The time has come when debtors have the opportunity to resist debt collectors at the legislative level. Thanks to Federal Law No. 230 (On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts) adopted on June 21, 2016, now any citizen can complain about collection services if their rights are violated.

An effective method is to file a complaint against debt collectors to five authorities:

- FSSP.

- Roskomnadzor.

- NAPCA Association.

- Law enforcement agencies.

- Judicial system.

You can turn to Rospotrebnadzor for help, but only if bank employees violate consumer rights. If this is done by collection agencies (CA), the number will not work, since the debtors are not consumers of services and commodity-contractual relations.

According to Rosstat, over the past two years the number of people unable to cope with the financial burden has sharply increased. Moreover, these are not necessarily clients of credit institutions.

We are talking about debt obligations in all areas of the economy:

- loans;

- taxes/fines;

- Housing and communal services

- receipts.

Why did it happen? There are many reasons - Western sanctions with all the ensuing consequences, tightening of the tax system and complete control by the state, unemployment.

Most creditors (including government agencies) resort to a collection system and cannot do without serious monitoring. Therefore, deputies approved a law that controls collection, and also gave citizens the opportunity to punish collectors for the chaos that they have committed over the past ten years.

True, debtors still do not understand how to influence collection and continue to endure endless calls and visits from collectors.

According to the business Internet portal TAdviser, over the past 5 years the lending rate for Russians has been the highest. The total number of loans in 2021 increased by 12%, loans by 37%. At the same time, the number of debtors who do not repay the loan or are in arrears increased by 5.6%.

The average debt of a borrower, according to TAdviser, is 199 thousand rubles. Typically, to collect this amount, credit institutions resort to the help of collection agencies.

The bank either enters into an agency agreement for intermediary services, paying interest when repaying the debt, or sells a monetary obligation (assigns the right, Article 382 of the Civil Code). The consent of the defaulter is not required when making a transaction. He finds out about this from a written notice or demand for payment sent by the new creditor.

Many debtors experience negative feelings when receiving letters. Still would! It’s one thing to talk to a polite, albeit very persistent, bank employee, and another thing to talk to a debt collector. Dark stories about the methods of work of financial bouncers come to mind.

Schedule for raising funds by credit institutions (deposits, loans)

Regulation of collection activities - Federal Law No. 230

The Central Bank prohibits credit institutions from holding on their balance sheet an amount exceeding the limit of loans from third-party lenders. Banks borrow funds at a small interest rate and resell them to the end consumer (borrowers). Any unpaid debt under a loan agreement reduces the amount that the bank can re-borrow. It turns out that contracts need to be written off in order to get new money and sell to clients.

You can write it off in two ways:

- Take the debtor to court and transfer the case to the bailiffs. The proceeds from the sale of the seized property will go to the balance sheet of the bank, which will put it back into circulation.

- Sell the debt to collectors, thereby getting rid of the contract. Debts are sold in portfolios for a small percentage, freeing up space for new loans.

It turns out that collectors are an integral part of the economy. Without them, lending becomes impossible in principle. Do the contracts have to go somewhere? Litigation over state fees is unprofitable and leads to large expenses. There are many debts not exceeding 500-1000 rubles, and the duty makes litigation pointless.

Other ways to protect rights in disputes with debt collectors

Obviously, not all issues can be resolved in court. In some cases it is worth using other methods, for example:

- Contacting the police.

It is worth contacting in cases where specific rights are violated and the actions of the claimant violate the norms of the Criminal Code of the Russian Federation or the Code of Administrative Offenses of the Russian Federation, for example, they receive threats to life or health, insults, and so on.

- Contact the prosecutor's office.

This method is broader, since the prosecutor’s office does not directly initiate criminal cases, however, it has an impact on other law enforcement agencies.

You can also contact the prosecutor's office when the actions of the collector do not fall under the norms of the Criminal Code of the Russian Federation and the Code of Administrative Offenses of the Russian Federation, but at the same time contradict the current legislation, for example, in case of violation of the procedure for the collector to contact the debtor (calls are received at night on a regular basis or are made constantly, in a huge quantity).

Another option is to contact the Central Bank of the Russian Federation . This method will be effective if the actions of the collector contradict special rules governing their activities as a specific market entity.

So, for example, if an organization is not a member of an SRO, but regularly collects debts after their redemption.

How does Federal Law No. 230 protect debtors?

It is no secret that collectors conduct business with an eye on the 90s and people working in the system are stuck there for a long time.

