 scams were registered in Moscow. This includes forgery of documents and sale and purchase of apartments through false relatives and heirs.

“Unfortunately, schemes for actually legal seizure of someone else’s home have become popular, when scammers first buy a share in an apartment and, on this basis, move in alcoholics, drug addicts or sick people who make the life of their neighbors unbearable,” one of the criminal investigation detectives told Life.

According to him, the matter ends with the neighbors being forced to buy out this share at an inflated price or run away from the apartment, selling their share at a huge discount. However, the capital’s police have learned to catch scammers by initiating cases under the article “Forcing a transaction.”

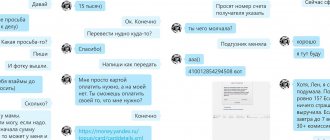

According to operatives, there are still many victims of telephone scams in Moscow. In 2015, more than 4.2 thousand were registered. This is traditionally done by pre-trial detention center prisoners and prisoners in colonies. To do this, they only need a mobile phone. Several calls are made using one SIM card, after which it is changed to another. Performances with supposedly relatives in trouble remain popular. The prisoners call the numbers in random order, and when they come across the voice of an elderly man, they introduce themselves as their son and ask for urgent help. For example, they say that he was detained with drugs, while committing another crime or an accident. The phone is handed over to the “investigator,” who asks from several thousand to tens and hundreds of thousands of rubles so as not to initiate a case. Money is transferred non-cash through payment systems.

Recently, scammers have been sending messages to mobile phones, allegedly from the Sberbank security service, stating that the client’s plastic card is blocked or an unauthorized debit has occurred. When a person calls them back, the scammers, under the guise of additional protection for the bank card, find out all the data and write off the money.

Fraudsters from websites of free advertisements for the sale of cars operate under similar schemes, using various schemes to force potential buyers or sellers to disclose bank card information.

Investigators say that in recent years, scammers have been stealing money or bank card data by creating clones of various online stores. Outwardly, they are similar to legal stores, but with different contact numbers and bank accounts. When a client selects and pays for a product, his money flows to the scammers.

Entire groups of scammers work on old people. For example, scammers find out the names and addresses of pensioners in clinics, find their phone numbers in databases, after which they call them and pretend to be doctors. The old people are told that the results of their tests have allegedly arrived and they have been given a terrible diagnosis. After which they offer to transfer money to expensive medicines.

This same contingent is hunted by psychics and sorcerers. They call potential clients and offer them to buy protective amulets or potions.

In another case, swindlers under the guise of representatives of the Moscow mayor's office or the Russian Government contact war veterans and say that the government has decided to pay 2 million rubles to all people born during wartime. To receive this money, you must pay income tax by transferring it to a special account.

Moscow has always been an attractive city for migrants, which scammers also take advantage of. Under the guise of fake employment firms or real estate agencies, they advertise in the regions. Migrants pay them money for non-existent apartments and jobs.

How to write an application correctly

Applications to all law enforcement agencies may be written by hand and in free form. However, it should be taken into account that the writing language must correspond to business style, be understandable, and the phrases must be clearly formulated. It is necessary to avoid swearing - the police have the right not to consider applications containing obscene language and insults. Anonymous requests are also not accepted. It is necessary to indicate the correct and full name of the body to which the citizen is applying. The presentation of the case should be in chronological order.

The application must contain:

- “hat” - in the upper right corner the exact name of the police department and the details of the applicant are indicated: full name, registration address, contacts;

- title – application to initiate a criminal case;

- “body” - the essence of what happened is stated in chronological order. Be sure to indicate: the date and place of the incident, the exact amount of theft, known information about the criminals;

- request - you need to make a specific statement: begin investigative actions on the stated facts, find and punish the perpetrators, find out the circumstances, and so on;

- list of documents and other evidence - all copies of available documentary evidence, recordings of negotiations, correspondence and other possible evidence are attached to the application;

- witnesses - if the victim can indicate his full name. witness to a crime;

- the applicant indicates that he is familiar with Article 306 of the Criminal Code of the Russian Federation - provision of false information and liability for this;

- date and signature.

To make it easier, you can fill out a ready-made application form; the form can be taken directly upon application.

