Is it possible and how to withdraw money? Where can I cash out maternity capital? How to do this before and after the child’s third birthday? Yuri Kapshtyk answers questions about the possibilities of withdrawing funds for family needs .

The maternity capital program has been operating in Russia since 2007, and this year it has undergone changes. Starting from 2020, money is allocated to young families at the birth of the first baby; this amount is 483,881 thousand rubles. For the birth of the second they give 639,431 thousand rubles, for the third and subsequent ones - the same, for a total of 616 thousand rubles.

Maternity capital is not provided for the birth of every child. This amount is paid to the family once, so if you have already received and used maternity capital before 2020, you will not be able to apply for it again.

The conditions for obtaining a certificate have been simplified. Starting this year, a young mother does not need to submit documents to the Pension Fund of the Russian Federation. Information about the birth of the baby will be sent there by the registry office staff, the certificate will be issued automatically, and the money will be deposited into the woman’s individual account. These funds can be used for strictly established legal purposes:

- improve living conditions;

- pay for the education of children: not only the child at whose birth the payment was made, but also other children in the family;

- provide a disabled child with means of rehabilitation and adaptation.

But is it possible to cash out maternity capital if the family needs money for other purposes?

“There are no legal ways to cash out maternity capital,” notes lawyer Yuri Kapshtyk. “This is not tolerated in any form.”

Maternal capital

Family capital is material support for families raising two or more children.

Receiving this assistance is possible only if there is no other financial support for the family from the state. It has been provided since 2007 to all parents with Russian citizenship.

Previously, parents could receive some of the money in cash, up to 20 thousand rubles, for example, for compensation for building a house. In 2020, this rule does not apply.

The government does not give cash to parents. They receive only a special certificate, which is submitted to the Pension Fund, then all payments are made by bank transfer.

The following have the right to receive maternity capital:

- women who have Russian citizenship and have given birth to two or more children;

- men who have Russian citizenship and have adopted two or more children;

- father, if the children’s mother was deprived of parental rights or she died;

- parents of a minor child or an adult, if he is studying full-time at a higher educational institution, in the absence of support from the state.

This material support is targeted and intended for:

- improving living conditions in the form of purchasing new real estate or renovation;

- construction of a new house;

- repaying a mortgage loan.

Matkapital will help if banks refuse to issue a loan to families for an apartment due to insufficient income or lack of funds for a down payment.

With this money you can pay for:

- down payment when buying a house or apartment on credit;

- mortgage debt and interest;

- a one-time purchase of real estate, adding your own money if necessary.

Funds can go towards children's needs, such as education or health care. By the way, maternity capital can be spent on any child in the family, namely:

- for the services of a kindergarten or other institutions;

- for educational services;

- accommodation during training.

The amount of capital is indexed every year; since 2007, its value has increased from 250 thousand rubles to 453 thousand rubles.

Since this amount is quite impressive, there is a temptation to come up with various methods of fraud.

What is maternity capital fraud?

All young parents who are citizens of the Russian Federation know about this state program. Its essence is that the state pays the family a certain amount of money after the birth of the second child. It is constantly indexed. In 2021, this amount exceeded 400 thousand rubles.

The peculiarity of this social program is that parents can spend these funds only either on the needs of the child or on improving the living conditions of the family. Most often, parents prefer to buy real estate with this money. As for the needs of children, this means health improvement, education and other targeted spending. In this case, you can use maternity capital for any child in the family.

Funds provided by the state are not given to parents immediately, much less in cash. There is a special document - a certificate, which, if necessary, the owner submits to the Pension Fund. All payments with maternity capital are carried out non-cash.

Previously, in some cases, the family could receive part of the money in cash. In emergency cases, 20 thousand rubles were given. Parents can also receive cash as compensation for building a house. Now this norm does not apply.

Despite the fact that the state observes all measures to preserve funds and controls their spending, cases of fraud with maternity capital are often recorded. Certificate holders try to deceive the state, unaware of real criminal liability.

The legislative framework

The provision of maternity capital is carried out on the basis of Law No. 256 of December 29, 2009. As for liability for fraud, it occurs in accordance with the Criminal Code of the Russian Federation (Article 159).

What are maternity capital allowed to be spent on?

This type of government support is considered targeted, and money can only be spent on the following needs:

- Mortgage loan repayment.