But everything has changed, now it won’t be possible to work this way (by intimidating and threatening). Agencies, banks and employees bear not only civil, but also criminal liability for their actions.

For example, the law clearly states fines for violations of its provisions. Collection actions will be controlled by Art. 14.57 Code of Administrative Offenses of the Russian Federation:

- Organizations not included in the register - 200 thousand.

- Spacecraft registered in the register - from 50 to 500 thousand.

- Illegal activities of a CA - 2 million rubles + 1 million is imposed on the manager.

Also, responsible persons who committed unlawful actions by agencies may be disqualified from office for a year, and the activities of organizations suspended for 90 days.

Important! Agencies that are not registered, as well as persons engaged in illegal collection, are advised to refrain from communicating with debtors. This will be cheaper than paying 200-500 thousand for each complaint.

Debtors and borrowers are required to know and understand their rights. As soon as judicial practice on punishing CAs is normalized, organizations will solve problems in the legal field.

Main provisions of the law:

- calls no more than twice a week;

- meetings with the debtor no more than once a week;

- the debtor has the right to revoke consent to transfer the debt to third parties;

- the collector has no right to exert mental and physical pressure;

- The collector must not have a criminal record.

When can you complain to the Central Bank?

The central bank can help the debtor solve the problem with debt collectors, but not in all cases. Protection is provided if unlawful actions were committed by bank employees, for example, the rules for disclosing confidential information regarding the existence of a debt were violated (calling the boss, neighbors, relatives at work), the agreement for the sale of debt to collectors was incorrectly drawn up, etc. Threats, reprisals, and damage to property are not within the competence of the regulator.

Illegal activities of collection agencies

Penalties for “black” collectors are much higher. Individuals for illegal collection activities face a penalty of 50 to 500 thousand rubles. Legal individuals will have to pay from 200 thousand to 2 million rubles, and the manager from 100 thousand to 1 million (Article 14.57, paragraph 4 of the Administrative Code).

In addition, the claimant can be brought to criminal liability for extortion (Article 163 of the Criminal Code). If the debtor has received threats of physical assault. 119 of the Criminal Code, a “black” collector faces imprisonment or forced labor.

Is it possible to complain to the prosecutor's office?

A powerful weapon is a complaint against debt collectors to the prosecutor's office. If the debtor is required to repay the debt without providing any documents confirming the right to transfer the creditor’s claims, unlawful actions are committed against the borrower (threats, blackmail, violence, etc.), you should go to the prosecutor’s office and write a corresponding complaint. An appeal to the supervisory authority may be final if all of the above options have not yielded any results. Prosecutor's office employees have much more powers than, for example, the police or Rospotrebnadzor.

You can complain about the lawlessness of debt collectors at the prosecutor’s office at the debtor’s place of residence, send a complaint by mail, or write a statement online on the official website of a government agency. See a sample application here.

Who are collectors

Collection agencies are commercial organizations engaged in collecting overdue debts, acting as an intermediary between the borrower and the lender.

Today there are a large number of companies in the country engaged in similar activities. But not everyone can contact debtors. According to the law, only CAs listed in the State Register have the right to work with a defaulter. The list is publicly available on the official website of the FSSP.

Collectors are required to perform work in accordance with current legislation. Exceeding authority entails administrative or criminal penalties.

In the collection services market, not all firms play by the rules established by law. And now we come across so-called black tax collectors.

They work unofficially and use methods that grossly violate the law:

- threaten the life and health of the debtor;

- damage property;

- they tarnish their reputation.

Thanks to such actions, the population has developed a negative attitude towards professional debt collectors.

Help from the Financial Ombudsman

The financial ombudsman is a conciliator between the bank and the client; it is a body that considers their disputes out of court. This position was created by the Association of Russian Banks. If the dispute has not yet reached court, then it is quite possible to achieve justice. Reception of complaints is free of charge.

The procedure is possible only if an agency agreement is concluded between the bank and the collection company, and not a direct sale of the borrower’s debt under an assignment agreement. Those. the collector acts on behalf of the banking organization, while violating the law and exceeding his authority.

You can file a complaint in the following ways

- By email or registered letter.

- On the official website of the Financial Ombudsman.

- When visiting an organization located in Moscow in person.

The period for consideration of a complaint can range from 1 to 3 months.

What is allowed to collectors

Indeed, until recently, collectors, while performing work, misled the borrower, threatening criminal punishment (Article 177 of the Criminal Code), and exerting pressure. But since January 2021, such methods are prohibited by law.