When should you file a fraud report?

Every year new schemes and types of fraudulent actions appear, as a result of which victims are left without their property. Fraudsters are some of the most highly educated criminals among all representatives of the criminal world. These are people with higher education who are well versed in laws, finance and human psychology.

This category of criminals does not have moral principles; they are driven only by greed. Such people know how to inspire trust, evoke pity, transform into different characters and quickly respond to changing external circumstances.

The main scams of scammers are:

- Requests to transfer funds to someone else’s phone or bank card, veiled under the guise of helping a sick person;

- Collection of funds for personal enrichment under the guise of charity;

- Impersonating a government service representative, a medical or social worker, an employee of a housing organization or a pension fund for the purpose of defrauding money;

- Deception of citizens for the purpose of census in the name of a real estate fraudster;

- Drawing citizens into sects and financial pyramids to enrich a criminal company;

- Selling goods from unofficial sites that are credited with healing properties (sites with magical amulets, rings, bracelets) or providing expensive magical services.

There are frequent cases when funds disappear from citizens’ bank cards. You should not delay contacting the police if:

- you were deliberately informed about the occurrence of dangerous circumstances for you or your relatives and as a result you transferred money to the criminal;

- they borrowed a large amount of money from you and are not going to pay it back;

- an unfavorable agreement was concluded with you - at the time of registration of cooperation you were not informed of important terms of the transaction, unfavorable circumstances were hidden (purchase of an apartment with an encumbrance, with registered persons, etc.);

- you ordered and paid for an item you don’t need online and now you can’t return it;

- under the influence of deception, you registered strangers and other schemes in the apartment.

Most often, criminals provide false information about their first and last name, place of residence, position and hide the true purpose of communicating with the victim.

Filing a police report

To submit an application, you must contact the police department at the place of residence or where the crime was committed. If the applicant made a mistake with the jurisdiction, the police will independently forward the submitted application to the correct department. Citizens' appeals are registered, and the applicant is given a receipt receipt with an incoming registration number. The document may be needed if you contact the prosecutor's office or court regarding an unreasonable refusal to initiate a criminal case.

Note!

In addition to the police, any citizen can contact the prosecutor's office to protect their rights. However, it should be borne in mind that it is the police who conduct the investigation. And if you first contact the prosecutor’s office, then they have the right to transfer the case to the Ministry of Internal Affairs for investigation.

The police are given 3 days to consider an application from a citizen, and in more complex cases the period can be increased to 10 days. If law enforcement officers find elements of a crime in the actions specified in the application, then a decision is made to initiate a criminal case and an investigator is appointed.

"STARLEYA UCHAYEVA" ERROR

My phone rang. Who's speaking? Fraudster. I understood this from the very first sentence:

— They are bothering you from the main directorate of the Russian Ministry of Internal Affairs. Senior Lieutenant Elena Nikolaevna Uchaeva.

Sounds serious. There’s just one problem: there’s no such thing as “from management.” There should be management either by territory, by region, or by professional area - on migration issues, for example. Therefore, I’ll clarify:

- What management?

“Federal,” the lady says confidently.

- Where are you? - I don’t let up.

“In Moscow, on Petrovka, 38,” my interlocutor demonstrates her erudition.

Another problem. On Petrovka, 38 there is not a “federal”, but the main department of the Ministry of Internal Affairs for Moscow.

Okay, let's not interrupt, let's listen further - the girl either doesn't understand that she's been exposed, or she's just going ahead, in the hope that, perhaps, she'll burn out.

“We received a signal from the security service of the Central Bank that an attempt was recorded to withdraw a large amount from your single personal account,” the “Starley Uchaev” reports the main news.

Filing an application to court

A deceived citizen can file a lawsuit to recover damages. But if we are talking about damage caused as a result of fraud, the application should be filed between the initiation of a criminal case and until the court leaves to make a decision. In this case, the plaintiff is exempt from paying state duty.

The court's decision on the claim may be made together with the sentence for the accused fraudster, or taken into separate proceedings. A claim can be filed after the end of the case if the fraudster was found guilty. It will not be possible to file a claim against the fraudster in advance, since until the court has rendered a verdict, his guilt has not been established.