- Improving living conditions in the form of repairs or purchasing real estate.

- Home construction.

- Accommodation for the child during training.

- Payment for educational services.

- Fee for visiting kindergarten and other institutions.

This list is incomplete, it is so extensive that everyone who is not too lazy is looking for any way to commit fraud with maternity capital.

Incentive to break the law

Is it possible to cash out mat capital? Is it legal to cash out mat capital?

The state attaches special importance to the issues of permitted use of subsidies. At the same time, the options where you can use the money received from the budget are not numerous.

Parents, according to Federal Law 256, are allowed to:

- use the money received to purchase or build new housing;

- invest in renovation of existing residential premises;

- spend capital on children's education;

- turn it into mom's retirement savings;

- used for rehabilitation or social adaptation of a disabled child.

Many subsidy owners believe that the state overly restricts them, depriving them of the opportunity to independently decide where to invest funds so that the money brings real benefits to the family.

The main arguments against bans:

- The amount of capital is not large enough to limit its use. If parents do not have personal savings, it is almost impossible to buy quality housing with a subsidy, even in remote regions.

- Education and retirement expenses assume some future family support. Whereas it is necessary at the current moment, while children are small and require significant expenses for their maintenance.

- In addition to strictly defined areas of spending, a special receipt scheme has been developed for the subsidy, introducing bureaucratic red tape into the process.

In an effort to avoid the possibility of recipients spending funds for other purposes, money is not given to the family in cash.

Pension Fund:

- keeps the due budget money at home;

- strictly controls where parents intend to apply the subsidy;

- has the right to approve or prohibit payment if the conditions do not comply with the law or raise suspicions of fraud.

Cunning citizens, even with existing legal restrictions, manage to find an opportunity to cash out family capital. For scammers, an amount of almost half a million rubles is a “tidbit.”

Fraud schemes

Certificate holders are trying to deceive the state through various frauds, unaware of criminal penalties. Due to improper spending of social support, the damage to the state amounts to hundreds of millions of rubles.

Fraud may consist in the fact that a citizen knowingly:

- registers someone else's child in his name;

- provides false information about himself or his children;

- hides that he was deprived of parental rights.

The list of ways to implement this manual is quite large, which has led to a large number of fraud methods.

The most common include:

- mortgage;

- its receipt by entities that do not have rights to maternity capital;

- cashing out funds;

- malfeasance.

The use of these methods of fraud is punishable by current legislation in the Russian Federation. You should not try to deceive the state, since the judicial practice on this issue is quite extensive; punishment for such a violation of the law cannot be avoided.

All kinds of schemes for obtaining money from capital are complex and confusing, designed for a high level of corruption in the state and the lack of verification of this type of transactions.

In 2007 alone, more than a dozen scammers were exposed who were trying to illegally implement this social support in various ways. So, let's look at them in more detail.

Cashing out funds

These schemes are practiced both by certificate holders themselves and by outsiders. In the case when the mother independently decides to illegally seize money, the following scheme is usually used: a contract for the sale and purchase of their home, both in full and in part, is concluded with close relatives (often with whom the young parents live). Often the price for an apartment is indicated equal to the size of the family capital.

Also read: Where to contact in case of fraud

Then all documents are transferred to the Pension Fund, which transfers money to the seller’s account. He, after receiving the funds, withdraws them and transfers them to the owner of the certificate.

In fact, after the transaction, the seller remains to live in the apartment or house purchased with social benefits. There is no improvement in the family's living conditions. This is an inappropriate use of maternal capital funds.

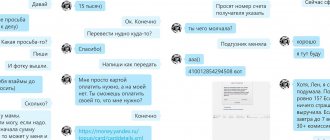

Currently, you can find many advertisements posted in public places or posted on the Internet offering assistance in cashing out maternity capital. These can be both legal entities (for example, real estate agencies) and individual specialists working as individual entrepreneurs.

Various methods of cashing out funds are being developed, where the role of the certificate owner is minimal. For example, he hands over a document to scammers, issues a power of attorney for them and receives a certain amount. As a rule, it is only 20-30 percent of the size of the capital.