Limited communication

Art. 7 Federal Law-230 regulates the time and frequency of telephone calls and personal meetings. The agency representative has the right to disturb the debtor with calls no more than twice a day and only twice a week.

Time from 08.00 - 22.00, on holidays from 09.00 - 20.00. The collector is required to make audio recordings of conversations with the debtor.

The collection officer has the right to meet with the defaulter only once a week. And 4 months after demands for debt payment arise, the debtor may completely refuse personal communication (Article 8, Clause 6 of the Federal Law).

Responsibilities of the claimant:

- introduce yourself, give your full name;

- name the organization he represents;

- declare the amount of debt;

- leave contact information;

- indicate your current account.

Communication with third parties with the consent of the borrower

According to Art. 4 clause 5 of Federal Law-230, the collector has no right to interact with relatives, colleagues, neighbors of the debtor, call and ask questions. To do this, you must obtain the consent of the interlocutor and written permission from the borrower (which can be revoked at any time).

Letters

An agency employee has the right to send letters to the debtor. The contents of the message are clearly regulated by Art. 7 clause 7 FZ-230:

- debt information;

- information about the documents on the basis of which the claimant makes demands;

- details of the account to which the money should be sent;

- contact details of the organization.

Procedure: what to pay attention to

Before filing a lawsuit, you should pay attention to the following points:

- is the issue really resolved in this manner and not in another way, for example, through the police;

- whether the jurisdiction has been chosen correctly;

- whether the application complies with the civil procedural requirements in force at the time of filing;

- whether there is sufficient evidence to substantiate your own position.

From October 1, 2021, some changes were made to the Code of Civil Procedure. Now the statement of claim must be accompanied by evidence of sending the papers and copies of the claim to the parties to the process. Previously, the court did this on its own.

After this, you should proceed to preparing a statement of claim. The text must contain:

- the name of the court to which he is sent;

- information about the plaintiff, as well as about the defendant;

- the price of the claim and the amount of the fee paid;

- title of the application;

- a description of the events preceding the dispute;

- the essence of the claim;

- evidence supporting the applicant's position.

At the end there is a petition part, as well as a list of attachments, after which the applicant must sign and date the claim.

Legal assistance in preparing a statement of claim >>

Attachments to the claim

The documents used as attachments are those that confirm the applicant’s position. When the question concerns a dispute with debt collectors, the following are most often used:

- an agreement indicating the occurrence of a debt to the original creditor;

- agreement of assignment (assignment of the right of claim) or notice of transfer of the right of claim to another person;

- financial papers indicating the repayment of debt to the original or subsequent creditor;

- own calculation of the claim if the collector’s claim does not correspond to legal reality;

- other papers confirming the applicant’s position.

A power of attorney may also be required if the applicant’s interests are represented by another person, an identification document and other papers that permit or explain certain issues.

Which companies are included in the FSSP register

In order for an agency to be included in the register, it must comply with the requirements of Art. 13 FZ-230:

- the constituent documents of the main OKVED of the company indicate - collection of overdue debt;

- authorized capital from 10 million rubles;

- It is mandatory to have annual insurance in the amount of 10 million rubles (a guarantee of compensation for possible damage to the debtor);

- An organization must have licensed software and a website.

What to write in a statement to the police.

In cases where collectors go too far and instead of working together to find a compromise with the debtor, they begin to threaten over the phone or in person, you will have to go on the offensive.

You should call the local police officer if a representative of a collection agency tries to enter your house or apartment, despite the lack of your consent.

You need to send a statement about extortion from debt collectors to the police station if they threaten violence against you or your loved ones. This must be supported by witness testimony or audio/video recording. Written threats must also be recorded and presented to the police.

Example of a complaint against debt collectors to the police

How to protect yourself from debt collectors

You can protect yourself from psychological or physical pressure by filing a complaint with law enforcement agencies. It is advisable to make an audio or video recording of the communication as evidence of illegal actions, and obtain testimony from witnesses.

Police officers will take the necessary measures and bring the offender to justice.

Important! The time of “black” collectors is running out. The state is developing a law prohibiting credit institutions from dealing with companies not included in the State Register.

How to write a complaint?

If a fact of unlawful action by debt collectors is revealed, none of the listed institutions can leave the appeal without consideration. The complaint is drawn up in free form, since there is no approved form.