The victim of fraud has the right to participate in the proceedings, present evidence, read court records that affect his case, speak in his own defense, engage lawyers to do so, and appeal the verdict according to the law. In addition, during the judicial investigation, you can apply to the court with a petition to protect property if it may suffer from the illegal actions of swindlers. For example, a car may be seized so that it cannot be sold to third parties.

The claim is filed on a standard form, which can be taken directly to the court. The standards for drawing up an application are established in Article 131 of the Code of Civil Procedure of the Russian Federation. It states:

- details of the plaintiff and defendant;

- the completed form already contains the full name of the court; if the claim is written independently, then this information must be clarified;

- the essence of the requirements and what happened;

- amount of the claim - how much the plaintiff demands to recover from the defendant;

- list of applications.

Depending on the punishment imposed by the court for fraud, the statute of limitations for victims varies - that is, the time during which they have the right to recover compensation through the court. The minimum statute of limitations is 2 years from the moment of committing fraudulent acts; in the presence of aggravating circumstances, the period can be increased to 6 and 10 years.

THE LATEST FRAUDULENT FASHION

This is the latest in fraudulent fashion. The way scammers usually operate is to surprise you with the news that someone is trying to withdraw money from your account. Many people do not even specify which bank - they simply believe, stunned by the sudden news. Next comes skillful solicitation of the card number and 3-digit CCTV code, or no less skillful persuasion to transfer money to a secure reserve account. Well, that's it - bye bye, money.

This performance was a great success six months ago. But after the media and banks began to actively expose scammers and tell people about the need to remain vigilant, it became harder for scammers.

— From which bank account do they want to withdraw money from me? - potential victims are interested.

The scammers answer at random about Sberbank - it is the largest financial institution, there is a high probability of getting hit. But many, including pensioners, keep money in other credit institutions and the reception does not work. Therefore, scammers came up with a new trick.

As “Senior Lieutenant Uchaeva” explained to me, a “single personal account” has been opened for each depositor at the Central Bank.

“All transactions with your money are carried out through it, regardless of which bank you have an account in - everything flows into the Central Bank, that’s how the operating system is designed,” “Uchaeva” began to talk, using professional terms. — And it’s more convenient for us, we don’t have to track every bank (sounds convincing). You don’t even know the number of this account, you don’t need it, but it is reflected by the operator.

- How much did they want to steal from me? - I’m interested.

- 50 thousand! — the interlocutor’s voice is filled with compassion.

Gullible pensioners are the favorite “clients” of telephone scammers. But it happens that the younger generation also falls for them.

Photo: Shutterstock

“TRANSFER MONEY TO A SECURED ACCOUNT”

Frankly, I expected to hear a more substantial figure. But I had to finish the episode and I exclaimed:

- What to do?!

And then it turned out that the scammers had one more know-how in store.

“You need to come to us at Petrovka, 38 and write a statement about attempted theft and about transferring money to a protected account,” “Uchaeva” explained to me. — This will be your personalized personal account with the latest hacking protection system. How are you doing with time?

It would seem, what does time have to do with it? And it matters!

- I’ll give you an appointment at 13 o’clock, but you come at 11, we have a very long queue at the pass office. And at the office you will also have to wait, I think, until 15 o’clock. And the registration will take another hour - you will need to write an application, open a case, then write an application to transfer money to a protected account. I will endorse him and you will need to go with him to the Central Bank and personally confirm there that you want to open a protected account and transfer money there. I’m not sure that you can do it all in one day, that’s why I’m asking how you manage your time.

What's the alternative?

“I can dictate the account number and you will transfer the money there,” the interlocutor suggested. - Do you have anything to write down?

This is the moment of truth. The scammer is counting on the fact that the interlocutor, lulled by the conversation, will be stunned by the prospect of spending the whole day in queues and offices and will most likely choose the option of sending money to a dictated account. Believe it and you will never see your money.

“No, let me better come to Petrovka myself,” I “changed my mind.” - Which office are you in?

“Room 213, on the second floor,” Nechaeva said and hung up.

Of course, I didn't go anywhere. And not a penny was lost from my accounts.