It may also be possible to provide for the mother’s participation in submitting documents to the Pension Fund and her signing the transaction papers. In most cases, the scheme for cashing out funds is as follows: unsuitable housing is selected (dilapidated houses, apartments in an old building) or a small share in the right to real estate. After this, a purchase and sale agreement is concluded. The price is often stated equal to the cost of maternal capital. However, it turns out to be prohibitively overestimated. As an example, in fact, the real market valuation is 50,000 rubles, but according to documents, it was purchased for an amount of over 400,000 rubles.

After the Pension Fund transfers money to the seller’s account, the amount is withdrawn. It is then distributed between the intermediaries and the certificate owner. As a result, the family’s living conditions do not improve, since it is impossible to stay in the purchased houses and apartments.

Buying a house

You can obtain maternity capital by purchasing a dilapidated house, unsuitable for housing, at an inflated price.

According to documents, the building may be in satisfactory condition, although the house may be fictitious and even destroyed by fire.

Then the real price of housing is subtracted from the market value, and the capital is transferred to the parents.

This method can be dangerous because it is carried out by dummies. The money is transferred to their account by non-cash means, after which the scammers simply disappear.

Defrauded citizens usually avoid contacting the police, as they themselves may be charged for fraudulent activities.

Fictitious transactions and fraud when buying a house with maternity capital are a violation of the law, for which criminal penalties are established.

Not all creditor banks agree to work with maternity capital due to economic instability. Only a few dozen organizations agree to issue a loan against a certificate or pay a mortgage on an apartment.

The Pension Fund also does not always accommodate young parents, especially for the reconstruction or construction of a house.

A transaction involving the purchase of housing is considered legal if the building is given the status of a full-fledged residential building, and the house itself:

- not dilapidated or in disrepair;

- suitable for permanent residence (equipped with all amenities and communications);

- has an individual address;

- has documents of residential construction;

- you can register there.

The Pension Fund considers the basic requirements for housing that parents want to buy with maternity capital:

- the house must have housing construction status;

- located on the territory of the Russian Federation;

- availability of water supply, sewerage, heating and electricity systems;

- wear no more than 50%.

The law prohibits the purchase of a house in disrepair with family capital. Also a necessary condition for obtaining permission to purchase is the land plot where the residential building is located. Land must be purchased or leased.

Buying an apartment from relatives

The safest way is to commit fraud when buying an apartment with maternity capital with the involvement of your own relatives. In this case, the contract itself is drawn up as expected, but the previous owner continues to live in his apartment.

The pension fund transfers the money to the account of a fictitious seller, who cashes it out and transfers it to the person who registered the maternity capital. In most cases, such schemes are not disclosed by law enforcement agencies.

The law does not prohibit buying apartments from relatives, but imaginary transactions are prohibited.

They can be identified by the following characteristics:

- the seller has not checked out of his home;

- the parties to the transaction are spouses;

- the buyer registered the property as joint ownership of all family members, including the seller.

Obtaining a certificate by persons who do not have the right to do so

As a rule, two situations serve as examples of these cases. In the first case, a woman who has not given birth to a second child applies to the Pension Fund to receive a payment. At the same time, all necessary certificates and certificates are presented.

The second case is the receipt of a certificate by persons whom the court has deprived of their parental rights or limited in them. According to the law, they are not entitled to social benefits. But these citizens hide this fact from the Pension Fund, illegally receiving maternity capital.

Subsequently, an illegally obtained certificate can be cashed. It is also possible that the payment funds will be used strictly in the areas listed in the law. But despite this, actions to illegally issue a document are a crime.

Schemes involving officials

Officials of government agencies do not often take part in illegal schemes, but such situations do exist. These could be Pension Fund employees who “turn a blind eye” to obvious falsifications of submitted documents for a certain fee. Sometimes bank employees whose powers include approving loans take part.

There are cases of illegal activities of doctors (gynecologists and pediatricians). These persons issue fictitious certificates about pregnancy and the birth of a child. Based on them, the registry office subsequently issues certificates for non-existent children.

No matter what schemes are used, if maternity capital is illegally cashed out, the perpetrators will be prosecuted. Any use of the payment for purposes not listed in the regulation is a crime.

Mortgages and home loans

The scheme for cashing out family capital through mortgage or loan agreements is also widespread. There are possible ways for certificate holders to receive money independently or with the involvement of relevant organizations. When implementing this scheme independently, the recipient of the payment negotiates with relatives or close persons who own suitable housing. After this, an agreement is concluded on obtaining a loan and purchase and sale using maternal capital funds. Documents are provided to the Pension Fund.