The claim must be made in writing and contain the following:

- the name of the institution where the injured party applies;

- information about the applicant (full name, address, contact telephone number);

- the name of the document, in our case – Complaint;

- information about the collection organization;

- a detailed description of the current situation;

- demands put forward by the applicant, for example, to inspect the institution and hold it accountable;

- the listed documentary evidence (they must be attached to the application);

- date of completion and personal signature of the applicant.

The complaint is drawn up taking into account the violations identified, as well as the body to which the debtor applies. You can even complain about calling relatives if personal information was obtained illegally.

Where to complain about debt collectors

Complaint to the FSSP

Complaints against debt collectors to the FSSP are now a priority. The fact is that bailiffs were made the supervisory body for working with collection agencies.

First, it is checked whether the agency is on the register. This can be done on the FSSP website. If the legal organization is registered, then a complaint is filed to verify its activities.

How to file a complaint:

- Evidence of offenses is collected, for example, call printouts from which it is clear that agency phones called more than twice.

- Call the bailiff hotline at the numbers listed on the website.

- Select the region where the agency is registered and contact the local FSSP office.

- The bailiffs website allows citizens to file complaints electronically. To do this, you need to go to the “Appeals” section.

Important! Citizens' claims are registered within three days, and verification actions are carried out within 30 calendar days.

The problem is described in any form and the necessary documents are attached.

Complaint to Roskomnadzor

We complain about collectors for calling Roskomnadzor. It is necessary to understand that this body does not consider the dialogue with penalties, but checks the fact and number of calls. For example, if they call a hundred times a day, you can stop this by writing a complaint electronically.

You can also restrict the subscriber to incoming calls and take a printout.

Important! It is necessary to use such an appeal only to demonstrate intentions. At the moment it is of little use, but in the future any confirmation of violations may be beneficial. For example, during a trial.

Complaint to NAPCA

You can file a complaint on the official NAPCA website. If the agency is on their registry, don't be shy about flooding the association with emails.

Most likely, such an appeal will be of a preventive nature for further actions. But we still recommend writing such an appeal.

Application to the prosecutor's office or police

A statement to the prosecutor's office or the police is written in case of physical and psychological pressure from collectors. The sample will be provided at any branch or electronically on the UK website.

Law enforcement agencies are required to look for evidence of agency guilt on their own, but if you attach a recording of the negotiations, this will significantly speed up the process.

Important! KA will reject any attempts to prove guilt in violating the law and shift the blame to employees. We advise you to write a statement not about the specific person who made the threat, but about the agency as a whole and its management.

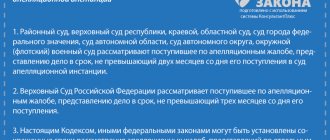

Lawsuit

Any citizen or legal entity has the right to go to court in case of violation of their rights and interests (Article 3 of the Code of Civil Procedure of the Russian Federation).

Violation of Federal Law 230 is a direct violation of rights, which serves as a basis for a claim. We advise you to find a qualified lawyer to defend your interests.

Important! In any subject of the Russian Federation there are colleges of lawyers that are obliged to provide a lawyer absolutely free of charge.

You can also always consult on our website by asking a question in the comments or by contacting the specialist on duty in the form of a pop-up window.

Where can I go?

In any case, first you should try to resolve the issue with the employees of the claimant’s company. Or write a statement addressed to the director so that he can understand the situation.

The pre-trial method of conflict resolution is considered priority. If a citizen was unable to reach an agreement with the management of the debt office, then there are several other authorities where he can turn to protect his rights.

| Police | A complaint is written if the debtor or his relatives were threatened or used physical force. |

| Roskomnadzor | The institution is contacted when telephone calls are received to the debtor, his relatives, friends and colleagues at prohibited times and days. |

| FSSP | The institution is empowered to control debt collectors and maintains a register of such persons. In case of discrepancies in the provided data, measures may be taken against violators. |

| Central Bank | A complaint is filed with this body if the collectors exceeded their powers or did not inform the debtor about the interests of which creditor they represent. |

| Prosecutor's office | It is worth contacting this authority if the supervisory authorities are inactive. |

| National Association of Professional Collection Agencies (NAPCA) | A higher organization may initiate an inspection of the company specified in the complaint. If the facts specified in the complaint are confirmed, members will be issued an order. There is a hotline: 8-800-737-77-66. |

A citizen can also contact the financial ombudsman - this is a representative of the public who is ready to resolve the issue peacefully between the parties to the conflict in the event of unlawful actions by debt collectors.