After transferring the money to the seller’s account, he transfers it to the owner of the certificate, who repays the loan taken out ahead of schedule, and keeps the amount of maternity capital for himself. There are only interest costs for the mortgage during the registration period. In fact, there is no improvement in the family's living conditions.

This scheme is also being implemented by many organizations specially opened for this purpose, including microfinance ones. They offer to conclude housing loan agreements, also with installments, using funds using a certificate. As a result, unsuitable properties for living are purchased, or small shares in the right to them.

Also read: Criminal liability under Article 159 Part 3

The funds received from the Pension Fund are divided between the organization and the owner of the certificate. Sometimes the latter can receive a very small amount.

Workers at such agencies deliberately seek out families from disadvantaged backgrounds. These are people with alcohol and drug addiction, or those in difficult financial situations. Such people are ready to give up their certificate for real money and sign all the necessary documents for a very small remuneration, ten times less than the payment required by law.

Where to go for help

If fraud was committed to obtain money based on maternity capital, then both the owner and his accomplices bear responsibility. If a citizen has information regarding a scam involving payments for children, he can:

- Go to court to invalidate the transaction. We are talking about fictitious transactions that the parties enter into to cash out funds.

- Write a statement to the police. It should include all information available on the case.

After the court recognizes the transaction as fictitious, all case materials can be transferred to law enforcement agencies for further proceedings. If the police can prove that these persons committed illegal acts and took possession of someone else's property through deception, they will be subject to criminal penalties. It provides:

- Prison term. Maximum imprisonment, in accordance with Art. 159 (part 2) of the Criminal Code of the Russian Federation is 10 years. This term may be awarded if fraudulent actions were committed by a group of persons or a particularly large amount of damage was caused as a result of the crime.

- Fine. Its size depends on the amount of government money stolen by fraud.

It is imperative to contact law enforcement agencies if you have been deceived by fraudsters or if you are suspected of committing illegal actions.

How to use money from the certificate?

It all depends on what purposes you plan to spend maternity capital. In short, in most cases you need to fill out an application for disposal of maternity capital funds, but each situation has its own conditions:

- improvement of living conditions: the easiest way is to use capital for a mortgage, then you can fill out an application directly at the bank. If you plan to buy a home without a loan or build it, you need to write an application to the Pension Fund; this can be done through the MFC or your personal account on the department’s website. In each case, you need to attach a certain package of documents - for example, a purchase and sale agreement, an extract from the Unified State Register of Real Estate, an equity participation agreement, documents for the plot, etc.;

Important:after the housing becomes the property of the family, shares in it must be allocated to all family members (that is, both parents and all children). The law does not stipulate what shares these will be.

- child’s education: you need to write an application to the Pension Fund for the disposal of maternity capital funds and attach to it a certified copy of the agreement for the provision of paid educational services;

- monthly payment for the second child: you need to submit an application to the Pension Fund (by any means), all necessary data, including information on family income, is collected by the Pension Fund independently;

- mother's funded pension: one application to the Pension Fund is enough (and this decision can also be withdrawn upon application);

- means of social rehabilitation of a disabled child: you need to submit an application to the Pension Fund of the Russian Federation, attaching a rehabilitation program, documents for the purchased funds, as well as a certificate of conformity of the goods.

In any option, you can manage your maternity capital without leaving your home - through State Services or your personal account on the website of the Russian Pension Fund.

Penalty for cashing a certificate

Article 159.2 of the Criminal Code of the Russian Federation establishes sanctions for cashing out maternity capital. This composition relates to fraud with social benefits. The case is initiated if facts of illegal use of the due amounts are revealed. This can happen even several years after receiving money under the certificate. These circumstances are revealed as a result of inspections by the Pension Fund, the prosecutor's office or based on statements from interested parties.

The preliminary investigation authorities must prove the participation and role of each person in the illegal receipt of money. The court makes a verdict and imposes punishment. The Criminal Code of the Russian Federation provides for the following types:

- Fine. Its specific amount is established by the court, ranging from 100,000 to 500,000 rubles.

- Forced labor for up to five years. The convict is sent to special places of detention where he will live and work.

- Imprisonment for up to six years. An additional fine of up to 80,000 rubles may also be imposed.