The person himself chooses which of the listed institutions to contact. This mainly depends on the violation committed.

The total period for sending a response to a complaint should not exceed 30 days. In special cases, the review may be extended, but not more than 30 days. In this case, the applicant must be notified of the change in deadlines.

Bottom line

Federal Law 230 gave debtors the opportunity to complain against debt collectors, knowing that the law would help. Of course, such a system is still poorly debugged, but within a year it should show its effectiveness.

Try to complain comprehensively: NAPKA, the prosecutor's office, bailiffs, courts, Roskomnadzor, etc. The more complaints you receive, the higher the chances of pressing the collectors.

- Today, debt collectors are not financial bouncers who use harsh methods of psychological or physical influence. Their activities are carried out strictly within the framework of the law (Federal Law 230).

- Violation of the Code is punishable by large fines or suspension of activities. If the organization is repeatedly held accountable, it is excluded from the register.

- Only organizations included in the State Register of the FSSP can demand repayment of overdue debts.

- Organizations not listed in the register are deprived of the right to demand payment of debt. As a rule, they use illegal methods of influence in their work. In this case, the debtor should contact law enforcement agencies.

- You shouldn't be afraid of dialogue. The debtor will be able to defend his rights if they are violated by the collection.

Going to court

This is the fifth - extreme measure of influence. In this case, the document acquires the status of a statement of claim. The injured party may refer to Art. 151 Civil Code of the Russian Federation. Used in cases of insults and humiliation. You can obtain compensation for moral damages. The court will consider the application received and a decision will be made taking into account the evidence presented.

Ways to file a complaint in court

The claim is sent to the inspection authorities in one of the available ways:

| Personally | If there is an appropriate authority in the city, then you can go to the office yourself and submit a complete set of documents. It is necessary to require that an employee of the institution put an acceptance mark on the copy of the person who applied. |

| By mail | If it is not possible to personally contact the government agency, then the letter is sent by registered mail, with acknowledgment of delivery. Then it will be known that the letter has been delivered to the addressee. |

| Electronically | Citizens can submit a claim online through the official website of a government agency or through State Services. This method of treatment is possible only if this option is provided by the institution. |

What to do if you didn't take out a loan?

You may face claims from collectors, even if you have already repaid the debt, or have never been late at all. This may be due to the following reasons:

- if errors were made when drawing up the assignment agreement or executive documents (for example, if information about the namesake was incorrectly indicated in the writ of execution);

- if the bank sold the repaid debt to collectors;

- if the collection organization initially collects a non-existent debt.

If you are not a debtor, any actions taken by debt collectors against you are a violation of the law. Immediately contact the police or the FSSP and describe in detail all illegal actions. If a mistake was made by banks or courts, it is necessary to submit a request to eliminate it. Our lawyers will provide you with the necessary assistance in these matters.

Call us or contact us through the online chat form.

We will write off your debts through bankruptcy with a guarantee

Our lawyer will call you in a few minutes and answer all your questions

our team

Vladislav Kvitchenko

CEO

Tatiana Smirnova

Senior bankruptcy lawyer persons

- Grigory Nechaev

Bankruptcy lawyer persons

- Oleg Martin

Financial analyst

- Yaroslav Mitkov

Junior bankruptcy lawyer persons

Help through court

If collectors present a debt that has already been outstanding in court, you can apply for a deferment or installment plan. To do this, you need to confirm that the reasons for the request are valid. For example, you can submit documents about dismissal or reduction, a certificate of salary reduction, and confirm the assignment of a disability group.

Since collectors cannot forcibly withhold money from salaries or bank accounts, a determination on deferment or installment plan must be submitted to the FSSP.

Filing for bankruptcy may be the best option, especially if you do not have property to sell. After completion of the procedure, most debts will be written off, which makes any subsequent actions of the collectors illegal. The disadvantage of bankruptcy is the additional costs of paying remuneration to the manager and the risk of losing property.

What actions of debt collectors are considered illegal?

The concept of illegality stems from the rule that guides lawyers when interpreting the legality of a particular offense: it is permissible to do everything that is not prohibited by law. Following this rule, it is not difficult to establish which actions of collectors are lawful, and which a borrower whose rights have been infringed can safely complain to regulatory authorities. This can be determined by clause 1 of Art. 4 of Law No. 230-FZ, which lists the rights of collectors. There are few of them:

- make calls;

- meet with the debtor in person;

- send SMS or voice notifications;

- send postal correspondence.