If a crime is committed by an organized group, the perpetrators are sentenced to up to ten years in prison.

An additional fine of up to 1,000,000 rubles is imposed. Consequently, the responsibility for cashing out maternity capital funds is quite serious. Under certain circumstances, fraudsters may be sentenced to actual imprisonment. In addition, they will be required to return all funds received to the budget.

Responsibility

Spending of government funds is controlled very strictly. Maternity capital can be invested only according to the rules described in Law No. 256. Everything is regulated in its text. Based on the articles of the normative act, we can highlight what cannot be done:

- submit documents to the Pension Fund: with knowingly false information;

- counterfeit;

- fake;

- do not comply with the norms of the Housing Code (the law describes which spaces are recognized as residential);

Any violation of the law entails liability. Moreover, when analyzing the case, the following facts become clear:

- participants in the illegal act (the certificate holder himself, officials, owners of companies involved in cashing);

- the degree of guilt of each;

- corpus delicti (fraud, production of a forged document, involvement in fraud with real estate and government funds, etc.).

For information: documents submitted along with the order to send maternity capital funds are checked by the Pension Fund. However, the success of this does not protect criminals from additional review of documentation, for example, by prosecutors.

What is the penalty for fraud with state aid?

Chapter 10 of the Criminal Code provides rules for sentencing for a criminal offense. These are appointed based on the totality of guilt, taking into account all the circumstances of the case. Consequently, the specific punishment will depend on how the court qualifies the act:

- According to Article 159 of the Criminal Code, for large-scale fraud, a citizen faces: a fine of up to five hundred thousand rubles;

- forced labor for up to five years;

- imprisonment for up to six years with a fine of up to 80 thousand rubles.

- fine up to five hundred thousand rubles;

For information: fraudsters who involve citizens in criminal activities face up to 10 years in prison.

A fine of 1 million rubles is also provided for such persons. Download for viewing and printing: Chapter 10 of the Criminal Code of the Russian Federation dated 06/13/1996 N 63-FZ (as amended on 02/19/2018)

Article 159 of the Criminal Code of the Russian Federation dated June 13, 1996 N 63-FZ (as amended on February 19, 2018)

Article 291 of the Criminal Code of the Russian Federation dated June 13, 1996 N 63-FZ (as amended on February 19, 2018)

Malfeasance

To date, fraudulent transactions involving officials continue to be carried out. In most cases, officials and pension fund employees participate in falsifying documents for a fairly large percentage.

Such scams are possible because the mother capital certificate represents a depositary receipt, and if you have certain contacts, you can easily cash out money through officials. But for this, several officials at once must be corrupt.

The most frequently used scheme is the registration of maternity capital for the construction of a house. The Pension Fund usually already has concluded agreements with construction companies, and the money is transferred to their account.

Next, fake cash and sales receipts are generated for the purchase of materials and construction work. The funds are then cashed out in various ways.

Even if the bribe was transferred through an intermediary, the recipient of the certificate will also be punished, and it is quite serious for this crime, since there is a preliminary conspiracy and intent here.

How to get a certificate

The Russian Pension Fund is responsible for issuing certificates and organizing the entire process, but from 2021 this is no longer so important. If previously the mother had to personally contact the Pension Fund office and receive a paper certificate there, now everything is extremely simplified:

- after the birth of a child, this fact is registered in the registry office;

- The civil registry office sends data about this to the Pension Fund through its system;

- The Pension Fund of Russia, having received the data (including SNILS), issues a certificate within 15 calendar days;

- the parent will receive a certificate in the user’s personal account on the State Services portal.

Only if for some reason the certificate was not issued without application

, the mother should contact the Pension Fund with an application. This can be done directly at the State Services by filling out a simple form (you only need to enter information about the child), or by contacting the Pension Fund or MFC in person.

In addition, maternity capital certificates have already been converted into electronic document format

. That is, what will come to your personal account at State Services is a certificate.

Arbitrage practice

Let's look at examples from judicial practice. Currently, many citizens have been convicted for cashing the certificate. For some sentences, real terms of serving the sentence in a colony were assigned.

- Members of an organized group were convicted in the Republic of Tatarstan. A scheme was developed in which Roma women, using fictitious certificates issued by gynecologists and pediatricians, received documents for unborn children. Subsequently, a certificate was issued, which the scammers then cashed in by purchasing dilapidated housing.

- Citizen Tyrnova was found guilty under Art. 159.2 of the Criminal Code. It was established that she, as the holder of the certificate for maternal capital, signed a contract for the sale and purchase of her mother-in-law’s apartment. At the same time, the seller remained living in this premises. A family with two children did not move into the purchased living space.

The court concluded that this transaction was concluded solely for the purpose of illegally obtaining maternity capital money. Tyrnova was sentenced to pay a fine of 100,000 rubles. All funds listed under the certificate were also collected from her.

- The court sentenced the founders and employees of the LLC who cashed out the capital. Through advertising, certificate holders were invited to receive cash.

The court found that the following scheme was implemented: citizen Ivanova handed over her certificate and issued a power of attorney to the employee of the LLC. Subsequently, a house in the village was purchased in her name. An examination of the case determined that it was not suitable for habitation and was in disrepair. The market value is 70,000 rubles, but the contract indicates a price of 350,000 rubles. The founders and employees of the LLC were sentenced to real terms of imprisonment. Those who handed over the certificates received fines.

The state issues a certificate for a large amount to women who give birth to a second child. It can be spent exclusively for the purposes specified in the law. Any cashing of these funds is a crime. The activities of organizations offering their services for processing and issuing money are illegal.

When using fraudulent schemes to obtain money for maternity capital from the budget, the perpetrators will be prosecuted and sentenced to punishment. Depending on the degree of guilt, sanctions can range from a fine to actual imprisonment. In addition, it will be necessary to compensate the state for everything listed under the certificate.

Additional questions

For what actions can you also be held accountable?

In addition to attempts to obtain cash from maternity capital fraudulently, liability under the law also arises for other persons. Namely those who try:

- It is illegal to qualify for this subsidy.

- Forge documents related to it.

- Bribe officials to obtain subsidies.

Also read: What is business fraud?

In the judicial practice of fraud with maternity capital, there are examples when authorized officials issued a certificate for receiving capital to childless mothers, and then cashed out this money.

Over the more than ten-year period of issuing this subsidy, law enforcement agencies have collected a lot of information about methods of fraud. It is usually detected:

- Thanks to unregistered shares in housing purchased with maternity capital.

- Fake documents.

- Facts of discrepancy between the declared and actual cost of housing or services provided.

- Thanks to information about imaginary transactions.

If there are suspicions, a prosecutor's inspection is ordered regarding the transaction. If fraud is proven, the transaction will be cancelled, the money will be returned to the Pension Fund’s account, and the perpetrators will be punished.

Where to contact if you learn about violations

You can report violations of the law to the police or prosecutor's office. You can also report to the Pension Fund, since it is this organization that monitors the legality of the use of maternity capital.

How to avoid becoming a victim of scammers

The first and main recommendation is not to try to cash out maternity capital. At best, this leads to the loss of most of its amount, and at worst, the fraud will be revealed and you will have to pay much more. There is a risk of even getting a criminal case.

If you want to invest maternity capital in housing, and the child is not yet 3 years old, then first of all you need to contact the bank. This will require more time for paperwork and loan approval, but in terms of finance, the option with a bank is much more profitable.

It is important that after applying for a loan and repaying it by the Pension Fund, you need to fulfill the requirement of the law - to divide the purchased housing between family members, allocating the appropriate shares to the children. This must be done after the encumbrance on the property is removed. Without this, the use of maternity capital will not be considered legal.

For those who are unable to get a loan from a bank but need housing, the only option left is a credit cooperative. Among all the cooperatives, there are many that operate in full compliance with the law.

To avoid getting into an unpleasant situation, you need to pay attention to several points:

- the cooperative must have the official status of a cooperative (not an LLC, but a CPC). You can find the official website of the cooperative, as well as reviews about it on independent resources. The cooperative must have been in operation for at least 3 years to be eligible for such operations;

- The paperwork for the loan must be completed at the cooperative office. There may not be an office in a small town, then you will have to go to another city. You should not trust cooperatives that do not have an office;

- when applying for a loan, you need to carefully read the contract, especially the obligations of the parties - how long will it take for the cooperative to transfer the money to the seller, for what period is the loan issued, what is the cost of the cooperative’s services, are there any penalties;

- You need to fully discuss with a cooperative employee the procedure for completing a transaction for the purchase and sale of housing using a loan.