What documents should I attach?

The claim must be submitted in writing. Additional copies are also attached to it, depending on the number of persons interested in the case. In addition to the statement of claim, the following package of documents is submitted to the court:

- loan agreement;

- certificate of financial income and tangible property in the form provided by the bank;

- copy of the passport;

- check for payment of state duty;

- evidence of loan payments (checks, statements, receipts, etc.).

The list of evidence can also include photo, video or audio materials with recordings of telephone conversations with collection agency employees, as well as witness statements and independent expert opinions.

This may include:

- recording telephone conversations with threats and insults to collection service employees,

- recording data of the collection service and its employees (during conversations with collectors),

- sending a letter to the organization, the main purpose of which is to obtain written confirmation that the debt is being processed by its employees, indicating the numbers they use to call the debtor;

- requesting a printout of telephone calls from a mobile operator, which would confirm that the calls were made exactly at prohibited times. Thus, the debtor will have documents in his hands confirming that collectors are calling him, violating his rights (calls from 22:00 to 8:00 are prohibited on weekdays, and from 20:00 to 9:00 on weekends; no more than once per day and 2 times for 7 days);

- contacting a doctor (psychotherapist) in order to record all the deterioration in physical well-being (for example, jumps in blood pressure), emotional and mental experiences that followed after communicating with debt collectors and documenting them in a card. The more such facts there are, the higher the chances of resolving the issue in favor of the plaintiff.

If new evidence is found, it can be added to the case during the trial. If the claim is well-drafted and all the listed documents are available, you can get the loan agreement cancelled, the interest rate reduced, or a deferment in loan repayment granted. If the collectors are found guilty, the court may take away the bank’s license or terminate the activities of the collection agency.

Video on the topic

Collectors

Author:

Vladislav Kvitchenko

CEO . Practicing lawyer in the field of bankruptcy of individuals. persons Since 2015, she has been successfully handling insolvency cases. Vladislav is brilliantly versed in bankruptcy law, gives expert comments on legal situations and actively publishes in specialized publications.

Grounds for a complaint against an MFO

First, let's make it clear: if you took out a microloan from MCC and did not return it, the organization has the legal right to act - call you and remind you about the debt, charge a penalty, and sue. Everything is legal - the borrowed money must be repaid. Grounds for a complaint arise when a microcredit company goes beyond the law either when collecting a debt or when concluding an agreement. Valid reasons for complaint:

- MCC does not have a license to issue microloans;

- the organization posts incorrect or misleading information about its offerings (or nothing at all) on its website or office;

- The microfinance organization prevents the repayment of the debt in order to increase the fine;

- the company uses prohibited methods of returning money - discloses your personal data, transfers credit rights to collectors without your consent;

- the annual interest rate on a loan for up to a year exceeds 365%;

- you received a microloan secured by real estate collateral;

- the amount of the fine + overdue amount exceeded twice the size of the mini-loan;

- They took extra money from you without your knowledge - for restructuring, for example;

- the microfinance organization changed the terms of the agreement without your consent after it was concluded;

- MCC employees or collectors call too often or do it at prohibited times;

- The MFO ignores your lawyer and continues to call you;

- debt collectors exert psychological pressure, threaten you, or do anything that harms you.

As you can see, there are many reasons to complain. Let's figure out how to compose it and where to send it.

How to revoke personal data

If you are tormented by calls from collectors or bank employees, there is no need to rush to write a statement to Rospotrebnadzor, the prosecutor's office, Roskomnadzor, the Central Bank or NAPKA. First of all, contact the bank where you received the loan with a request to withdraw your personal data. This action will first of all let bank employees know that you will not allow your rights to be violated with impunity. Also, this appeal will be an additional plus in your favor if the matter comes to trial. You can write such a statement correctly using a sample.

When sending such a request, be on the safe side. Send it both to the legal address of the lender and to the branch where the loan was directly issued. If collectors participate in this action, another copy must be sent to them. The best way is the postal service. Just don't rely on a regular letter. Order the post office employees to send documents with a description of the attachment and notification of receipt of the letter by the addressee. Your post office will tell you how to do this correctly and what papers you need to fill out. There is one caveat: the registration address must be the same as when applying for a loan. If your registration changed during this time, you should have notified the bank about it. Otherwise, violations of the agreement will only benefit your tormentors. Provided that the registration address is the same, but the actual residence is in a different place, you must indicate this information in the “address for receiving correspondence” section.