If there is any sign of fraud, you should stop working with the cooperative. Even if the manager only offers to cash out capital without actually purchasing a home, you should not contact such an organization. For example, if law enforcement authorities determine that a cooperative was engaged in illegal activities, all transactions carried out through its loans may be canceled.

Therefore, we repeat again - do not contact organizations that offer to cash out maternity capital!

Is it possible to legally buy housing from relatives?

The law does not prohibit investing maternal capital in the purchase of apartments from relatives, if they are not spouses. Consequently, the transaction is recognized as legitimate and not fraudulent. However, it should be completed according to all the rules. In this case, an important point is the re-registration of ownership.

For example, a woman with many children lives with her mother, the owner of the apartment. They decided to receive maternity capital in cash. To do this, a contract for the sale and purchase of an apartment is drawn up. The funds are transferred to the mother's account. Next, you need to do the following:

- discharge the former owner from the property;

- register ownership of the daughter of a saleswoman with children.

If everything is done correctly, then law enforcement agencies will not find signs of fraud in such “cash.” However, the scheme itself is connected with the fact that the grandmother of minors will be left homeless. She will have to look for another place of registration, although in fact she will be able to live with her family.

Attention: apartments and houses in which government money is invested can be resold only with the permission of the guardianship and trusteeship authority. Contacting one may provoke another check of the legality of using the certificate.

How to legally cash out government aid

The regulatory requirements are strict. Violators will face serious punishment. You will have to go to prison, leaving your children in the care of loved ones or complete strangers. But even such a threat sometimes does not stop loving mothers. After all, not everyone is able to provide for their children with dignity, but the document on the right to half a million rubles beckons with great prospects.

The authorities are well aware of the problems of modern parents. Therefore, on the initiative of the President of the Russian Federation, from January 1, 2018, low-income families were given the right to cash out maternity capital quite legally. The rules are described in the articles of Law No. 418-FZ dated December 28, 2017. They are:

- The family that has a second newborn (adopted) since 01/01/18 can apply for monthly money;

- who has issued maternity capital according to the established rules;

- having an income not exceeding 1.5 times the subsistence level (ML) per person established for the region of residence;

Hint: in the event of the death of mother (father), the guardian of a minor may apply for benefits. This right is recognized if the parents:

- died;

- declared missing or dead;

- deprived of parental rights.

Can bailiffs arrest and take away social capital?

According to Federal Law No. 229 “On Enforcement Proceedings”, social subsidies are not included in the list of funds that can be seized by bailiffs.

In addition, maternity capital funds are stored in pension fund accounts, so they cannot be seized or physically seized. A maternity capital certificate is not money, but the right to dispose of the money received. Based on this, the actions of the bailiffs to confiscate maternity capital will be considered illegal.

If the bailiffs are going to seize the money that has been deposited into your account, this is also illegal. At any stage of receiving MSC, it is not your money, but the state’s money, you only decide how to use it.

Ways to get money from maternity capital legally

There are no direct legal ways to receive the designated measure of government support in the form of cash. However, the law provides for the possibility of receiving money from MK in the form of monthly payments, which are transferred to the parent’s bank account and in fact are “cash out”, but not a one-time payment.

The procedure and conditions for making such payments are determined by a separate law No. 418-FZ, signed by the President on December 28, 2017.

In accordance with this regulatory document, you can apply for a monthly benefit if the following conditions are met:

- the mother or father (in some exceptional cases) of the second child has received a certificate for MK;

- the second child was born no earlier than 01/01/2018;

- the child has not reached the age of 3 years;

- the average income for each family member (including all minors and minors) is less than the subsistence level in the region for the corresponding category of citizens, multiplied by two.

If the specified criteria are met, the certificate holder applies to the Pension Fund with the appropriate application and attaches supporting documents.

Reference! The amount of the child benefit will be the subsistence minimum for children, approved for the 2nd quarter of the year preceding the payment.

For example, in the Nizhny Novgorod region in the 2nd quarter of 2021, the cost of living per child was 10,658 rubles. Accordingly, the amount of the benefit will be equal to this amount, and even if it does not increase in the following years, then in 3 years you can “cash out” almost the entire MK (10,658 * 36 months = 383,688 rubles).